These days, the term "fintech" is frequently used, but what does it genuinely mean? The term "financial technology" refers to any cutting-edge technology that is utilised to improve and mechanise financial services. Consider it to be a sophisticated phrasing for "tech in finance."

Here are a few crucial fintech elements:

Innovation: Using cutting-edge technologies to make money management simpler, quicker, and more accessible is the key to innovation. This might involve everything from blockchain-based systems for safe transactions to AI-driven chatbots for customer support.

Read also - Top 10 Fintech Startups in Netherland

Disruption: Fintech doesn't hesitate to cause a stir. By providing more effective and user-friendly alternatives to established financial institutions' services, a growing number of fintech businesses hope to upend them.

Accessibility: Encouraging people who might have been neglected by traditional banks or other financial organisations to have access to financial services is one of the main objectives of fintech. This can entail providing microloans, mobile banking choices, or other solutions designed to meet particular requirements. What are some real-world instances of fintech? These are a handful:

Read also - Top 10 Fintech Startups in Greece

Mobile banking apps: With these apps, you may use your smartphone to pay bills, transfer funds, and check your balance.

Apps for peer-to-peer payments: With these, you may send and receive money from friends and family instantaneously.

Robo-advisors: Usually at a lesser cost than traditional financial advisors, these automated platforms handle your assets.

The fintech industry is always changing as new businesses emerge on a regular basis. It's a fascinating field that has the power to completely change how we handle money.

Read also - Top 10 Fintech Startups in Lithuania

List of Top 100 Fintech Companies in the World

Accelerant

Accelerant is an insurance company based in United Kingdom, A team of software experts, data scientists, and insurance industry veterans lead Accelerant. They are familiar with the unique needs of MGAs, MGUs, and program administrators as well as the challenges of collaborating with traditional capacity providers.

Read also - Top 10 Fintech Startups in Latvia

Accelerant offers a novel methodology and a novel risk exchange paradigm, They are not a carrier that areas. Instead, They serve as a platform that provides specialist underwriters with access to an appealing risk portfolio while providing outstanding data, hands-on portfolio assistance, and long-term capacity. Altamont Capital Partners, Deer Park Road, Eldridge, MS&AD Ventures, Marshall Wace Asset Management, Barings, these are investor of the company.

AccessFintech

AccessFintech is an capital market company based in Israel, Synergy from AccessFintech is the data platform that provides insights for capital optimization, failure compression as well, and increased operational capacity. AFT facilitates optimization of workflows and cooperation via normalized data and shared technology access through its Synergy platform.

Read also - Top 10 Fintech Startups in Hungary

J.P. Morgan Chase & Co., Citi Ventures, Credit Suisse, GS Growth, Dawn Capital, Deutsche Bank, BNP Paribas, BNY Mellon, Bank of America, WestCap Group, these are investors of the company.

adumo

Adumo is an payment acceptance company based in south africa, They are your partner in growth, enabling you to seamlessly and securely accept a range of payment types with our omnichannel approach. They exist to help you run, grow, simplify and optimise your business through best-in-class payment experiences.

Read also - Top 10 Fintech Startups in Denmark

They have a goal to be a part of something greater than ourselves: to be the partner that grows African businesses, today and tomorrow.International Finance Corporation, Investec, Apis Partners, Crossfin, these are investor of the company.

Airbase

Airbase is an spend management company based in united states, For businesses with between 100 and 5,000 people, Airbase's revolutionary all-in-one spend management solution offers finance teams more control, visibility, and automation than any other solution. For cost management and AP Automation, we are pleased to announce that we routinely place first on the G2 Grid.

Read also - Top 10 Fintech Startups in Germany

BoxGroup, First Round Capital, Maynard Webb, Quiet Capital, Village Global, Bain Capital Ventures, Ron Gill, Webb Investment Network, Alumni Ventures, Craft Ventures, Eric Sager, Frederic Kerrest, Henry Ward, Kenny Mendes, Manik Gupta, Menlo Ventures, Scott Shipman, Sriram Krishnan, Zachary Bookman, American Express Ventures, Goldman Sachs, these are the investor of the company.

Akur8

Akur8 is an insurance company based in france, For P&C and health insurers ready to take part in the pricing revolution, our end-to-end actuarial pricing software offers significant advantages. Our patented Transparent AI and machine learning technology uncover unrealized combined ratio improvement possibilities.

Read also - Top 10 Fintech Startups in France

Kamet, BlackFin Capital Partners, MTech Capital, Plug and Play APAC, FinTLV, Guidewire Software, Plug and Play Insurtech, Plug and Play Japan, these are the investor of the company.

Allica Bank

Allica Bank is an Digital Banking company based in United Kingdom, Allica Bank is focused on serving and helping small and medium-sized businesses and giving them the tools they require to succeed. The company has been recognized by The Times newspaper as one of the UK's Top 20 fintech startups. We provide professional banking to companies in Britain by fusing cutting-edge, potent technology with local contacts in the surrounding area.

Read also - Top 10 Fintech Startups in Belgium

Our company has offices in Milton Keynes, Manchester, and London. We also have a staff of knowledgeable relationship managers traveling around England and Wales, giving small and medium-sized businesses in their local areas personal help. Warwick Capital Partners, Atalaya Capital Management, Technology Crossover Ventures, NACFB Patron Awards and Gala Dinner, Crowdcube, these are the investor of the company.

Alloy

Alloy is an Fraud prevention & compliance company based in United States, The only entire identity risk management platform for companies that provide financial services is Alloy. Alloy offers banks and fintechs a scalable, adaptable platform to manage identity risk across the customer lifecycle, starting with origination and opening of accounts.

Read also - Top 10 Fintech Startups in Finland

With customizable solutions for fraud, credit, and compliance risk, committed professional support, and the biggest network of data partners in the market, Alloy enables companies to offer top-notch financial goods to more people worldwide. Almost 500 businesses rely on Alloy to manage their compliance, fraud, and credit risks so that they can expand while having the clearest image feasible of their clients.

Commerce.Innovated, Barclays Accelerator, MasterCard Start Path, Clocktower Technology Ventures, Eniac Ventures, Bessemer Venture Partners, Justin Overdorff, Primary Venture Partners, Avid Ventures, Canapi Ventures, Felicis, Lightspeed Venture Partners, Avenir Growth Capital, Plug and Play Fintech Accelerator, these are the investor of the company.

AlphaSense

AlphaSense is an Wealth & asset management company based in United States, Major companies and financial institutions use the market information and search tool AlphaSense. Since 2011, our technology based on artificial intelligence has provided insights from a wide range of public and private content, such as equity research, company filings, event records, expert calls, news, trade journals, and clients' own research content, to help professionals make better business decisions.

Read also - Top 10 Fintech Startups in Austria

First Fellow Partners, Quantum Strategic Partners, Soros Fund Management, Tom Glocer, Triangle Peak Partners, Tribeca Venture Partners, NVIDIA Inception Program, Vendep Capital, Horizon 2020, MassChallenge, Plug and Play Fintech Accelerator, Innovation Endeavors, Paycheck Protection Program, AllianceBernstein, Bank of America, Barclays Bank, Citigroup, Cowen, Goldman Sachs, Morgan Stanley, Viking Global Investors, Wells Fargo Strategic Capital, Microsoft GrowthX Accelerator, BlackRock, GS Growth, CapitalG, Goldman Sachs Asset Management, Plug and Play Insurtech, BAM Elevate, Bond, these are the investor of the company.

Altruist

Altruist is an Wealth & asset management company based in United States, The present RIA custodian.When you cooperate with a custodian that offers necessary RIA technology and top-notch support for clients, you may create the greatest possible version of your business. Advisors of all sizes are able to manage the business they intended thanks to straightforward software that integrates account opening, trading, reporting, and billing into one complete solution.

Read also - Top 10 FinTech Investors in Europe

Endeavor, Venrock, Ron Carson, William McNabb, Insight Partners, Adams Street Partners, Bill McNabb, Marty Bicknell, Declaration Partners, Vanguard Group, these are the investor of the company.

Anyfin

Anyfin is an Lending company based in Sweden, Anyfin is a Swedish fintech company on a mission to change debt management and advance financial well-being. We enable clients to handle all of their loans and credit cards in one place and lower the prices of credit cards with high interest rates. Mikael Hussain (CEO), Sven Perkmann (Chairman of the Board), and Filip Polhem (COO) created Anyfin in 2017 in Stockholm. Together, the three founders have over twenty years of experience working for industry titans like Klarna, Spotify, and iZettle.

Read also - Top 10 Fintech Startups in UK

Accel, Global Founders Capital, Northzone, FinTech Collective, EQT Ventures, Augmentum Fintech, Quadrille Capital, Citi Ventures, these are the investor of the company.

Apexx Global

Apexx Global is an Cross-border payments company based in United Kingdom, APEXX acts as a Payment Orchestration platform combining all the worlds acquirers, gateways, shopping carts, and Alternative Payment Methods into a single integration. APEXX consults its enterprise level customers to consolidate their global Payment Service Provider relationships, and display all their reporting and transactional data in a single interface.

Read also - Top 10 Best FinTech Startups in Europe

Innovate UK, Alliance Venture, Forward Partners, MMC Ventures, Tech Nation Fintech, Alliance Ventures, MMC Technology Ventures, Plug and Play Accelerator, these are the investor of the company.

Arc Technologies

Apexx Global is an Lending company based in United States, Arc allows businesses to get up to 5.20% APY while diversifying beginning deposits with up to 100% coverage among multiple FDIC, SIPC, and government-backed accounts. Insurance includes $5M FDIC Insurance with BNY Mellon Pershing, $500K SIPC Insurance on Money Market Funds, and $250K FDIC Coverage on savings and checking accounts.

Read also - Top 10 Agritech Startups in Europe

Clocktower Technology Ventures, NFX, Alumni Ventures, Atalaya Capital Management, Bain Capital, Dreamers Fund, Pioneer Fund, Soma Capital, Y Combinator, Bain Capital Ventures, Left Lane Capital, Torch Capital, South Park Commons, these are the investor of the company.

Aspire

Aspire is an Spend Management company based in Singapore, The complete financial operating system used by businesses is called Aspire. By doing more than a bank, bookkeeper, or incentive scheme could ever do on their own, They assist businesses in paying, managing, and generating revenue more wisely.

Their goal is to equip the next generation of business owners with the resources they need to achieve the full potential of their enterprises. They think that if They can help entrepreneurs succeed, they will eventually have a significant positive impact on the communities that They are all a part of.

Read also - Top 10 European Gaming Startups

Y Combinator, Hummingbird Ventures, Insignia Ventures Partners, Mark 2 Capital, Arc Labs, Beacon Venture Capital, MassMutual Ventures, Picus Capital, AFG Partners, Alexandre Prot, B Capital Group, CE Innovation Capital, DST Global, Gerry Giacoman Colyer, Hendra Kwik, Moses Lo, Pierpaolo Barbieri, Steve Anavi, Taavet Hinrikus, Fasanara Capital, LGT Capital Partners, Lightspeed Venture Partners, PayPal Ventures, Peak XV Partners, Tencent Exploration, Pioneer Fund, VentureSouq, these are the investor of the company.

Balance

Balance is an Payment acceptance company based in United States, While worked at PayPal, we saw the hardships of B2B merchants who ended up processing transactions offline because they were unable to make the move to the internet world. Retrofitted customer solutions wouldn't do because some of their business is conducted using credit cards.

What was required was a solution created especially for B2B eCommerce businesses and marketplaces that would supervise the entire B2B checkout process from start to finish, combining various payment methods and terms, offering a self-serve environment, and taking complete ownership.

Read also - List of Unicorn Startups in Europe

Y Combinator, Lightspeed Venture Partners, SciFi VC, Stripe, Avid Ventures, Ribbit Capital, Forerunner Ventures, Gramercy Ventures, HubSpot Ventures, Jibe Ventures, Lyra Ventures, Salesforce Ventures, UpWest, Viola Credit, these are the investor of the company.

Banked

Banked is an Account-to-account (A2A) payments company based in United Kingdom, Banked is rethinking conventional payment methods and the infrastructure that supports digital payments globally. Our objective is to offer consumers and businesses with a more equitable, quick, and extremely safe payment network.

Read also - Top 10 Profitable Unicorn Startups in Europe

Backed VC, Acrew Capital, Force Over Mass Capital, Paul Forster, 9yards capital, Bank of America, Edenred Capital Partners, Firestartr, Huey Lin, Kuvi Capital, Love Ventures, OM2 Ventures, Sidekick Partners, Citi Ventures, Insight Partners, NAB Ventures, Rapyd Ventures, these are the investor of the company.

BitGo

BitGo is an Cryptocurrency payments company based in United States, BitGo offers the most secure and most scalable solutions for the bitcoin market, including core facilities regulated custody, borrowing, and lending. In the early years of cryptocurrency, in 2013, BitGo pioneered the multi-signature wallet. Later, to surpass competing MPC products, BitGo introduced TSS. With multi-sig and TSS, BitGo offers the most safe technology accessible and protects over 600 coins on numerous various blockchains.

Read also - Top 10 EdTech Startups in Europe

Over time, BitGo has evolved from offering wallets to delivering a comprehensive suite of services that enable users to store assets safely before put them to use. A-Grade, Blockchain Capital, Bridgescale Partners, Digital Currency Group, Founders Fund, Liberty City Ventures, Radar Partners, Redpoint Ventures, BitFury Capital, Bill Lee, DRW Trading Group, David Sacks, Valor Equity Partners, Craft Ventures, DRW Venture Capital, GS Growth, Galaxy, these are the investor of the company.

Bolttech

Bolttech is an Insurance company based in Singapore, The objective of bolttech, a global insurtech, is to establish the most advanced, technologically sophisticated environment for protection and insurance. Bolttech, with its main office in Singapore, provides excellent client service in 30 regions in Europe, Asia, and North America. Bolttech facilitates connections among insurers, distributors, and customers with a full suite of digital and data-driven capabilities to make the purchase and sale of insurance and protection products easier and more efficient.

Read also - Top 10 Defence Tech Startups in Europe

Pacific Century Group, Activant Capital, Alpha Leonis Partners, B. Riley Venture Capital, Dowling Capital Partners, Tarsadia Investments, Tony Fadell, EDBI, Mundi Ventures, BRV Capital Management, Tokio Marine, Khazanah Nasional Berhad, MetLife Next Gen Ventures, LeapFrog Investments, these are the investor of the company.

Brex

Bolttech is an Insurance company based in Singapore, Their goal is to enable workers worldwide to make wiser financial decisions. Modern commercial procedures are being advanced by creative companies. Modern companies are growing globally, digitizing information, automating workflows, and empowering their staff members. They are breaking the mold, doing things differently, and creating new avenues.

Read also - Top 10 best HR Tech Startups in Europe

Carl Pascarella, Max Levchin, One Way Ventures, Peter Thiel, Ribbit Capital, Y Combinator, Yuri Milner, DST Global, Greenoaks Capital Management, Greyhound Capital, Institutional Venture Partners, Mindset Ventures, Barclays Bank, Kleiner Perkins Caufield & Byers, 3G Capital Management, G Squared, Credit Suisse, Lone Pine Capital, Baillie Gifford & Co., Base10 Partners, Durable Capital Partners, Endeavor, GIC, Madrone Capital Partners, Technology Crossover Ventures, Tiger Global Management, Valiant Capital Partners, Global Founders Capital, SB Opportunity Fund, VamosVentures, these are the investor of the company.

Brightside

Brightside is an Payroll & benefits based in United States, Financial Care is a fresh area of employee perks that Brightside designed. They want to help the seven out of ten working families who currently live paycheck to paycheck. By working with forward-thinking companies who recognize that their financial well-being is an essential component to their employees' and their company's wellbeing.

Read also - Top 10 best HealthTech startups in Europe

When it matters most, They then use a combination of behavioral technological advances, science, and compassion to meet employees where they are and help them in attaining financial comfort. Comcast Ventures, Trinity Ventures, Financial Solutions Lab, Andreessen Horowitz, Alumni Ventures, Chestnut Street Ventures, Clocktower Technology Ventures, Obvious Ventures, Plug and Play Insurtech, these are the investor of the company.

Bunq

Bunq is an Digital banking company based in Netherlands, They are Bunq, The Free Bank. They are here to defy tradition and build a bank with our customers in mind. giving people freedom to live their lives as they see fit.

Read also - Top 10 Best Space Tech Startups in Europe to Watch |Europe’s Space Tech Startups

By designing our own financial system from the bottom up, they completely transformed banking as we know it with the advent of our app in 2015. And that's only the start! They continuously develop fintech methods to make banking and money management as straightforward, open, and enjoyable as possible,Pollen Street Capital, these are the investor of the company.

C6 Bank

C6 Bank is an Digital banking company based in Brazil, Over 25 million people's financial experiences are currently changed by them. selected as the finest digital bank in Brazil by the general public in the fourth CanalTech award competition. Join us as a CSixer.

Read also - Top 20 Best Electric Vehicle(EV) Startups in Europe

Credit Suisse, J.P. Morgan Chase & Co.,these are the investor of the company.

Casavo

Casavo is an Real estate & mortgage company based in Italy, The European PropTech startup Casavo uses technology to make the real estate industry simpler. Casavo offers an easy and transparent end-to-end experience by connecting house sellers' needs with home purchasers' preferences through its cutting-edge digital platform.

Read also - Top 10 Best AdTech startup in Europe

360 Capital Partners, Boost Heroes, Kervis Asset Management, Marco Pescarmona, Picus Capital, Project A Ventures, Rancilio Cube, Greenoaks Capital Management, Bonsai Partners, EXOR Seeds, Programma 101, Goldman Sachs, D. E. Shaw Group, Endeavor, Exor, Fuse Venture Partners, Hambro Perks, Neva SGR, Sebastien De Lafond, Goldman Sachs BDC, Intesa Sanpaolo, UniCredit, these are the investor of the company.

Clair

Clair is an Digital banking company based in United States, With their Clair Debit Mastercard and FDIC-insured Spending and Savings accounts, American workers may access their earnings at any time, free of charge, thanks to Clair, a mission-driven digital banking platform situated in New York.

Read also - Top 10 climate Tech and Green Tech startups in Europe

Founder Collective, Michael Vaughan, Paul Appelbaum, Upfront Ventures, Walkabout Ventures, Thrive Capital, Pathward, Kairos HQ, these are the investor of the company.

Clara

Clara is an Spend management company based in Mexico, For businesses in Latin America, Clara is the most popular platform for spend management. Their comprehensive package comprises Their corporate cards issued locally, financing options, Bill Pay, and their well regarded Spend-management software, which is utilised by thousands of the most prosperous businesses in the area.

Read also - Top 10 Information Technology Startups in Europe

Adapt Ventures, BossaNova Investimentos, Canary Ventures, General Catalyst, Picus Capital, Soma Capital, DST Global, Kaszek Ventures, Monashees+, Alter Global, Avid Ventures, BoxGroup, Coatue Management, Gaingels, Global Founders Capital, ICONIQ Growth, Goldman Sachs, Accial Capital, Skandia Group, Canary VC, Acrew Capital, Bayhouse Capital, Citi Ventures, Citius, Commerce Ventures, Endeavor, Ethos, Fluent Ventures, GGV Capital, Goanna Capital, Lago Innovation, VentureSouq, these are the investor of the company.

Clear Street

Clear Street is an Capital markets company based in United States, The financial infrastructure of today's institutions is being created by Clear Street. Their clearing, custody, execution, and prime brokerage platform are used by customers of all sizes to run their companies. The financial services industry keeps on depending on antiquated technology that was created in the 1970s. The fact that COBOL mainframes that are 50 years old are still in use today presents a lot of challenging issues.

Read also - Top 10 B2B Ecommerce startups in Europe

Alastair Trueger, Belvedere, Illia Polosukhin, McLaren Strategic Ventures, Moses Lo, Near Foundation, NextGen Venture Partners, Prysm Capital, Validus Growth Investors, Walleye Capital, Belvedere Strategic Capital, IMC Investments, these are the investor of the company.

Cognaize

Cognaize is an Financial services automation company based in United States, Vahe Andonians, a visionary with decades of experience in the financial services business, is a software engineer, data scientist, professor, senior lecturer, and academic.

Read also - Top IoT startups in Europe

Argonautic Ventures, Armen Kherlopian, BAJ Accelerator, Granatus Ventures, Jeff Ingber, Metaplanet, these are the investor of the company.

Collective

Collective is an Accounting & finance company based in United States, The goal of Collective is to revolutionise how Businesses-of-One operate. The goal of Collective, the first digital financial concierge platform, is to provide independent contractors with the team and technology they require to let them concentrate on their passion instead of their paperwork. Collective takes care of bookkeeping, accounting, taxes, and company formation.

Read also - Top AR startups in Europe

Dan Lewis, Darian Shirazi, Dylan Field, Expa, Garrett Camp, General Catalyst, Gokul Rajaram, Gradient Ventures, Jared Hecht, QED Investors, Scott Belsky, Topher Conway, Vitor Lourenco, Aaron Levie, Adrian Aoun, Andrew Dudum, Edward Hartman, Hamish McKenzie, Holly Liu, Kevin Lin, Li Jin, Sam Yam, Shadiah Sigala, Sound Ventures, Steve Chen, Better Tomorrow Ventures, Innovius Capital, The General Partnership, these are the investor of the company.

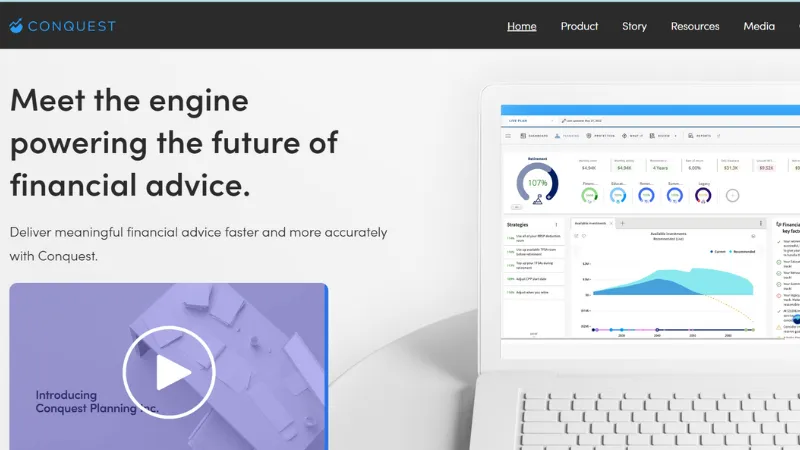

Conquest Planning

Conquest Planning is an Wealth & asset management company based in Canada, In 2018, it all started with a straightforward whiteboard meeting and a goal of streamlining and improving accessibility to financial advice for everyone. The original members of Conquest were committed to providing clients with insightful, individualised financial advice that cut across company boundaries, internet platforms, and economic divides.

Read also - Top 10 Data Analytics Startups in Europe

Fidelity International Strategic Ventures, Portage, IGM Financial, BNY Mellon, Royal Bank of Canada, these are the investor of the company.

ConsenSys

ConsenSys is an Cryptocurrency company based in United States, The top web3 and blockchain software provider is Consensys. Consensys has led the way in innovation since 2014, creating cutting-edge technologies for the web3 ecosystem. With the help of their product portfolio, which includes the NFT platform, Infura, Linea, Truffle, Diligence, and the MetaMask platform, they have proven yourself as a reliable partner for users, developers, and producers.

Read also - Top 10 Early Stage Startups You Should Look Out in Europe

SK Group, Paycheck Protection Program, J.P. Morgan Chase & Co., Alameda Research, Fenbushi Digital, Greater Bay Area Homeland Investments, Liberty City Ventures, MakerDao, Mastercard, Protocol Labs, Quotidian Ventures, The LAO, UBS, Animoca Brands, Coinbase Ventures, DeFiance Capital, Dragonfly, Electric Capital, HSBC Venture Capital, Marshall Wace Asset Management, ParaFi Capital, Sanctor Turbo, Spartan Group, Think Investments, Third Point, Anthos Capital, C Ventures, Microsoft, SoftBank, Sound Ventures, Temasek, True Capital Management, UTA Ventures, Mindrock Capital, Tribe Capital, these are the investor of the company.

Coterie Insurance

Coterie Insurance is an Insurance company based in United States, Coterie Insurance in a matter of minutes! With the assistance of our support team, independent agents, or our website, Coterie Insurance assists small businesses in obtaining the necessary coverages at the appropriate time, allowing them to resume their core competencies.

Read also - Top 10 Drone Delivery Startups in Europe

Greenlight Re Innovations, Intercept Ventures, RPM Ventures, The Hartford, Allos Ventures, Alpha Edison, Intact Ventures, Lackawanna Insurance, Group 1001, Weatherford Capital Management, these are the investor of the company.

Cover Genius

Cover Genius is an Insurance company based in Australia, The insurtech for embedded protection is known as Cover Genius. In unison, they safeguard the global clientele of the foremost digital enterprises globally, encompassing Booking.com, Priceline, Hoppered, Ryanair, Turkish Airlines, Descartes ShipRush, Zip, and SeatGeek.

Read also - Top 10 Fitness Startups in Europe

King River Capital, Belfer Family, Jasper Tans, Marinya Capital, Regal Funds Management, Leap Capital, G Squared, Sompo Holdings, Atlas Merchant Capital, Dawn Capital, these are the investor of the company.

Cowbell Cyber

Cowbell Cyber is an Insurance company based in United States, As the pioneer of Adaptive Cyber Insurance, Cowbell is the top supplier of cyber insurance for medium-sized enterprises (SMEs). Cowbell offers stand-alone cyber insurance customised to satisfy the specific needs of every company.

Read also - Top 10 European Women Investors in Startup Ecosystem

Plug and Play Insurtech, Global Insurance Accelerator, Holmes Murphy, ManchesterStory Group, Tri-Valley Ventures, Paycheck Protection Program, Avanta Ventures, Brewer Lane Ventures, Markel, Pivot Investment Partners, Anthemis, Nyca Partners, Permira, PruVen Capital, QIC Digital Venture Partners, Viola Group, Shin Nihon Asset Management, these are the investor of the company.

Cross River

Cross River is an Core banking & infrastructure company based in United States, Technology infrastructure for the banking and insurance sectors of the future is provided by Cross River Bank. Cross River offers millions of consumers and organisations with cutting-edge and scalable embedded payments, cards, and loans solutions by utilising a proprietary real-time banking core.

Read also - Top 10 Robotics Startups in Europe

Andreessen Horowitz, Battery Ventures, Ribbit Capital, CE Innovation Capital, KKR, LionTree Partners, Shefa Capital, V Capital Investments, Eldridge, Hanaco Ventures, T. Rowe Price, Whale Rock Capital Management, these are the investor of the company.

DANA

DANA is an Mobile wallets & remittances company based in Indonesia, A TechFin startup called DANA aims to provide inclusive financial services so that people can take control of their lives and live better. By facilitating smooth social actions, they hope to establish one of Indonesia's foundational elements of the digital economy.

Read also - Top 10 Semiconductor Manufacturing Companies in Europe

Ant Group, Lazada, Sinar Mas Indonesia, these are the investor of the company.

Endowus

Endowus is an Wealth & asset management company based in Singapore, Financial technology startup Endowus, located in Singapore, gives consumers the power to take charge of their financial destiny. The company's in-house technologies provide data-driven financial guidance when creating customised solutions. The basis of their portfolios is the lowest cost possible access to institutional-quality financial services.

Read also - Top 10 VR Startups in Europe

Lightspeed Venture Partners, Softbank Ventures Asia, Samsung Ventures, SingTel Innov8, UBS, EDBI, Prosus Ventures, Z Holdings, Citi Ventures, Mitsubishi UFJ Financial Group, UBS Next, these are the investor of the company.

Fairmatic

Fairmatic is an Insurance company based in United States, By providing the first data-driven fleet insurance that incentivizes safety with savings, Fairmatic will introduce a brand-new category of commercial insurance. By encouraging responsible driving, which leads to safer roads, Fairmatic's new strategy values driving behaviour and uses deep telemetry data along with AI-powered technology to provide significant cost savings for fleets.

Read also - Top 10 Best Tech Startups in Europe

Aquiline Capital Partners, Assaf Wand, Bill Tai, Foundation Capital, Jerry Yang, Oren Zeev, Zendrive, Battery Ventures, Bridge Bank, Veronorte, these are the investor of the company.

Farther

Farther is an Wealth & asset management company based in United States, As the top technology-focused wealth management company, Farther offers its clients an unusual, all-inclusive, and efficient assistance by fusing cutting-edge technology with experienced advisors. Farther, a 2019 startup supported by premier venture capital companies, serves high-net-worth individuals who need a more comprehensive approach to money management.

Read also - Top 10 Media Startups in Europe

MassChallenge, Bessemer Venture Partners, Context Ventures, Cota Capital, Khosla Ventures, MassMutual Ventures, Moneta VC, Lightspeed Venture Partners, these are the investor of the company.

Finch

List of Top 100 Fintech Companies in the World |Finch

Finch is an Payroll & benefits company based in United States, Data systems are becoming more open, standardised, and networked worldwide. The infrastructure for employment is still closed, dispersed, and complicated. Their goal is to open up much-needed innovations, democratise access to the infrastructure supporting the employment sector, and generate enormous economic activity that benefits both businesses and employees.

Read also - Top 10 Elder Care Startups in Europe

Y Combinator, BoxGroup, Clocktower Technology Ventures, Digits, Eric Glyman, General Catalyst, Henrique Dubugras, Homebrew, Menlo Ventures, Pedro Franceschi, Bedrock Capital Management, SemperVirens, Altman Capital, PruVen Capital, QED Investors, Intuit Ventures, these are the investor of the company.

Fourthline

List of Top 100 Fintech Companies in the World |Fourthline

Fourthline is an Fraud prevention & compliance company based in Netherlands, Fourthline offers an bank-grade identity stack and unmatched expert support for regulated organisations facing problems with digital identification. The battle of financial crime is their ultimate objective. By developing cutting-edge solutions that make use of artificial intelligence and make it simple for their clients to comply, they safeguard the world's financial system.

Read also - Top 10 Agritech Startups in UK

Finch Capital, Radboud Vlaar, these are the investor of the company.

Genesis

List of Top 100 Fintech Companies in the World |Genesis

Genesis is an Capital markets company based in United Kingdom, With its prepackaged solutions, extensive understanding of capital markets and financial services, and software development platform, Genesis Global helps financial markets organisations to innovate quickly. Genesis provides a buy-to-build solution, which supercharges developers to construct high-performance, robust, and secure applications quickly.

Read also - Top 10 Home Care Startups In Europe

Illuminate Financial Management, Tribeca Early Stage Partners, Citigroup, Accel, Google Ventures, ING, LCH Group, Salesforce Ventures, XP Investimentos, Insight Partners, Tiger Global Management, BNY Mellon, Bank of America, Citibank, Fuse Incubator, these are the investor of the company.

Jeeves

Jeeves is an Spend management company based in United States, The objective of Y Combinator startup Jeeves is to help companies all around the world to access a cutting-edge approach to financial services. They provide cutting-edge technology so that their customers can concentrate on expanding their businesses. They understand the limitations of today's financial services as well as the room for development because they are entrepreneurs with first-hand experience founding, running, and expanding their own companies.

Read also - Top 10 Real Estate Startups in Europe

Y Combinator, Tribe Capital, William Hockey, Wollef, 9yards capital, Andreessen Horowitz, BlockFi, Carlos Garcia Ottati, Clocktower Technology Ventures, Daniel Vogel, David Velez, Florian Hagenbuch, Larry Fitzgerald, Ricardo Weder, Sebastian Mejia, Stanford University, Uncorrelated Ventures, Urban Innovation Fund, Adolfo Babatz, Alkeon Capital Management, Andre Iguodala, Bo Jiang, CRV, Des Traynor, Gabriel Braga, Immad Akhund, Kevin Durant, Odell Beckham Jr., Pablo Gonzalez, Pierpaolo Barbieri, Silicon Valley Bank, Soros Fund Management, Tencent, The Chainsmokers, Tom Blomfield, Zac Prince, Gaingels, AltaIR Capital, Alumni Ventures, Carlo Enrico, Financial Technology Partners, GIC, Haven Ventures, Soma Capital, Spike Ventures, Foreword, VentureSouq, these are the investor of the company.

Kasisto

Kasisto is an Conversational banking company based in United States, With the objective of empowering businesses to communicate and do business with their customers through intelligent dialogues at any time, anyplace, Kasisto launched in 2013. With the help of industry-specific domain expertise and a comprehensive AI technology stack, Kasisto's conversational AI platform, KAI, provides organisations with intelligent digital assistants that are knowledgeable about the industries they serve.

Read also - Top 10 Clean Tech Startups in Europe

AlphaPrime Ventures, Cristobal Conde, HBS Alumni Angels Association, Larry Ng, New York Angels, Partnership Fund for New York City, SRI International, Two Sigma Ventures, Wells Fargo Startup Accelerator, FinTech Innovation Lab, DBS Bank, MasterCard Start Path, Commerce Ventures, Mastercard, Propel Venture Partners, Oak HC/FT Partners, Rho Ventures, Napier Park Global Capital, Paycheck Protection Program, NCR, Naples Technology Ventures, BankSouth Holding, FIS, Westpac Group, these are the investor of the company.

kevin.

kevin. is an Account-to-account (A2A) payments company based in Lithuania, Kevin, this payment change was unexpected. Their mission is to release partners from the shackles of antiquated technology so that together, they may create an endless array of payment options. Their innovative multi-tenant payment plan changes the rules for businesses without altering consumer payment behaviour, even in-store.

Read also - Top 10 Startup Business Grants Around the World

Global PayTech Ventures, Henry McGovern, OTB Ventures, Open Ocean Capital, Speedinvest, Accel, Amitabh Jhawar, Eurazeo, Harry Stebbings, Ilkka Paananen, Startup Wise Guys, Lighthouse Development Program, these are the investor of the company.

Ledger

Ledger is an Cryptocurrency company based in France, LEDGER is a global platform for digital assets and Web3, founded in Paris in 2014. In regards to accessibility and safety for critical digital assets, Ledger already leads around the world.

Twenty percent of the world's cryptocurrency assets are safeguarded, more than 100 financial institutions and brands use more than 6 million devices that have been sold to customers in 200 countries and more than ten languages, and there are services that allow trading, buying, spending, earning, and NFTs.

Read also - Top 10 Crypto Mining Software in Europe

Alain Tingaud Innovations, Fred Potter, Hi-Media, Pascal Gauthier, Thibaut Faurès Fustel de Coulanges, XAnge, BHB Network, CapHorn Invest, Digital Currency Group, GDTRE, Kima Ventures, Libertus Capital, MAIF Avenir, Nicolas Pinto, The Whittemore Collection, Wicklow Capital, Boost VC, Cathay Innovation, Draper Associates, Draper Dragon, Draper Venture Network, FirstMark Capital, Korelya Capital, Molten Ventures, IFA Next, Samsung Ventures, Accelerateur Allianz, 10T Fund, Alliance Entreprendre, Animoca Brands, Caisse d’Epargne, Cardinal Capital Group, Cite Gestion, Credit Agricole, Crypto.com Capital, Fabric Ventures, Felix Capital, Financiere Agache, Global Founders Capital, Inherent Group, Marcy Venture Partners, Rosemoor Capital, Scott Galloway, Tekne Capital Management, The Maze Group, Uphold Ventures, Warburg Serres Investments, iAngels, Cap Horn Finance, Digital Finance Group, Morgan Creek Capital Management, True Global Ventures, Vaynerfund, these are the investor of the company.

LemFi

LemFi is an Mobile wallets & remittances company based in United Kingdom, For the upcoming wave of immigrants, they are creating the future of financial services. An app for financial services that looks out for and knows you.

Read also - The Future of E-commerce Industry in Europe

Y Combinator, Acuity Ventures, Microtraction, Kube VC, VentureSouq, Global Founders Capital, Left Lane Capital, Olive Tree Capital, Zrosk, these are the investor of the company.

Liberis

Liberis is an Lending company based in United Kingdom, Liberis creates flexible embedded financial strategies that have a positive impact and empower organisations. Liberis is a prominent international embedded finance platform that was established in 2007. Its objective is to provide small businesses access to responsible and accessible financing since it thinks that funding should always be a driving force for development.

Read also - Top 10 Agritech Startup in Denmark

Blenheim Chalcot, BCI Finance, British Business Bank Investments, Paragon Commercial Corporation, FTV Capital, British Business Investments, Silicon Valley Bank, Barclays Bank, FinTech Legal Labs, Tech Nation Future Fifty, these are the investor of the company.

Liquidity

Liquidity is an Lending company based in Israel, The most significant AI-powered financial asset management company in the world is called Liquidity Group. With headquarters in Tel-Aviv, Abu Dhabi, New York, London, Singapore, Tokyo, Mumbai, Boston, and San Francisco, Liquidity Group operates globally with $2.7b AUM spanning funds focused on North America, Asia-Pacific, Europe, and the Middle East.

Read also - Top 10 Health and Wellness Startups in Europe

MUFG Innovation Partners, Spark Capital, Apollo Global Management, Meitav Dash, Bank of Tokyo-Mitsubishi UFJ, these are the investor of the company.

M2P

M2P is an Core banking & infrastructure company based in India, M2P is a large API infrastructure supplier that uses cutting edge technology to provide financial services that are futuristic and customer-focused. They provide banks, NBFCs, and internet companies globally with a broad range of Payments, Lending, and Banking solutions.

Read also - Top 10 leading Mental Health Startups in Europe

8i Ventures, Abhishant Pant, Amrish Rau, Jitendra Gupta, Kunal Shah, Peifu Hsieh, Alok Mittal, Ashneer Grover, BEENEXT, Better Capital, DMI Finance, Flourish Ventures, Omidyar Network India, Visa FinTech Fast-Track Program, Better Capital, DMI Sparkle Fund, Tiger Global Management, Insight Partners, MUFG Innovation Partners, Visa, these are the investor of the company.

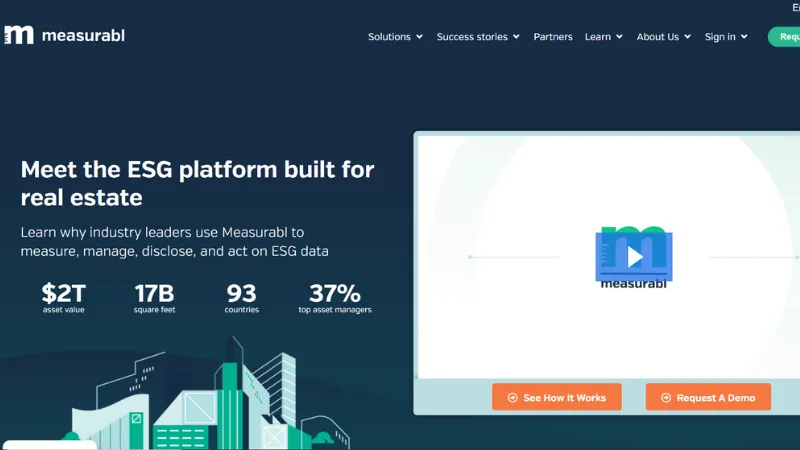

Measurabl

Measurabl is an Real estate & mortgage company based in United States. Measurabl is utilised by customers in 92 countries to measure, manage, report, and take action on ESG data on approximately 15 billion square feet of commercial real estate. Measurabl gives users the ability to drive decarbonization, assess their exposure to physical climate risk, optimise ESG performance, and find environmentally friendly financing options.

Read also - Top 10 Agritech Startups in Germany

CrossCut Ventures, Borealis Ventures, Camber Creek, Concrete, DivcoWest, Impact Engine, Salesforce Ventures, Sway Ventures, Building Ventures, Concrete Ventures, Constellation Technology Ventures, S&P Global, Colliers, Cushman & Wakefield, Energy Impact Partners, Lincoln Property, Starwood Capital Group, Broadscale Group, Lincoln Property Company, Moderne Ventures, RET Ventures, Suffolk Construction, WVV Capital, these are the investor of the company.

Mesh

Mesh is an Spend management company based in United States. Mesh makes travel and spending management easier for contemporary, international businesses. They offer an adaptable platform which fits their workflows, guaranteeing flexible travel, smooth automation, and unified expenditure management. They offer efficient solutions for all stakeholders, including team members, financial officers, and travel managers, going beyond antiquated processes.

Read also - Top 10 Agritech Startups in Italy

Meron Capital, R-Squared Ventures, Ryan Gilbert, TLV Partners, Alpha Wave Global, Entree Capital, Tiger Global Management, Google Startup Growth Lab, these are the investor of the company.

Mondu

Mondu is an B2B BNPL company based in Germany. At Mondu, They are transforming the B2B payments landscape by offering payment solutions that let any B2B business expand securely and swiftly. With flexible payment periods, they enable merchants and marketplaces to provide the most widely used B2B payment options to their business clients throughout all sales channels, including online, telesales, and field sales.

Read also - Top 10 Most Successful Bootstrapped Startups in Europe

Cherry Ventures, FinTech Collective, Valar Ventures, Vereinigte Volksbank Raiffeisenbank eG, Peter Thiel, these are the investor of the company.

Moneyhub

Moneyhub is an Core banking & infrastructure company based in United Kingdom. Our team comprises developers, financial specialists, and optimists who are committed to improving the financial well-being of people, companies, and neighbourhoods.

Read also - Top 10 Best Men’s Grooming Brands in Europe

Nationwide Building Society, Financial Conduct Authority, Nesta Open Up Challenge, SPWOne, Shawbrook Bank, Legal & General, Lloyds Banking Group, Phoenix Group, these are the investor of the company.

Moniepoint

Moniepoint is an Payment acceptance company based in United Kingdom. Leading financial technology provider Moniepoint Inc. offers a smooth platform that lets companies, their staff, and customers take digital payments, obtain loans, and utilise business management solutions that let them expand easily.

Read also - Top 10 Mutual Fund Startups in Europe

Quantum Capital Partners, British International Investment, Endeavor, FMO, Global Ventures, Kepple Africa Ventures, Novastar Ventures, Oui Capital, Soma Capital, Lightrock, QED Investors, these are the investor of the company.

Moonfare

Moonfare is an Retail & alternative investing company based in Germany. Moonfare. Legacy investing. A digital platform named Moonfare is spearheading a new era in private equity investing. They make it possible for the most active investor community on the planet to get professional advice and small-scale private equity investments. Their goal is to encourage better investing practises while offering more individuals with access to higher returns.

Read also - Top 10 Best Online Doctor Consultation Apps in Europe

Fidelity International Strategic Ventures, Insight Partners, Vitruvian Partners, 7 Global Capital, German Accelerator Tech, these are the investor of the company.

Multiplier

Multiplier is an Payroll & benefits company based in Singapore. Companies can effortlessly hire teams abroad with the help of Multiplier, a top worldwide hiring platform. By handling the maze of labour contracts, payroll, benefits, taxes, and localcompliance, its patented technology streamlines the recruitment process.

Read also - Top 10 Agritech Startups in Sweden

Golden Gate Ventures, MS&AD Ventures, Picus Capital, Surge, Amrish Rau, Deepinder Goyal, Peak XV Partners, DST Global, Tiger Global Management , these are the investor of the company.

NIUM

NIUM is an Cross-border payments company based in Singapore. Global leaders of the modern money movement includes Nium. It offers worldwide payment and card distributing services to banks, payment processors, and companies of all sizes. Its modular platform facilitates frictionless commerce through providing services for pay-outs, pay-ins, card issuance, and banking-as-a-service, enabling businesses to make transactions and receive payments worldwide.

Read also - Top 10 Best Organic Food Startups in Europe

Fullerton Financial Holdings, Global Founders Capital, Vertex Ventures SE Asia, GSR Ventures, SBI Ven Capital, Beacon Venture Capital, MDI Ventures, Rocket Internet, Visa FinTech Fast-Track Program, Atinum Investment, Ripple, BRI Ventures, Visa Ventures, Qatar FinTech Hub, Arjun Sethi, Gokul Rajaram, Rajaram Family Trust, Riverwood Capital, Temasek, Vertex Growth, Vicky Bindra, Plug and Play APAC, Bond, Moore Capital Management, NewView Capital, Tribe Capital, these are the investor of the company.

Nomad

Nomad is an Digital banking company based in United States. They are a Brazilian fintech company that has been in business since 2020 and their mission is to provide Brazilians access to a global financial life by providing ease of use, security, and price savings on cross-border transactions. They deliver a variety of financial alternatives via a single app, including access to international investments including stocks and ETFs featured on major US exchanges, contracted foreign exchange transactions, and US financial accounts.

Read also - Top 10 Organic Beauty Startups in Europe

Abstract Ventures, Hans Tung, Monashees+, GF Capital Management & Advisors, Globo Ventures, ONEVC, Propel Venture Partners, Spark Capital, Vast Ventures, Stripes Group, Norte Ventures, Tiger Global Management, these are the investor of the company.

Nomba

Nomba is an Payment acceptance company based in Nigeria. Their goal is to create a setting that makes it easier for companies to take payments, processing payments, and oversee operations. The objective of this journey started in 2016 with the integration of "Kudi.ai," a chatbot that answers financial queries on social media platforms, facilitating access to financial services.

Read also - Top 10 Online Dating Startups in Europe

Y Combinator, Ecobank Fintech Challenge, Google for Startups Accelerator: Africa, Khosla Ventures, Michael Seibel, Partech Partners, Kube VC, Base10 Partners, Helios Digital Ventures, Shopify Ventures, these are the investor of the company.

Novidea

Novidea is an Insurance company based in Israel. Real-time business analytics and smooth workflow management are offered by Novidea's end-to-end platform to brokers, agents, MGAs, bancassurance, and corporate risk management. The Novidea cloud-based platform, developed specifically for insurance distribution, offers you with a single perspective to manage every aspect of the insurance distribution lifecycle across all business lines.

Read also - Top 10 Mattress Startups in Europe

KT Squared, Salesforce Ventures, 2B Angels, JAL Ventures, Israel Growth Partners, Battery Ventures, Cross Creek, these are the investor of the company.

ONE ZERO

ONE ZERO is an Digital banking company based in Israel. As innovators in the financial sector, ONE ZERO Bank is changing the way consumers view banking. Together with conventional banking amenities like current accounts, credit, deposits, and securities management, they also provide sophisticated financial solutions, such as competitive and flexible credit alternatives.

Read also - Top 10 Agritech Startups in Spain

Hachshara Insurance, Hebrew University of Jerusalem, Julius Baer Group, OurCrowd, SBI Group, Tencent, Far East Ventures, West Coast Equity Partners, these are the investor of the company.

Opay

Opay is an Mobile wallets & remittances company based in Nigeria. With OPay, you can accomplish more! their network is 100% uptime, transfers are swift and inexpensive, and they provide fantastic returns on data and airtime recharges.

Read also - Top 10 Agritech Startups in Netherland

GSR Ventures, HongShan, IDG Capital, Meituan, Opera, Source Code Capital, Bertelsmann Asia Investments, Gaorong Capital, Longzhu Capital, Redpoint Ventures China, Softbank Ventures Asia, 3W Partners, SoftBank, these are the investor of the company.

OpenFin

List of Top 100 Fintech Companies in the World |OpenFin

OpenFin is an Capital markets company based in United States. The most significant international financial institutions enable their teams to work more effectively, quickly, and intelligently by utilising OpenFin's developer platform and intelligent workspaces. With a workspace that can handle everything, you can draw in people and shorten time-to-value. Start apps, set up intricate layouts, automate chores, search, exchange context, send and receive notifications, and find new apps.

Read also - Top Incubation Centres For Startups in Europe

Bain Capital Ventures, FinTech Innovation Lab, Nyca Partners, Pivot Investment Partners, DRW Venture Partners, Euclid Opportunities, J.P. Morgan Chase & Co., Barclays Ventures, Wells Fargo Strategic Capital, HSBC Venture Capital, SC Ventures, ING Ventures, Bank of America, Barclays Capital, CME Ventures, CTC Capital, DRW Venture Capital, HSBC, J.P. Morgan, Tribeca Early Stage Partners, First Growth Venture Network, these are the investor of the company.

Payhawk

Payhawk is an Spend management company based in United Kingdom. One of the top expenditure management options available to both domestic and foreign companies in the US, UK, and Europe is Payhawk. Payhawk simplifies business payments for everyone concerned by combining company cards, reimbursed costs, accounts payable, and smooth accounting software connections into a single system.

Read also - Top 10 Agritech Startups in Switzerland

Eleven Ventures, Mark Ransford, Perry Blacher, Earlybird Venture Capital, Keith Robinson, Mark Antipof, tiny.vc, Eleven Ventures, QED Investors, Greenoaks Capital Management, Endeavor, HubSpot Ventures, Jigsaw, Lightspeed Venture Partners, Sprints Capital, these are the investor of the company.

PayJoy

PayJoy is an Lending company based in United States. The goal of PayJoy is to give the next billion people living in emerging markets around the world access to credit. With the help of their special mobile security technology, clients may utilise their first smartphone as collateral to finance it on loan. This allows them to climb the economic well-being ladder and handle life's unforeseen financial surprises by having additional access to credit.

Read also -

Read also - Bolognese Biotech startup Cellply Secures €3.6 million in Funding

Compound, Red Swan Ventures, Core Innovation Capital, DNX Ventures, Fenway Summer Ventures, Orange Digital Ventures, Union Square Ventures, CSC Upshot Ventures, Western Technology Investment, ITOCHU Technology Ventures, Mouro Capital, Mindset Ventures, Arc Labs, Assurant Ventures, EchoVC Partners, Greylock Partners, Paycheck Protection Program, NXTP Ventures, Village Capital, Citi Ventures, Invus Group, Warburg Pincus, Citigroup, these are the investor of the company.

Paymob

Paymob is an Payment acceptance company based in Egypt. A multinational financial technology business called Paymob creates the framework for the digital economy. their goal is to encourage the growth of SMEs by providing them with a payments infrastructure that gives companies of all sizes access to the latest digital payment solutions.

Read also - Annika Falkengren Joins Swedish Tech Company Ark Kapital’s Board of Directors

A15, FMO, Global Ventures, British International Investment, Clay Point Investors, Helios Digital Ventures, Kora Management, Nclude, PayPal Ventures, these are the investor of the company.

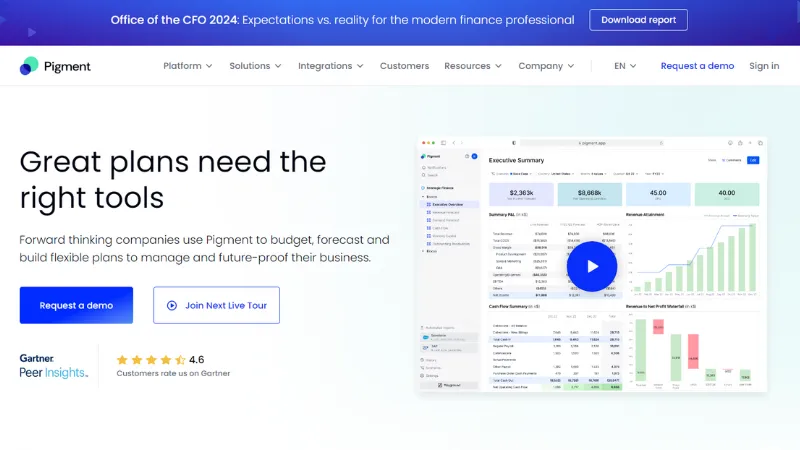

Pigment

Pigment is an Accounting & finance company based in France. Their objective at Pigment is to support corporate teams in their planning, decision-making, and change adaptation. They accomplish this by integrating people, information, and workflows into a user-friendly, flexible, integrated platform that allows teams to quickly develop reliable operational and strategic business plans. They can spur expansion, adapt to shifts, and prepare their company for the future with Pigment.

Read also - Berlin-based Proptech Startup Novo Raises €1 million Pre-seed Funding

Blossom Capital, David Clarke, FirstMark Capital, Frst Capital, Paul Melchiorre, Greenoaks Capital Management, Institutional Venture Partners, Meritech Capital Partners, Felix Capital, ICONIQ Capital, Accel, Visionaries Club, these are the investor of the company.

Possible Finance

Possible Finance is an Lending company based in United States. At Possible, they think everyone has an entitlement to financial stability. Their goal is to assist communities in ending the debt cycle and allowing future generations to have access to economic mobility. They are steadfast in their dedication to this goal and take great joy in creating goods and services that demonstrate that it is feasible to improve the industry.

Read also - Austrian-based Greenwood Power Secures €5.1 million in Funding

FJ Labs, Hustle Fund, Seattle Bank, Unlock Venture Partners, Columbia Pacific Telesystems, Park Cities Asset Management, Canvas Ventures, Tom Williams, Union Bay Capital, Union Square Ventures, Euclidean Capital, these are the investor of the company.

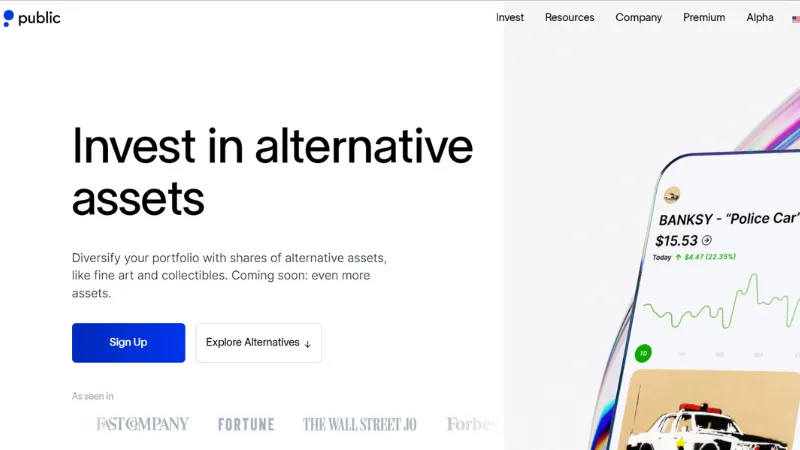

Public

Public is an Retail & alternative investing company based in United States. A website called Public.com helps users become better investors. Within a single platform, members can put together a varied portfolio of equities, ETFs, and cryptocurrencies. Ownership on Public opens them a world of content and education relevant to their portfolio, crafted by a community of over a million investors, creators, and professionals.

Read also - Amsterdam-based no -code Website Builder Framer Secures $27M in Series C Round Funding

Peter Dartley, Sean Hendelman, Accel, Greycroft, Advancit Capital, Casey Neistat, Dreamers Fund, Justin James Watt, Morgan DeBaun, Scott Belsky, Sophia Amoruso, Paycheck Protection Program, Mohammed Alabsi, Scott Galloway, Dick Parsons, Lakestar, MANTIS Venture Capital, Tony Hawk, Aglae Ventures, Inspired Capital, Intuition Capital, Philip DeFranco, Tiger Global Management, VIne Capital, Bobby Wagner, Maria Sharapova, West Quad, these are the investor of the company.

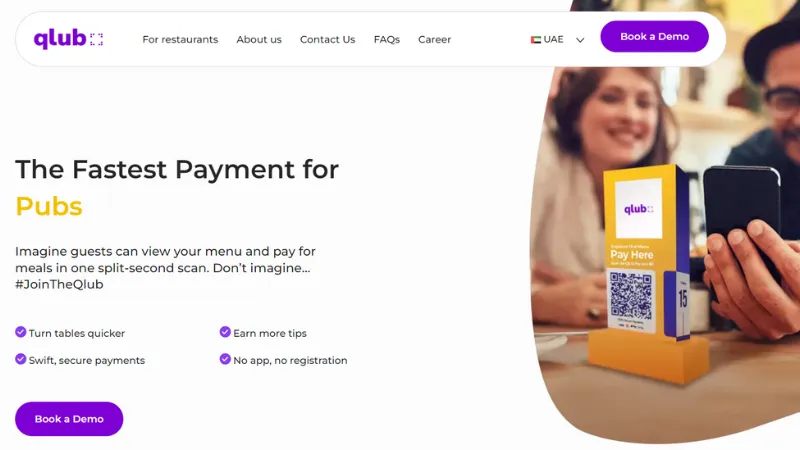

Qlub

Qlub is an Payment acceptance company based in United Arab Emirates. Qlub's lightning-fast payment option is elevating the dine-in experience. Everyone has had to wait about for the bill for an annoying twenty minutes at some point. With Qlub, paying with just one click, scanning a QR code, and leaving the payment area takes no more than ten seconds. You can do all of this even without downloading an app. Furthermore, splitting the cost when dining with friends has never been simpler.

Read also - Hungary-based Startup Flawless Secures $2.2 Mn in Seed Funding

Cherry Ventures, FinTech Collective, Heartcore Capital, Point Nine Capital, Raed Ventures, STV, Shorooq Partners, Al Dhabi Capital, Heartcore, these are the investor of the company.

Qoala

Qoala is an Insurance company based in Indonesia. Qoala is an omnichannel insuretech startup that was founded in 2018 with the goal of empowering, democratising, and reinventing insurance for consumers. Qoala believes that all parties involved must be involved in order to redefine insurance. As a result, Qoala is dedicated to giving its clients, insurance partners, and regulators the best possible service.

Read also - French Startup Kamino Retail Secures €1.25m Pre-Seed Round Funding

Genesia Ventures, MDI Ventures, MassMutual Asia, SeedPlus, Surge, Centauri Fund, Central Capital Ventura, Flourish Ventures, KB Kookmin Bank, MassMutual Ventures, Mirae Asset Venture Investment, Peak XV Partners, BRI Ventures, Daiwa PI Partners, Eurazeo, Indogen Capital, KB Investment, Mandiri Capital, Salt Ventures, responsAbility Investments, ASAP, these are the investor of the company.

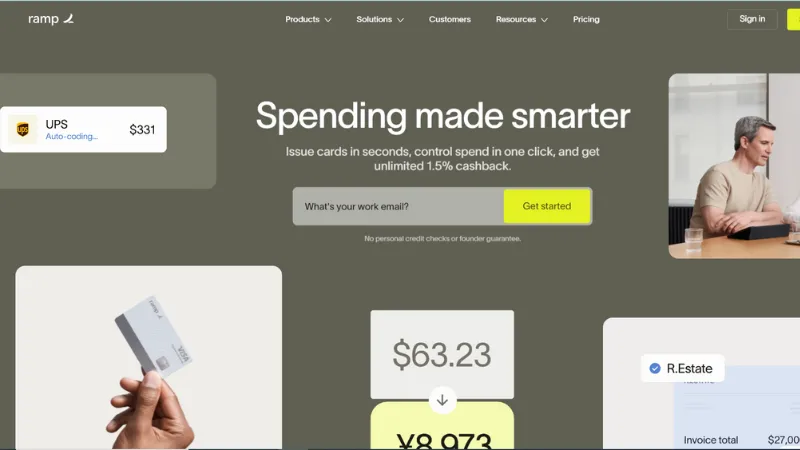

Ramp

Ramp is an Spend management company based in United States. The best platform accessible to modern financial teams is Ramp. Ramp is an all-in-one solution that brings together corporate cards with accounting automation, bill payment, vendor management, expenditure management, and more. Its objective is to save organisations money and time while enabling finance professionals to focus on their work to the fullest.

Read also - Brussels-based Proptech Startup Izix Raises €3 Mn Series A Funding

BoxGroup, Coatue Management, Keigh Rabois, Backend Capital, Conversion Capital, Founders Fund, Soma Capital, D1 Capital Partners, Goldman Sachs, Stripe, Altimeter Capital, Definition Capital, ICONIQ Capital, Lux Capital, Redpoint Ventures, Spark Capital, Thrive Capital, one, 137 Ventures, Avenir Growth Capital, Declaration Partners, General Catalyst, Vista Equity Partners, Citibank, Plug and Play Accelerator, Julian Capital, Sarona Ventures, Satya Nadella, Sands Capital, these are the investor of the company.

Remote

Remote is an Payroll & benefits company based in Netherlands. Talent is everywhere — opportunity is not. Remote’s mission is to create opportunity everywhere, empowering employers to find and hire the best talent, and enabling individuals to build financial and personal freedom. Businesses around the world use Remote to hire, manage, and pay their globally distributed workforces, simply and compliantly. Remote was founded in 2019 by Job van der Voort and Marcelo Lebre.

Read also - Nord Security Raises $100 Mn funding at a $3 Bn valuation

General Catalyst, INKEF Capital, Index Ventures, Liquid 2 Ventures, Remote First Capital, Two Sigma Ventures, Aaron Levie, Julia Hartz, Kevin Hartz, Sequoia Capital, Zach Weinberg, Accel, Day One Ventures, Flat Capital, SoftBank, B Capital Group, these are the investor of the company.

Republic

Republic is an Retail & alternative investing company based in United States. Republic serves as a meeting place for accredited and non-accredited investors to connect with entrepreneurs and find high-growth opportunities in various private markets. Former employees of AngelList, the biggest online marketplace for private investing, launched Republic. Since then, They have built a network and team of the best individuals from the venture capital, investing, and startup industries.

Read also - London-based Fintech Startup Apron Raises $15M Series A Funding

WellFound, Good Growth Capital, Binance Ventures, East Chain Co, FBG Capital, Hazoor Partners, NEO, NGC Ventures, Oyster Ventures, ZhenFund, zk CAPITAL, Broadhaven Capital Partners, Galaxy Interactive, Motley Fool Ventures, Prosus Ventures, Tribe Capital, Nomura Strategic Ventures, Atreides Capital, Brevan Howard Digital, CoinFund, HOF Capital, Pillar, Valor Equity Partners, Ceras Ventures, these are the investor of the company.

Rightfoot

Rightfoot is an Financial services automation company based in United States. The top supplier of password-free, customer-permissioned financial data is Rightfoot. In order to receive equitable financial services, they think customers should be able to simply agree to the use of their financial information. Furthermore, they firmly believe that a consumer shouldn't be asked to divulge private bank information, such as their username and password, throughout this process.

Read also - Swiss Startup Tune Insight Raises $3.4M in Funding

NFX, The MBA Fund, Annie Hockey, Bain Capital Ventures, BoxGroup, Julia Hartz, Kevin Hartz, Omri Dahan, SemperVirens, William Hockey, FinTech Innovation Lab, ONEVC, WMN FINtech, Blue Lion, Kraken Ventures, Renegade Partners, these are the investor of the company.

Ripple

Ripple is an Cross-border payments company based in United States. Ripple offers enterprise-grade solutions that are quicker, more transparent, and more affordable than traditional financial services because they leverage blockchain and crypto technologies that have been refined over a ten-year period. These solutions are utilised by their clients to source cryptocurrency, enable instantaneous payments, strengthen their treasury, interact with new audiences, reduce capital needs, and generate new revenue.

Read also - Stuttgart-based Metergrid secures €2.7 million Seed Funding

Andreessen Horowitz, Digital Currency Group, FF Angel, Lightspeed Venture Partners, Vast Ventures, Camp One Ventures, Core Innovation Capital, IDG Capital, Venture51, Founders Fund, Google Ventures, Pantera Capital, AME Cloud Ventures, Blockchain Capital, CME Ventures, CRCM Ventures, China Growth Capital, RRE Ventures, Route 66 Ventures, Seagate Technology, Wicklow Capital, Ideabox, Mouro Capital, Abstract Ventures, Accenture, SBI Investment, SCB 10X, Standard Chartered, Bank of England Accelerator, 10X Capital, NKM Capital, Bill & Melinda Gates Foundation, SBI Group, Tetragon Financial Group, Ripple, Tokentus, these are the investor of the company.

SESAMm

SESAMm is an Wealth & asset management company based in France. Businesses may use SESAMm to use AI to gather vital insights from the internet. They use natural language processing to analyse over 20 billion articles and messages to deliver ESG, sentiment, and thematic insights. Global enterprises, asset managers, index providers, and large private equity firms are among our clientele.

Read also - Paris-based Rayon Secures €4 million in seed funding

A-Venture, Bourgogne Franche Comte Angels, Bpifrance, Caisse d’Epargne, Champagne Ardenne Croissance, Lorraine Capital, AngelSquare Fintech, Havenrock, Institut Lorrain De Participation, Plug and Play Japan, Banque Populaire, Carlyle, NewAlpha, AFG Partners, CEGEE Capital, Elaia Partners, Elevator Ventures, Opera Tech Ventures, Unigestion, Plug and Play Fintech Accelerator, these are the investor of the company.

Signzy

Signzy is an Fraud prevention & compliance company based in India. With its industry-leading platform, Signzy, banking institutions are revolutionising the speed, accuracy, and digital onboarding experience for both businesses and customers. The company's no-code GO platform, which has won awards, offers fully customisable workflows along with seamless, multi-channel, end-to-end onboarding experiences.

Read also - Hamburg-based Resourcify Secures €14 million Series A Round Funding

YES FINTECH, CATALYST Startup Accelerator, K-Start, Amrish Rau, Dilip Khandwelwal, Kalaari Capital, Rajan Anandan, Stellaris Venture Partners, Facebook India Innovation Hub, Google for Startups Accelerator, Arkam Ventures, Mastercard, Vertex Ventures, Tenity, Gaja Capital Partners, these are the investor of the company.

StockGro

StockGro is an Retail & alternative investing company based in India. India's First Social Trading Platform: Encouraging Social Investment.

Read also - AI Platform Machine Discovery Secures £4.5M in Funding

Roots Ventures, Velo Partners, Kunal Shah, Rahul Garg, Ramakant Sharma, Vivekananda Hallekere, Ankush Gera, BITKRAFT Esports Ventures, CreedCap Asia Advisors, General Catalyst, LGVP Partners, Nitish Mittersain, Patrick Ryan Grossman, Root Ventures, U1 Technologies, Witthers Khattarwong, Knuru Capital, these are the investor of the company.

Synctera

Synctera is an Core banking & infrastructure company based in United States. With the help of Synctera's platform, businesses of all sizes can introduce FinTech or embedded banking solutions with the technical infrastructure, sponsor bank link, and regulatory framework they require.

Read also - Digital Palliative Care Company Pal Raises €300k in Pre-seed Round

Alexa von Tobel, Diagram Ventures, Henry Ward, Lightspeed Venture Partners, Max Levchin, Zach Perret, Fin Capital, Gaingels, Mastercard, SciFi VC, Scribble Ventures, Emigrant Bank, Midland States Bancorp, NAventures, The Banc Funds, Veritex Holdings, these are the investor of the company.

Tapcheck

Tapcheck is an Core banking & infrastructure company based in United States. The best accurate earned income access tool available is Tapcheck, which gives workers instant access to their pay at no expense to their employers. After including Tapcheck in their benefits package, tens of thousands of employers have discovered that providing on-demand pay boosts employee satisfaction, lowers attrition, and sets them apart from rivals.

Read also - Faraday invests €1.3M to strengthen its position in Valencian Jewellery Brand Singularu

PeakSpan Capital, FIS Fintech Accelerator, these are the investor of the company.

Tazapay

Tazapay is an Cross-border payments company based in Singapore. Tazapay is a fintech startup with headquarters in Singapore that aims to revolutionise international payments. Tazapay was established in 2021 by veterans of the sector, and since then, it has successfully raised a $16.9 million Series A fundraising round, including notable contributions from esteemed organisations like Sequoia and the PayPal Alumni Fund.

Read also - Barcelona-based Incapto Raises €6 million in Funding

Surge, Saison Capital, January Capital, RTP Global, Escape Velocity, Foundamental, Gokul Rajaram, PayPal Ventures, Peak XV Partners, these are the investor of the company.

Telda

Telda is an Digital banking company based in Egypt. Telda is a financial brand designed to make peer-to-peer payments easier for Millennials and Generation Z. For everyone looking for an alternative to the established banking system, they are introducing a better way to send, spend, and save money.

Read also - Amsterdam-based Orquesta Raises €800K in pre-seed Funding

Class 5 Global, Global Founders Capital, Sequoia Capital, Byld Ventures, Block, Yellow Card, these are the investor of the company.

Terrapay

Terrapay is an Cross-border payments company based in Netherlands. With its headquarters located in London, the United Kingdom, TerraPay is of the opinion that even the smallest payment should have a borderless, secure trip. TerraPay's cross-border payments network facilitates international money transfers as the only payment provider authorised in 29 countries.

Read also - Lausanne based Debiopharm Innovation Fund Launches $150 million Seed Funding Initiative.

International Finance Corporation, Management Buyout (MBO), Partech Partners, Prime Ventures, U.S. International Development Finance Corporation, Symbiotics, Visa, these are the investor of the company.

Thought Machine

Thought Machine is an Core banking & infrastructure company based in United Kingdom. Their team's audacious goal is to develop technology capable of operating the world's banks using the best contemporary software and design principles. By doing this, they will effectively and long-term remove the issues caused by subpar technology operating on antiquated infrastructure from the world's institutions.

Read also - Amsterdam-based no -code Website Builder Framer Secures $27M in Series C Round Funding

Lloyds Banking Group, Backed VC, IQ Capital, Molten Ventures, Playfair Capital, Tech Nation Fintech, MasterCard Start Path, British Patient Capital, Eurazeo, SEB Venture Capital, ING Ventures, J.P. Morgan Chase & Co., Nyca Partners, SC Ventures, Intesa Sanpaolo, Morgan Stanley, Temasek, ING, SEB Alliance, these are the investor of the company.

Thunes

Thunes is an Cross-border payments company based in Singapore. Thunes is a business-to-business (B2B) firm that facilitates payments for the fastest-growing companies in the world, ranging from global Fintech heavyweights like PayPal and Remitly to gig economy titans like Uber, Deliveroo, and Southeast Asia's superapp Grab.

Read also - Austrian-based Greenwood Power Secures €5.1 million in Funding

DT One, Airbnb, GGV Capital, Xiaomi, Checkout.com, Future Shape, Helios Investment Partners, Hogan Lovells Global FinTech Mentor and Momentum Programme, Insight Partners, Marshall Wace Asset Management, 01Fintech, Bessemer Venture Partners, EDBI, Endeavor, Visa, Plug and Play APAC, these are the investor of the company.

Trade Republic

Trade Republic is an Retail & alternative investing company based in Germany. Trade republic is on a mission to set million of european up for wealth creation with secure with easy and commission free access to capital market.

Read also - French Startup Kamino Retail Secures €1.25m Pre-Seed Round Funding

Creandum, Project A Ventures, Accel, Founders Fund, Sequoia Capital, Technology Crossover Ventures, Thrive Capital, Ontario Teachers', these are the investor of the company.

TRM

TRM is an Cryptocurrency company based in United States. TRM Labs is a blockchain intelligence startup that assists government authorities, financial institutions, and cryptocurrency companies in identifying and looking into financial crime and fraud related to cryptocurrencies. Their daily tasks involve addressing problems in threat intelligence, data science, and data engineering in order to forward their goal of creating a financial system that is safer for billions of people.

Read also - Hungary-based Startup Flawless Secures $2.2 Mn in Seed Funding

Blockchain Capital, Green D Ventures, Tapas Capital, The MBA Fund, Y Combinator, Initialized Capital, PayPal Ventures, Alumni Ventures, Bessemer Venture Partners, Jump Capital, Operator Partners, SGH Capital, Salesforce Ventures, American Express Ventures, B Capital Group, Block, Cap Table Coalition, Castle Island Ventures, Citi Ventures, DRW Venture Capital, Emilie Choi, Frank Slootman, Marshall Wace Asset Management, Michael Scarpelli, Tiger Global Management, Visa Ventures, J.P. Morgan Chase & Co., Goldman Sachs, Thoma Bravo, VentureSouq, these are the investor of the company.

Trullion

Trullion is an Accounting & finance company based in United States. A tool called Trullion uses AI to automate finance and audit teams' activities. Their fast-growing startup is creating the future generation of accounting work from their locations in Tel Aviv and New York, advancing the field and assisting companies in completing their tasks.

Read also - French SaaS Firm, Scnd” Raises €4 million in Funding

Aleph, Artie Minson, Bob Mylod, Greycroft, Jody Padar, Zachary Bookman, Guzel Lumpkin, Third Point Ventures, Verissimo Ventures, Stepstone Group, these are the investor of the company.

Two

Two is an B2B BNPL company based in Norway. The full B2B payment suite, which makes it simple to sell to both online and offline business clients, is number two. With their Buy Now, Pay Later options, you can provide your B2B clients with flexible, interest-free loans without taking on additional credit risk or requiring invoice factoring.

Read also - Finnish AI Governance Startup Saidot Raises €1.75M Seed Round Funding

LocalGlobe, Sequoia Capital, Visionaries Club, Alliance Venture, Alumni Ventures, Antler, Day One Ventures, Shine Capital, these are the investor of the company.

Uala

Uala is an Mobile wallets & remittances company based in Argentina. A fintech company called Ualá provides more affordable and convenient services than other options while offering its consumers, especially the unbanked population within the financial system, a cutting-edge and integrated experience.

Read also - German Climatetech Startup Purpose Green Raises €3.3 million in Funding

Bessemer Venture Partners, George Soros, Kevin Ryan, Point72 Ventures, Greyhound Capital, Jefferies, Soros Fund Management, GS Growth, Monashees+, Ribbit Capital, Tencent, Google for Startups Accelerator, Endeavor, SoftBank, 166 2nd Financial Services, D1 Capital Partners, Emanuel Ginobili, Goldman Sachs Asset Management, Isaac Lee, Jacqueline Reses, SoftBank Latin America Fund, these are the investor of the company.

Unit

Unit is an Core banking & infrastructure company based in United States. Unit is the premier financial infrastructure platform that facilitates the storage, transfer, and lending of funds for Internet enterprises. Discover new sources of income and satisfy your clientele.

Read also - French cybersecurity Firm Nano Corp has Raises a $4.2 million Seed Round Funding

Aleph, Better Tomorrow Ventures, Flourish Ventures, Operator Partners, TLV Partners, Accel, Insight Partners, these are the investor of the company.

Unit21

Unit21 is an Fraud prevention & compliance company based in United States. Unit21 is on a mission to unite the world’s fraud fighters and AML heroes to see the financial ecosystem restored to the pathway of opportunity it was meant to be. They specialize in delivering solutions that don’t just identify but proactively mitigate risks tied to money laundering, fraud, and other illicit activities.

Read also - Ukraine-based Product Development Company Trinetix Raises $10 million in Funding

Commerce.Innovated, A.Capital, Chris Britt, Core Ventures Group, Diane Greene, Gradient Ventures, Michael Vaughan, Ryan King, South Park Commons, Sumit Aggarwal, William Hockey, ICONIQ Capital, Tiger Global Management, Gaingels, these are the investor of the company.

Upvest

Upvest is an Wealth & asset management company based in Germany. Upvest is a fintech company founded in 2017 that empowers other fintechs to provide their end customers with any type of investment product. To achieve that, Upvest has developed an Investment API that is easy to integrate for fintechs and banks alike. This allows Upvest clients to offer their end customers the best experience in the field of capital market investment and retirement planning, save resources and fully concentrate on their core business.

Read also - Hungary-based Startup Flawless Secures $2.2 Mn in Seed Funding

Speedinvest, HV Capital, Notion Capital, Partech Partners, Investitionsbank, Komercni banka, Earlybird Venture Capital, Maximilian Tayenthal, ABN AMRO Ventures, 10x Group, Bessemer Venture Partners, these are the investor of the company.

Valon

Valon is an Real estate & mortgage company based in United States. Valon is an insurance company, lender, and servicer of residential mortgages. Their goal is to give every homeowner more authority. They are building a world in which having a house is easy, secure, and financially sound.

Read also - Barcelona-based Incapto Raises €6 million in Funding

166 2nd Financial Services, Andreessen Horowitz, Jefferies, Rithm Capital, AlleyCorp, Kairos HQ, Soros Fund Management, Zigg Capital, Fortress Investment Group, Freedom Mortgage, Human Capital, Marcelo Claure, Starwood Capital Group, Ribbit Capital, these are the investor of the company.

Velocity Global

Velocity Global is an Payroll & benefits company based in United States. With Velocity Global, you can expand your workforce globally by leveraging local knowledge and seamless technology across more than 185 countries. Anywhere you are, they make it easy to employ, compensate, and manage personnel in compliance. You can take over the world with Velocity Global.

Read also - Helsinki-based MeetingPackage Secures $4.6 million in Series A Funding Round

FFL Partners, Eldridge, Norwest Venture Partners, these are the investor of the company.

Veriff

Veriff is an Fraud prevention & compliance company based in Estonia. The largest and most successful digital businesses in the world, including leaders in the gaming, fintech, cryptocurrency, and mobility industries, use Veriff as their identity verification partner. They offer cutting-edge technology, profound knowledge, and experience that they have developed over decades of leading the digital identity revolution, starting with their establishment in digitally first Estonia.

Read also - Helsinki-based MeetingPackage Secures $4.6 million in Series A Funding Round

Y Combinator, ACE & Company, Ashton Kutcher, Elad Gil, Mosaic Ventures, Paul Buchheit, SV Angel, Superangel, Taavet Hinrikus, Change Ventures, NordicNinja, Accel, Institutional Venture Partners, Alkeon Capital Management, Tiger Global Management, these are the investor of the company.

Vic.ai

Vic.ai is an Accounting & finance company based in United States. Vic.ai is leading the way in digitally transforming accounting and finance processes to increase efficiency, ROI, and decision-making through the application of autonomy and intelligence. Vic.ai improves speed and scalability to help customers reimagine their accounts payable processes and enhance financial management by tackling the most laborious and inefficient chore in accounting: processing invoices.

Read also - Amsterdam-based Orquesta Raises €800K in pre-seed Funding

Costanoa Ventures, Cowboy Ventures, GGV Capital, ICONIQ Growth, ICONIQ Capital, these are the investor of the company.

Volt