[Funding alert] Prague-based Flowpay Secures Over €2 Million in Seed Funding

Mar 20, 2024 | By Team SR

Flowpay, a Prague fintech startup using predictive AI models, automation and Embedded Finance to help small and medium-sized enterprises (SMEs) secures over €2 million in seed funding.

In addition to prominent angel investors like Mark Ransford, Martin Herrmann, Kartik Varma, Allard Luchsinger, and others, it received backing from Techstars and emerging Czech venture capital firms Soulmates Ventures and DEPO Ventures.

Read also - Munich-based VC Alpine Space Ventures Secures €10 Million in Funding

With the help of this recently acquired investment, Flowpay will be able to expand its technological capabilities, reach a larger spectrum of SMEs, and grow beyond the borders of the Czech startup ecosystem.

RECOMMENDED FOR YOU

William Jalloul, founder and CEO of Flowpay said, “Even if you have a profitable and fast-growing business, banks might still not give you a loan when you need it for something like stocking up your warehouse or investing in advertising. Banks cannot assess risk precisely and usually just look at tax returns, which are outdated and most often do not reflect reality. At Flowpay, we work with client data taken directly from their point-of-sales systems, e-commerce platforms like Shoptet, and use AI to rate their potential to obtain financing. We want to help SMEs grow with our Risk as a Service (RaaS) solution and license it to financial institutions around the world,”.

In order to better meet the demands of its customers, Flowpay intends to enhance its technology and enter new areas. It will also be able to offer more individualized financing solutions that are catered to the unique requirements and capacities of every company thanks to this seed funding.

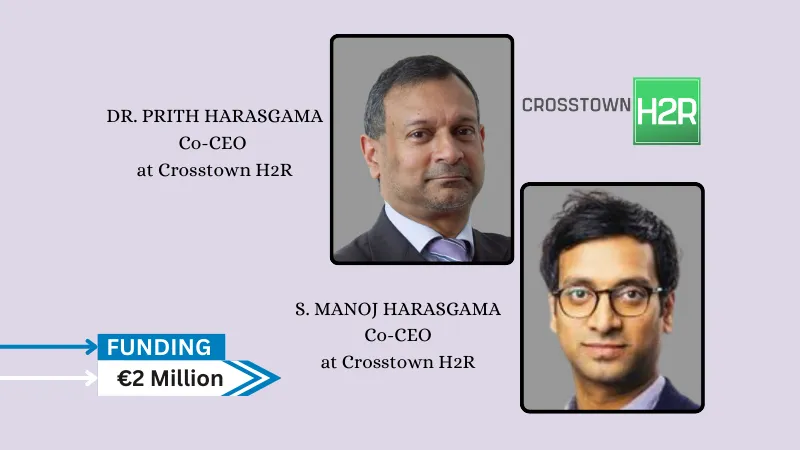

Read also - Baden-based Crosstown H2R Secures over €2 Million in Fundin

About fifteen specialists make up the Flowpay team at the moment; they are mostly from the IT and data science domains, and their combined skill sets enable the business to run smoothly and effectively. Flowpay hopes to add 20 team members in the near future as part of its aspirations to keep developing and accelerate development.

Allard Luchsinger, Managing Director Techstars said, “SMEs are the backbone of our economy. To be successful, they need financing to fund their growth. Most banks are not well set up to support them effectively, as processing relatively small loans is costly, and assessing risk based on outdated data poses a significant challenge for them. Because of these dynamics, many traditional lenders choose to focus on higher-value loans for larger companies, leaving the SME segment poorly served and economies performing sub-optimally. Flowpay is a prime example of a new generation of tech-driven companies that enable fast and cost-effective funding of smaller loans for the SME segment,”.

Hynek Sochor, founder of the accelerator and fund Soulmates Ventures said, “Borrowing money and going into debt can be unsustainable. To address this challenge, Flowpay has introduced a key innovation for SMEs, which make up an undeniably crucial segment of the economy. Flowpay shortens the time needed to evaluate credit applications to mere minutes, increases the accuracy of risk assessment, and speeds up access to finances for SMEs. This approach represents a revolution in financing, supports dynamic growth, and contributes to the sustainable prosperity of our economy,”.

Michal Ciffra, partner at DEPO Ventures said, “For businesses, the loan application process is often prolonged and uncertain, which is a result of the bank sector’s slow progress in digitalization. The main problem is the limited availability and use of data, as the analysis and assessment process is in the hands of individuals, which is far from efficient. Even though the trend of open banking has not yet fully become the norm, banks are facing difficulties in assessing prospective SMEs. Flowpay solves the problem of digitalization and process automation by utilizing accurate and available data. This approach opens up partnership possibilities in the realm of Embedded Finance as a mutually beneficial solution, reinforcing Flowpay’s position as a technological organization,”.

About Flowpay

Flowpay has had a great deal of success, including being a part of the esteemed Techstars accelerator in Amsterdam. Thanks to its cutting-edge platform and use of AI, which allows businesses to swiftly and simply access funding based on the analysis of actual operational data, Flowpay has grown to be a significant participant in the operational finance sector.

Follow us

Follow us Follow us

Follow us