[Funding alert] Lyon-based Axeleo Capital Secures €73 Million second Fund

Dec 12, 2023 | By Startup Rise EU

Lyon-based Axeleo Capital Secures €73 Million second Fund. A fund that invests in early-stage fintech, blockchain, artificial intelligence, novel uses of data, and the next generation of B2B software.

This organisation makes investments in interest French and Western European firms with an initial seed investment that ranges from €0.2 to €2 million. Over 95% of them have reaffirmed their trust in the managing group, which includes the vast pool of digital entrepreneurs known as the Fonds National d'Amorçage 2, which is run by Bpifrance on behalf of the French government as part of the France 2030 plan.

Read also - Copenhagen-based Biotech Company Hoba Therapeutics EUR 23M in Series A Round Funding

This second vintage has attracted new investors, notably corporates, Tikehau Capital, a number of prestigious family offices, and makers of several French unicorns.

RECOMMENDED FOR YOU

Eric Burdier, founding partner said, “With this final closing, above our €60M initial target, we are doubling our size compared to our first vintage and we are confirming the relevance of our early-stage strategy, which combines investment from the seed stage, support in direct contact with our network of entrepreneurs/LPs and, for our most promising teams, significant amounts in reinvestments in Series A and B. In this challenging market context, our positioning proves its worth, enabling today’s talent to emerge,”.

AXC2 is investing in B2B digital firms who are interested in transforming business in the future by making it more efficient, robust, sustainable, and agile.

Read also - Copenhagen-based Seasony Secures €1.5 Million in Funding

Mathieu Viallard, founding partner added “The future of technology lies in the boldness of each startup. At Axeleo Capital, we are delighted to be able to support these revolutions and their mutations. It is also in difficult economic contexts that the most resilient and visionary startups are born. The areas we are targeting, notably data, fintech and cybersecurity in B2B markets, are acyclical segments that will shape the landscape of tomorrow,”

About Axeleo Capital

Europe's leading independent early-stage venture capital firm, Axeleo Capital (AXC), is regarded and supported by business owners everywhere. With 13 staff, €150 million in assets under management (AuM), and three completed fund raises, the company has made over 65 investments around the EU and accomplished 17 successful exits in the last 24 months. Every fund strives for a triple net return.

Read also - Berlin-based Montamo Raises €2.1Million in Pre-Seed Funding

Recommended Stories for You

[Funding alert] Oslo-based Online app Builder Databutton Secures €4.8 million in Seed Funding

Startup Rise EU Sep 24, 2023

[Funding alert] Munich-based Deeptech Startup Proxima Fusion has Extended its Pre-Seed Round to €7.5 Million

Startup Rise EU Nov 16, 2023

[Funding alert] Hamburg-based Heyflow Secures $16Million in Series A Round Funding

Startup Rise EU Feb 29, 2024

[Funding alert] Munich-based InPlanet Secures €5.6M in Funding

Startup Rise EU Nov 16, 2023

SLAY funding news – Germany-based SLAY Secures $5Million in Seed Funding

Startup Rise EU Jun 20, 2024

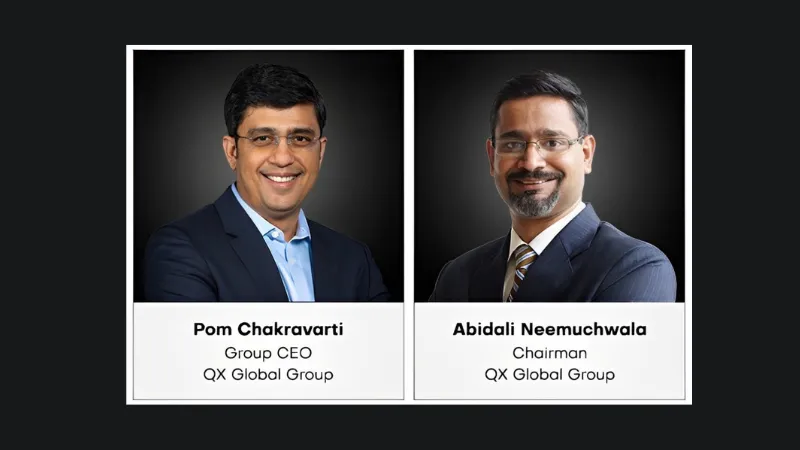

QX Global Group Funding News – QX Global Group Secures £100m Growth Investment From Long Ridge Equity Partners

Team SR Jul 12, 2024

Follow us

Follow us Follow us

Follow us