Real-time payments platform Volt Join forces with Bumper. a payment platform for car dealerships, to harness the power of open banking and real-time payments so that consumers can pay for vehicle deposits, repairs, parts, services and even purchase vehicles outright.

This partnership comes amidst a rebound in UK car sales, as more were sold in the UK in 2023 than in any year since the Covid-19 pandemic, with used car sales particularly booming, experiencing 5.5% year-on-year growth in Q3 2023.

Read also - Krakow-based edrone Secures €4.6 Million in Funding

This rebound is already being reflected in Volt and Bumper’s sales volume, as since dealerships began quickly adopting the integration in January 2024, more than £3 million in payments has been processed in the UK, with some customers using Volt to buy cars outright.

RECOMMENDED FOR YOU

[Funding alert] Stockholm-based Fever Secures €10 Million in Seed Funding

Team SR

Feb 15, 2024

London Startup Incentifi Raises €174K To Reward Workplace Wellness

Kailee Rainse

Jan 15, 2026

Volt now powers Bumper’s ‘Pay Now’ function, facilitating these automotive payments, with dealerships receiving the benefit of instant settlements, which are tracked in real time. Helping to digitise dealerships, the integration also allows checkout flow and pay-by-link options, providing a mobile-first experience to the service car dealerships provide.

Read also - Amsterdam-based DataSnipper Secures $100Million in Series B Round Funding

The collaboration addresses a key pain point for dealerships by eliminating friction caused by slow settlement times. With the freedom of knowing payments settle instantly, dealerships gain greater control over their cash flow and inventory, also reducing the risk of non-payment or system errors.

Volt and Bumper’s collaboration shows that when merchants actively push open banking payments, customers are happy to use them, reporting safer and safer experiences; helping to drive UK open banking adoption in a pivotal year of the technology’s development.

Read also - Galway-based CitySwift Secures €7Million in Funding

The partnership brings open banking payments to customers of over 5,000 dealerships throughout the UK, including several of the world’s major automotive manufacturers, such as Audi, Ford, Porsche and Volkswagen.

Richard Drury, VP Partnerships at Volt, said: “For car dealerships, the payments process has been a major challenge and our solution is a real asset in alleviating those challenges many dealership owners are facing today. We’ve created a perfect solution for Bumper, with the initial results and quick adoption proving that it resonates with both buyers and sellers. There’s huge potential for real-time payments to take off in the automotive industry, so this partnership was a no-brainer for Volt.”

Jack Allman, CCO and Co-founder at Bumper, added: “The move to Volt as Bumper’s open banking payment provider will have a huge impact on functionality for our partnered dealerships and their customers, providing them with a frictionless account-to-account payment experience.

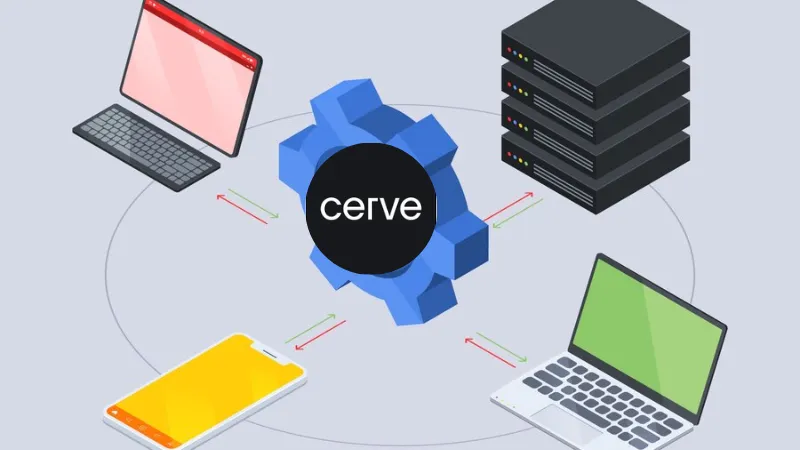

About Volt

Volt is developing the next generation of payment networks, which will link real-time payments worldwide and be instantaneous, global, and interoperable. They are spearheading the transition to a time where time exists solely in real-time. The new era has begun.

Read also - Transporttech Company Zeelo Acquired UK-based Kura

About Bumper

Dealerships are intimidating environments. It might be challenging to distinguish between poor craftsmanship and wise counsel from deceptive sales tactics. Thus, it is normal to feel apprehensive when presented with a large sum of money. Would that someone would just watch out for you. Greetings to Bumper. First, they made sure the person you are driving your car to is reputable, high-quality, and provides excellent service.

Read also - Swedish Heart Aerospace Secures $107 Million in Series B Round Funding

Follow us

Follow us Follow us

Follow us