What are Fintech Startups?

Fintech startups represent diverse companies utilizing technology to innovate and optimize financial services. These enterprises, often disrupting traditional financial systems, focus on providing more efficient, accessible, and user-friendly solutions.

Read also - List of Top 100 Fintech Companies in the World

Operating in the banking, payments, lending, insurance, and wealth management sectors, fintech startups leverage mobile apps, blockchain, artificial intelligence, and data analytics to enhance financial processes and deliver improved services. The fintech industry's rapid expansion underscores its transformative impact on the global financial landscape.

Read also - List of Unicorn Startups in Europe

Top 12 Fintech Startups in Spain

Bnext

Bnext is Spain's foremost neobank, distinguished for its mobile-first approach to banking services. With a commitment to redefining the banking experience through mobile technology, the founders, location, and exact founding details are not readily available.

Read also - Top 10 Profitable Unicorn Startups in Europe

Nonetheless, Bnext has become a prominent figure in the Spanish neobanking sector, offering a suite of innovative financial services to tech-savvy consumers.

Bit2Me

Bit2Me is a versatile suite of blockchain services designed to facilitate cryptocurrency exchange and promote Bitcoin adoption. Established by Leif Ferreira, the startup has become a significant player since its inception in 2014.

Read also - Top 10 Home Care Startups In Europe

Operating from Spain, Bit2Me contributes to the evolution of cryptocurrency services. The startup's dedication to providing a comprehensive suite of blockchain solutions underscores its role in shaping the future of digital currencies.

Verse

fintech payments Company Square acquired Verse in 2020. Verse, a payments platform, simplifies financial transactions by enabling users to share payments easily and instantly without hidden fees. Founded in 2015, the startup has made strides in the financial technology sector.

Read also - Top 10 Real Estate Startups in Europe

While detailed founding information may not be explicitly stated, Verse, headquartered in Spain, focuses on providing seamless and transparent payment solutions, enhancing the overall accessibility and efficiency of financial transactions.

Cobee

Cobee, a fintech startup based in Spain, specializes in automating and streamlining employee benefits management through its online platform. Although specific founding details may not be readily accessible, Cobee's innovative approach to managing employee benefits has garnered recognition.

Read also - Top 10 Agritech Startups in UK

The platform empowers organizations to optimize their benefits programs, contributing to a more engaged and satisfied workforce.

ID Finance

ID Finance stands out as a rapidly growing provider of data science, credit scoring, and global consumer digital finance solutions. Boris Batine and Alexander Dunaev founded the startup as a key player in the financial technology sector.

Read also - Top 10 Clean Tech Startups in Europe

While detailed founding information might be soon apparent, ID Finance, with a global footprint, focuses on leveraging data-driven insights for responsible lending and financial inclusion. The startup combines innovative technologies with a deep understanding of consumer credit, contributing to the dynamic landscape of digital finance.

Fintonic

Fintonic is a free app designed to aid individuals in managing their finances with simplicity and accessibility. The specific founding details may not be immediately clear, but Fintonic has emerged as a significant player in the financial technology sector, focusing on providing a user-friendly platform based in Spain.

Read also - Top 10 Crypto Mining Software in Europe

The startup empowers users to take control of their financial well-being, emphasizing ease of use and streamlined financial management.

Startupxplore

Startupxplore operates as a platform simplifies the investment process for inexperienced and time-constrained investors. While specific founding information might not be readily available, the platform, based in an undisclosed location, aims to democratize startup investing.

Read also - Top 10 Health and Wellness Startups in Europe

Startupxplore facilitates portfolio diversification for investors navigating the startup landscape efficiently, aligning with the evolving needs of the investment community.

Banco Bilbao Vizcaya Argentaria (BBVA)

Banco Bilbao Vizcaya Argentaria, or BBVA, is a global financial services group headquartered in Spain, with a long-established presence in the industry.

Read also - Top 10 European Gaming Startups

While specific founding details may not be applicable in the startup context, BBVA has played a significant role in the evolution of the banking sector, embracing digital transformation and innovation to enhance customer experiences.

Cleverea

Cleverea operates in the insurance sector, focusing on Property and Casualty (P&C) Neo-insurance. The startup, based in an undisclosed location, is involved in designing, developing, underwriting, distributing, and managing innovative insurance solutions across the entire customer journey.

Read also - Top 10 EdTech Startups in Europe

While detailed founding information may not be immediately available, Cleverea is a noteworthy player in reshaping the insurance landscape through innovation.

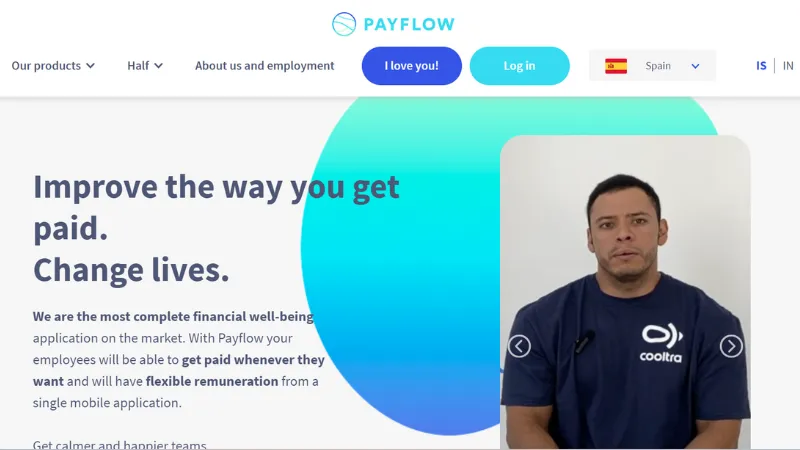

Payflow

Payflow is a fintech company providing a mobile app that enables employees to access their earned wages instantly. While specific founding details may not be immediately apparent, Payflow addresses the growing need for flexible financial solutions in the workplace.

Read also - Top 10 Defence Tech Startups in Europe

The platform, operating from an undisclosed location, empowers employees by allowing them to access their earned wages on demand, contributing to financial flexibility and well-being.

AURA PAY

AURA PAY is a digital "Fintech" solution that helps send low-cost money transfers to families in LATAM. It offers subscriptions with great exchange rates, a secure wallet for stable money, and tools for payments and savings.

Aurapay is a cryptocurrency wallet that connects you with stores and the blockchain. Our solution supports the United Nations Sustainable Development Goals 2030 by providing access to accounts for sending, receiving, and saving money.

Twinco Capital

Twinco Capital is one of the few fast-growing fintech companies in Europe led by women. It offers the first sustainable supply chain finance solution. Using advanced technology and access to data, they assess performance risk and provide funding to suppliers of all sizes globally.

Their model supports suppliers from the purchase order to the final invoice payment, reducing financing costs and improving reliability for both suppliers and buyers. Twinco works with large companies to help their suppliers access affordable funding, lowering risks and costs while also promoting competitive and responsible supply chains.

Follow us

Follow us Follow us

Follow us