[Funding alert] The Landbanking Group has Secures $11 million in Seed Funding for eco-Fintech Platform

Oct 26, 2023 | By Startup Rise EU

The Landbanking Group has secures $11 million in seed funding for eco-fintech platform Landler. In addition to 4P Capital, Vanagon, Planet A, the SUN Institute of the Deutsche Post Foundation, and angel investors and family offices like Prince Maximilian of Liechtenstein, Alexa Firmenich, Jan-Hendrik Goldbeck, and Fabian Strüngmann, the round was led by BonVenture and André Hoffmann.

Balance-sheet grade nature equity assets are provided to firms in the agri-food, energy, resource, or infrastructure sectors, as well as, gradually, to financial institutions and insurance companies. It just launched Landler, a platform for natural capital.

RECOMMENDED FOR YOU

LillianCare funding news – Healthcare Startup LillianCare €1.5 Million in Extension Round Funding

Startup Rise EU

Jun 21, 2024

Soda funding news – Brussels-based Soda Secures $14 Million in Funding

Startup Rise EU

Jul 11, 2024

Alinia funding news – Barcelona-based Alinia Secures €2.2 Million in Pre-Seed Funding

Startup Rise EU

Jun 6, 2024

Dr. Erwin Stahl, Managing Partner at BonVenture said,“As a high-impact investment fund we consider nature and biodiversity as critical for our common future. The Landbanking Group has developed a market-innovating platform to monitor nature in a trusted and transparent way. Through our investment we want to be part of this exciting journey from the beginning,”.

About The Landbanking Group

The Landbanking Group was established as a moonshot project to transform how land is valued and utilized by land stewards at a time when ecosystem services are vital preconditions for prosperity and peace that are democratic, resilient, and climate compatible.

Read also - Tilak Healthcare Secures €10M in Funding to Gamify Eye Disease Monitoring

The Landbanking Group is dedicated to achieving the SDGs, the Paris Climate Agreement, and the High Ambition Coalition's biodiversity commitments. It is a private, socially conscious business that unites investors, business developers, top scientists, and technologists.

Recommended Stories for You

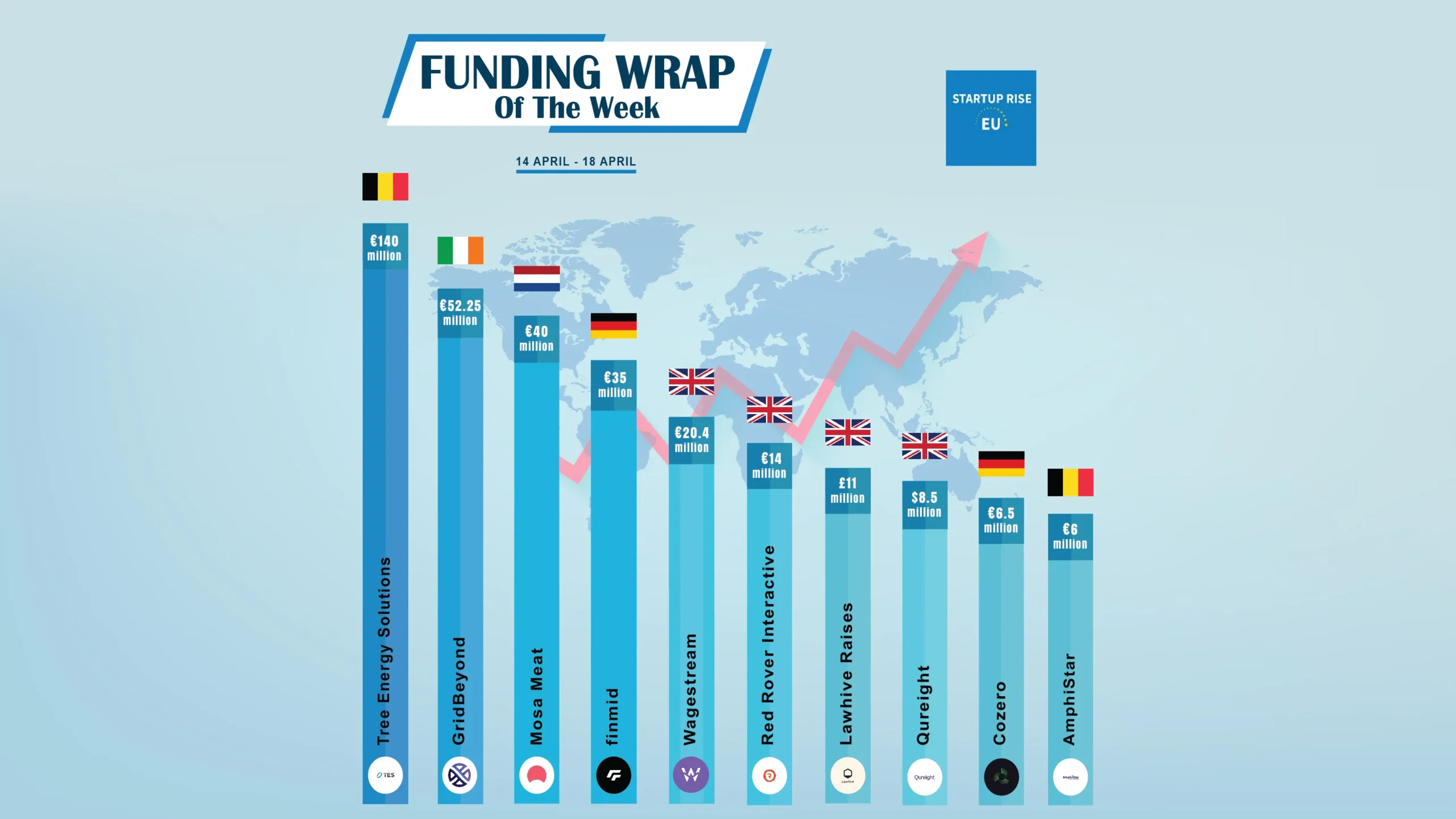

Funding Wrap of the Week | European Startups Funding Roundup | April 14 – April 18

Startup Rise EU Apr 19, 2024

[Funding alert] Reykjavík-based Quest Portal Secures €7.1M in Funding

Startup Rise EU Oct 21, 2023

UK Energy Company OVO Acquire EV Charging Consumer App Bonnet

Startup Rise EU Nov 25, 2023

VersaTile funding news – VersaTile Automation Secures £8 Million in Seed Funding

Startup Rise EU Jun 28, 2024

[Funding alert] London-based Fyde Treasury Secures $3.2M in Seed Funding

Startup Rise EU Dec 23, 2023

[Funding alert] Turin-based Climatetech Startup CarpeCarbon Secures €1.7 Million in Pre-Seed Funding

Startup Rise EU Nov 15, 2023

Follow us

Follow us Follow us

Follow us