[Funding alert] Bethnal Green Ventures Secures First Close of Newest Tech Fund at £33M

Nov 29, 2023 | By Startup Rise EU

Bethnal Green Ventures secures first close of newest tech fund at £33M has been committed by investors including the British Business Bank (through its Enterprise Capital Funds programme), M&G Catalyst and Big Society Capital.

They will use the fund to back one hundred new ventures over the next four years through their Tech for Good Programme (apply here!). Each venture selected for the programme will receive a £60,000 investment for 7% equity.

Read also - Amsterdam-based Biotech Startup Cradle Secures $24M in Series A Round Funding

They have been at the forefront of supporting tech startups that address pressing global challenges for the past decade. They are super proud of their portfolio of companies who have consistently made a positive impact on society and the environment, demonstrating the incredible potential of technology to drive positive change as well as deliver returns to investors.

RECOMMENDED FOR YOU

[Funding alert] Metz-based i-Virtual Secures €3 Million in Funding

Startup Rise EU

Dec 12, 2023

[Funding alert] French-based AZmed Secures €15Milion in Series A Round Funding

Startup Rise EU

Feb 21, 2024

[Funding alert] UK-based Technology Company Travelport Secures $570m in New Equity Funding

Startup Rise EU

Jan 4, 2024

They have backed 177 ventures and helped create the tech for good movement in the UK through a series of ‘firsts’ including becoming the first UK VC firm to certify as a B Corp in 2015.

Read also - Stockholm-based Lassie Secures €23 Million in Series B Round Funding

They have also had diversity and inclusion at the heart of their strategy. For the last three years BGV has been the top ranking UK firm for their efforts in diversity & inclusion in the global Inclusive PE & VC Index. This fund will be no different - they want to work with founders from all walks of life.

About Bethnal Green Ventures

The top early-stage VC firm in Europe for quality startups is Bethnal Green Ventures. They support visionary, diverse entrepreneurs who are using technology to large-scale social and environmental issues.

Read also - Hexa Secures €20M for Launching 30 Startups Annually by 2030

BGV has an unmatched track record of investing in and developing tech for successful companies, delivering both major and quantifiable impact as well as outstanding returns for investors.

Recommended Stories for You

[Funding alert] London-based Winnow Secures Funding from ABC Impact

Startup Rise EU Mar 5, 2024

[Funding alert] Budapest-based Qneiform Secures €750k in Pre-Seed Funding

Startup Rise EU Feb 8, 2024

[Funding alert] Amsterdam-based Mews Secures €101 Million in Fresh Funding

Startup Rise EU Mar 5, 2024

[Funding alert] Finnish-based Biochemical Company Montinutra Secures €2 million in Pre-A Funding

Startup Rise EU Oct 26, 2023

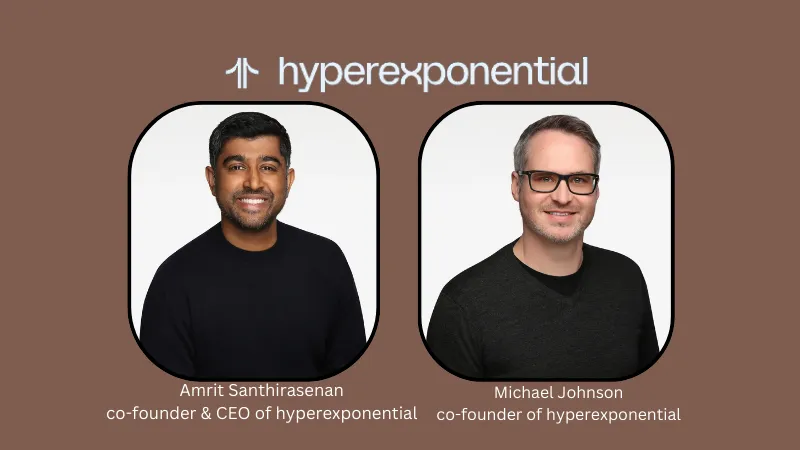

[Funding alert] London-based hyperexponential Secures $73 Million in Series B Round Funding

Startup Rise EU Jan 11, 2024

[Funding alert] Stockholm-based Telness Tech Raises €5 Million in Bridge Funding

Startup Rise EU Apr 4, 2024

Follow us

Follow us Follow us

Follow us