[Funding alert] Abingworth raises $356 million for new Clinical Co-Development Co-Investment Fund (CCD-CIF)

Oct 31, 2023 | By Startup Rise EU

Abingworth raises $356 million for new Clinical Co-Development Co-Investment Fund (CCD-CIF). Abingworth Clinical Co-Development Co-Investment Fund (CCD-CIF) was significantly oversubscribed, exceeding its target of $300 million.

Alongside the Abingworth Clinical Co-Development Fund 2 (ACCD 2), a fund of $583 million, Abingworth has raised over $930 million in new funds since 2021 to invest in the development of late-stage clinical programs from pharmaceutical and biotechnology companies in the US, UK, Europe, and Asia-Pacific, and create innovative therapeutics with potential to significantly improve human health.

Read also - UK-based Globacap Secures $21Million Series B Round Funding

Abingworth pioneered the clinical co-development (CCD) investment strategy in 2009, investing initially via its venture funds and then through its first dedicated fund, Abingworth Clinical Co-Development Fund (ACCD 1), which launched in 2016 raising $109 million.

RECOMMENDED FOR YOU

Qargo funding news – London-based Qargo Secures €12Million in Series A Round Funding

Startup Rise EU

Jun 7, 2024

[Funding alert] Belfast-based Neurovalens Secures £2.1Million in Funding

Startup Rise EU

Apr 9, 2024

[Funding alert] Stockholm-based Serverpod Raises €1.7 Million in Pre-Seed Funding

Startup Rise EU

Feb 23, 2024

Bali Muralidhar, Managing Partner, Chief Investment Officer & COO said,“Our clinical co-development approach has proved to be a great success as an alternative investment strategy since we pioneered the concept more than a decade ago, in terms of gaining new product approvals, getting new medicines to patients, and generating returns for investors. Our CCD program creates bespoke investment and operational solutions that enable resource-constrained pharma companies to pursue additional clinical projects and biotech companies to avoid near-term equity dilution,” .

Kurt von Emster, Managing Partner & Head of Abingworth Life Sciences said, “We are delighted to announce this new Clinical Co-Development Co-Investment Fund that, combined with Abingworth Bioventures 8 and ACCD 2, brings new funds closed by Abingworth to over $1.4 billion since 2020,”.

About Abingworth

Abingworth is a leading transatlantic life sciences investment firm. Abingworth helps transform cutting-edge science into novel medicines by providing capital and expertise to top calibre management teams building world-class companies. Since 1973, Abingworth has invested in over 185 life science companies, leading to 49 M&As and 75 IPOs.

Read also - Amsterdam-based Climate Tech Startup Overstory Secures $14M Series A Round Funding

Recommended Stories for You

[Funding alert] Warszawa-based Rainbow Weather Secures almost $2M in Funding

Startup Rise EU Nov 8, 2023

[Funding alert] Finnish-based Cleantech Startup SpinDrive Raises €3.8 Million in Series A Round Funding

Startup Rise EU Nov 8, 2023

[Funding alert] London-based Recraft Raises €11 Million in Series A Round Funding

Startup Rise EU Jan 19, 2024

[Funding alert] Madrid-based Cüimo Secures €900k in Funding

Startup Rise EU Nov 23, 2023

Enifer funding news – Mycoprotein Company Enifer Secures €36 Million in Funding

Startup Rise EU May 23, 2024

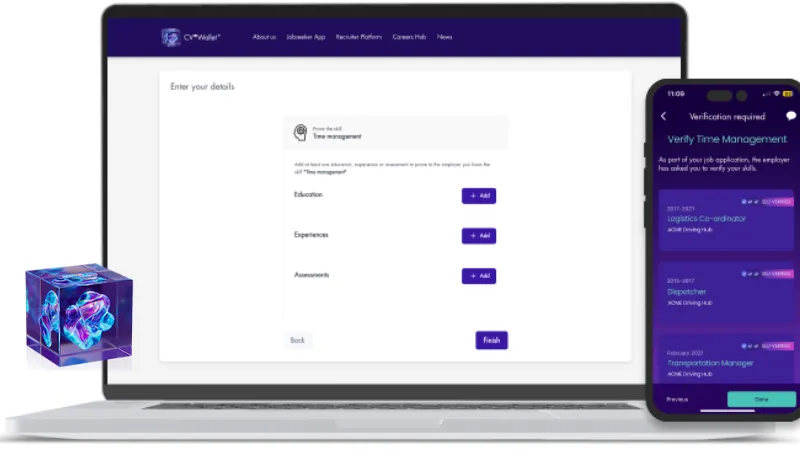

UK-based CV Wallet,Secures $500K in Angel Funding

Startup Rise EU Apr 29, 2024

Follow us

Follow us Follow us

Follow us