[Funding alert] Invest-NL backs Climate-First Fund Extantia Capital

Sep 26, 2023 | By Startup Rise EU

Dutch impact investor Invest-NL invested €10 million in Extantia. They join their group of LPs alongside existing investors Anglo American, Toyota Ventures, and top-tier family offices such as the Piëch and Oldendorff families.

Their unique strategy and already existing strong relationships in the Netherlands create a significant alignment of interest and enable Invest NL to pursue this investment.

Read also - London-based Dawn Capital Secures $700million For B2B Software Fund

Their commitment to Extantia aligns with their strategic objective to organise financing for capital-intensive and impactful ventures. Extantia’s scientifically grounded approach to assessing impact ventures, coupled with robust operational support, will strengthen the Dutch investment landscape.

RECOMMENDED FOR YOU

[Funding alert] Cambridge-based Metrion Biosciences Secures £3.7M in Funding

Startup Rise EU

Dec 21, 2023

Carwow Group funding news – London-based Carwow Group Secures $52Million in Fresh Round Funding

Startup Rise EU

Jul 19, 2024

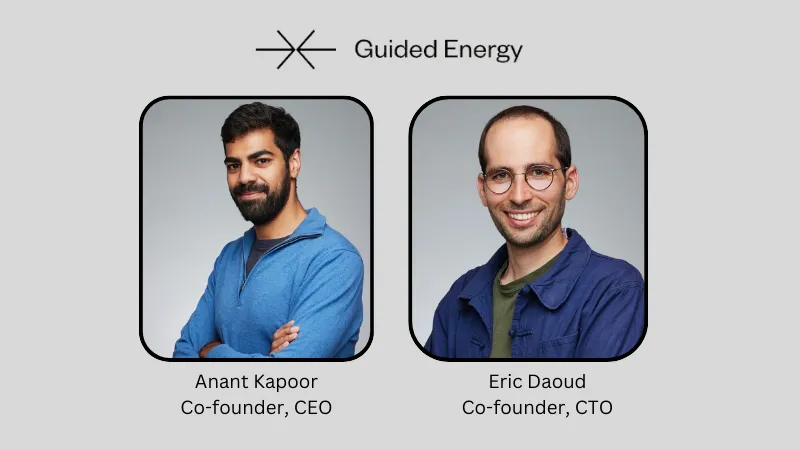

[Funding alert] Paris-based Startup Guided Energy Secures $5.2 Million in Funding

Startup Rise EU

Feb 7, 2024

Read also - Edinburgh-based Continuum Industries Secures $10 million Series A Round Funding

They are enthusiastic about Extantia’s potential to broaden the range of funding opportunities for hardware-based ventures in the Netherlands.

To ensure its investments have a significant and timely impact, they conduct a rigorous Carbon Math assessment prior to any engagement and incorporate impact goals into the fund manager’s compensation.

Read also - Hamburg-based Bioeconomy Startup Traceless Raises €36.6 million in Series A Funding

Extantia also uses a comprehensive methodology to verify that new technologies “do no harm” and avoid negative impacts on the environment and society. Areas of primary interest are energy, industrial processes, buildings, transportation, and carbon removal technologies. Notable portfolio companies include MAGNOTHERM, H2Pro, INERATEC, GA Drilling, BeZero, and Reverion.

Read also - Madrid-based AI Writting Platform Correcto Secures $7 mn Seed Funding

About Extantia

Extantia’s platform, launched in 2022, includes Extantia Flagship, a venture fund dedicated to backing scalable deep decarbonisation technology companies, Extantia Allstars, a fund-of-funds investing in climate tech venture capital funds around the world, and Extantia Ignite, a sustainability hub that advances knowledge and skills in climate innovation and ESG practices.

Read also - Deskbird, a Swiss SaaS workplace management company, receives $13 mn from ALSTIN Capital and AVP

About Invest-NL

They are an open organization. An organization that thinks broadly and looks further. They look to 2050 and see an economy that is radically different from the economy of today. With more attention to people, the environment, society and our shared future. This requires major social transitions, belief in opportunities and long-term thinking.

Read also - British Spacetech Startup Open Cosmos Raises $50 million Series B Round Funding

Recommended Stories for You

Italian-based Lithium Lasers Secures €2 Million in Funding

Startup Rise EU Apr 22, 2024

Copenhagen-based Acquia a Acquires Monsido

Startup Rise EU Jan 10, 2024

[Funding alert] Utrecht-based Eddy Grid Secures €1.5 Million in Funding

Startup Rise EU Jan 22, 2024

[Funding alert] German-based Healthtech Startup Doctorly Secures €6.7M in Series A extension Round Funding

Startup Rise EU Nov 10, 2023

[Funding alert] Paris-based Sorella Secures €5 Million in Fresh Funding

Startup Rise EU Feb 27, 2024

[Funding alert] Barcelona-based Open Wealth Platform Flanks Secures €7.5 million Series A Round Funding

Startup Rise EU Oct 18, 2023

Follow us

Follow us Follow us

Follow us