[Funding alert] Tallinn-based Tuum Secures €25 Million Series B Round Funding

Feb 6, 2024 | By Startup Rise EU

Tallinn-based Tuum secures €25 million series B round funding. CommerzVentures led this round, and Speedinvest and previous investors also participated.

Since establishing its first client relationship in February 2019, Tuum has grown quickly. It assists banks with the digital transformation to more affordable, adaptable systems, allowing them to focus on creating new products and expanding into untapped markets.

Read also - British Biotech FA Bio Raises €6.1 Million in Funding

The company currently has ten countries as its customer base, with the UK and the Nordics having a significant presence. Tuum's revenues have increased dramatically over the last three years, with a compound annual growth rate above 250%.

RECOMMENDED FOR YOU

Visibly funding news – London-based Visibly Secures €7 Million in Funding

Startup Rise EU

Jun 10, 2024

[Funding alert] UK-based IsomAb Secures £7.5Million in Seed Funding

Startup Rise EU

Feb 21, 2024

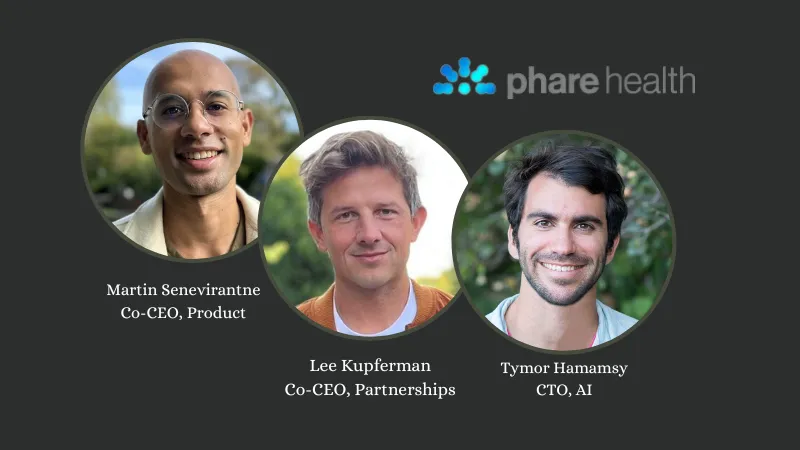

[Funding alert] London-based Phare Health Secures €2.8 Million in Pre-Seed Funding

Startup Rise EU

Nov 22, 2023

Andreas Kitter, co-CEO of LHV UK, a Banking-as-a-Service provider working with over 200 fintechs, commented: “Bank executives are put off doing core replacements because of the costs and risks involved. With Tuum, we migrated millions of customer accounts in 2 months. We are now running a state-of-the-art core system with a small team and spending 75% of our IT budget on innovation.”

Tuum's global reach will be strengthened by the new funding, which will enable it to expand into new markets in the Middle East, Southern Europe, and the DACH region, where it is setting up an office.

Read also - Dutch AI Startup Whispp Secures €750k in Seed Funding

In order to increase sales reach and implementation scalability, the company intends to improve its direct sales and marketing operations as well as strengthen its partner channel with important managed service agreements.

Enhancing Tuum's primary competitive differentiators will be another goal of the fundraiser. The organization plans to allocate more resources towards its "smart migration" capabilities, which enable intricate core migrations in as little as two months.

Read also - Lyon-based ENYO Pharma Secures a €39 Million in Series C Round Funding

Additional funding will be used to improve Tuum's "Business Builder," a platform that allows for extensive customization through configuration and offers a strong substitute for other cloud-native cores' generic "one size fits all" or "toolbox" approaches.

Last but not least, Tuum plans to invest money in growing the breadth of its module set and depth of functionality. Currently, it offers card, loan, accounts, and payment services, serving the corporate and banking markets.

Read also - London-based Episode 1 Secures its Third Fund at £76 Million

Myles Bertrand, CEO of Tuum, said: “I joined Tuum in the summer of last year because I saw the gap in the market for its proposition. Everyone knows that banks need to replace their ageing core banking systems if they are going to successfully adapt their business models for digital banking. However, no core banking vendor has to date made core migration simple and predictable, which is what Tuum is now doing through a combination of smart migrations, a modular and functionality-rich core, massive extensibility, and a broad ecosystem of partners. With this Series B funding, we’re not just expanding our reach: we’re redefining the very essence of core banking for a digital-first future.”

Heiko Schwender, Managing Partner at CommerzVentures, added: “At CommerzVentures, we have been following and investing in the core banking market for a long time. While it’s hard to break into, this is a huge, highly attractive space, with over $15bn in annual spending. Tuum’s standout modular approach is particularly suited to today’s ever-changing environment, offering a mature, yet flexible solution to a real pain point.

About Tuum

At Tuum, their mission is to allow banks to replace their legacy systems quickly and safely, to lower their maintenance spending and to open up new possibilities to adapt and prosper in the digital world; in short, to set them free. They employ a smart migration approach to help banks to move off their current systems. Using this approach, their clients go-live on average within 7 months.

Read also - London-based AudioStack Secures €2.9 Million in Pre- Series A Round Funding

Recommended Stories for You

FOSSA Systems funding news – Space Tech Startup FOSSA Systems Secures €6.3 Million in Series A Round Funding

Startup Rise EU Jun 19, 2024

[Funding alert] London-based Thema Raises €5.8 Million in Funding

Startup Rise EU Jan 15, 2024

HERO Software funding news – Hannover-based HERO Software Sercures €40Million in a Series B Round Funding

Startup Rise EU Jul 12, 2024

[Funding alert] London-based Startup Unitary Secures $15 million Series A Round Funding

Startup Rise EU Oct 3, 2023

[Funding alert] Manchester-based Holiferm Raises €21.4M in Series B Round Funding

Startup Rise EU Jan 9, 2024

Follow us

Follow us Follow us

Follow us