Seaya funding news – Madrid investment firm Seaya has closed Seaya Andromeda at €300 Million

Jul 2, 2024 | By Team SR

Madrid investment firm Seaya has closed Seaya Andromeda — the first Article 9 climate-tech fund based in Southern Europe — at €300 Million. The new fund's LPs include Iberdrola, Nortia, Santander, BNP Paribas Group, Next Tech Fund, and Bpifrance. With its current AUM of over €650 million, Seaya Platform is now the biggest venture capital firm in Spain.

SUMMARY

- Madrid investment firm Seaya has closed Seaya Andromeda — the first Article 9 climate-tech fund based in Southern Europe — at €300 Million.

- Established in 2013, Seaya presently oversees more than €650 million distributed across five seed-stage entrepreneurial funds.

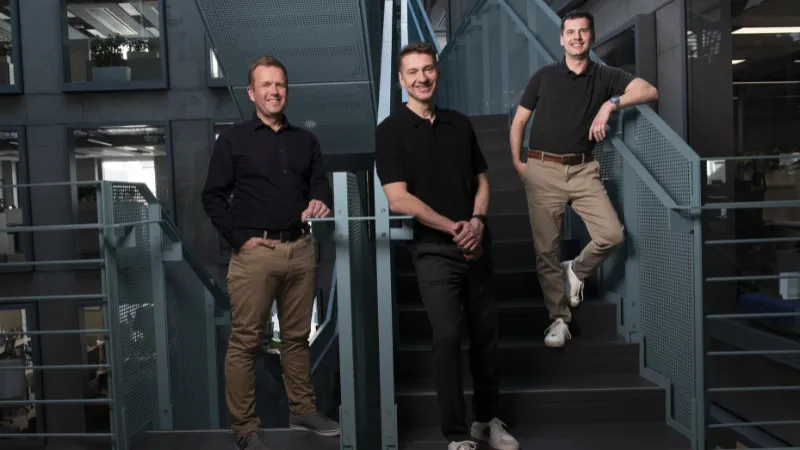

Having worked in the field of climate technology for twelve years, Seaya founded Andromeda with the goal of investing in impact-driven growth firms that focus on decarbonisation, energy transition, sustainable food value chains, and circular economies. As Investment Partners, Carlos Fisch and Pablo Pedrejón are in charge of Andromeda.

The fund exclusively makes investments in businesses that lessen pollution and waste in order to foster a sustainable society. The fund abides by SFDR's Article 9, which guarantees that every investment the company makes will benefit society or the environment.

What SFDR Article 9 actually entails

RECOMMENDED FOR YOU

London-based Adaptive Receives Strategic Investment From Citi And HSBC

Kailee Rainse

Mar 6, 2026

Lendurai funding news -Estonian Startup Lendurai Secures €5.57M Funding

Kailee Rainse

Jun 5, 2025

Article 9 of the SFDR classifies financial products in the EU based on their primary objective of sustainability. These "dark green" funds have the toughest sustainability requirements and strive for beneficial social or environmental effect. They have to prioritise sustainability when making investments, fully explain their strategy, and maybe comply with the EU's green activity classification scheme.

While a large percentage of Article 9 funds tackle particular social or environmental issues, some concentrate on broad ESG criteria; these impact-oriented funds typically have higher fees.

Read also - Meela Funding News – Sweden-based Meela Raises €2.6M Seed Funding

Seaya's new fund would set aside money for follow-on investments and make an initial investment of anywhere from €7 to €40 million. Between now until the end of 2027, it intends to make 25 investments in total, including maybe five more agreements this year.

Beatriz González, Founder and Managing Partner of Seaya, says; "From day one we were focused on impact and climate. We have a strong technological background in this space. We started in 2012 backing climate tech companies and have successfully guided three of them right through to exit. We have 12 years of experience in this space and we can bring this knowledge and expertise to founders through this specialised vehicle.”

Pablo Pedrejón, partner at Seaya, says: “Deep-tech climate entrepreneurs face a unique set of challenges compared to software-tech entrepreneurs. Climate-tech companies must translate research into a working product, bring it to market, and then scale it. This long journey requires different kinds of support than what is typically provided to software startups. This is why there is a need for Series B and B+ investors that help climate tech startups bridge the ‘valley of death’ – the gap from initial development to deployment at scale.”

About Seaya

Established in 2013, Seaya presently oversees more than €650 million distributed across five seed-stage entrepreneurial funds. Using its global platform, vast network of investors, founders, and multinational corporations, along with its wealth of experience in the international expansion of businesses like Glovo, Cabify, Wallbox, Spotahome, Clarity AI, Clicars, Alma, and RatedPower, Seaya helps startups grow faster.

Follow us

Follow us Follow us

Follow us