re:cap funding news – Berlin-based re:cap Secures $14.6 Million in Series A Round Funding

Jun 4, 2024 | By Team SR

Financing and data insights company re:cap secures $14.6 million in series A round funding and the release of its proprietary software as a service (SaaS) platform. The funding round was led by Entrée Capital and included participation from further existing shareholders Felix Capital and Project A, following 24 months of rapid growth for re:cap.

SUMMARY

- Funding round was led by re:cap’s pre-seed investor Entrée Capital with participation from additional existing shareholders Felix Capital and Project A.

- Release of software platform for investors, re:cap Institutional, as well as cash flow software for businesses, Cash Insights, as re:cap continues its strategic expansion.

With the new funding, the company is positioned to further expand its successful alternative debt financing business and marketplace and to scale its software platform.

Paul Becker, co-founder and CEO of re:cap said, “Since day one, our mission has been to build a platform that connects businesses with investors, enabling better decision-making for providers of capital and better financing options for businesses. As a first step, we built an industry-leading debt financing product. In parallel we created a powerful software suite for both investors and businesses. Today, in conjunction with our Series A capital raise, we are announcing the general release of our investor SaaS platform re:cap Institutional and our cash flow software Cash Insights. It’s a great sign that our strong investor base is doubling down on this opportunity”.

RECOMMENDED FOR YOU

Vizgard funding news – London-based Vizgard Raises £1.5 million in an Oversubscribed Funding

Kailee Rainse

Jan 22, 2025

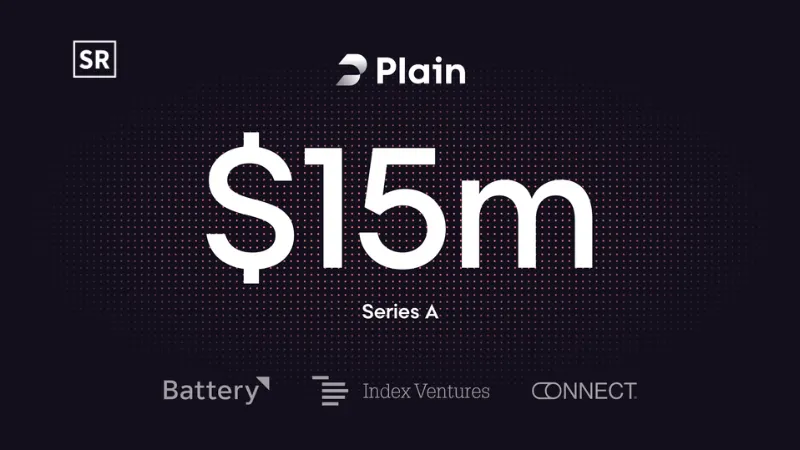

Plain funding news – London-based Plain Secures €14.5 Million in Series A Round Funding

Kailee Rainse

Feb 11, 2025

The Series A along with the release of it’s software platform mark a crucial point in the company’s history. With re:cap Institutional, the company is offering a data-driven software platform for modern investors. re:cap Institutional is built on re:cap’s own underwriting and monitoring platform.

The platform was developed and continuously optimized using insights from over a thousand businesses and a multitude of real-time business data sources. With Cash Insights, which was previously only available in combination with alternative funding from it, the company is also launching a cash flow management software solution for businesses.

Read also - Seedtag acquisition news – Spain-based Seedtag Acquired Beachfront

The first customers using re:cap Institutional include London-based investment firms Avellinia Capital and Channel Capital. They use it's Institutional to monitor the cash flow of their portfolios in real time, automate data collection and processing, and set up smart early warning systems. Portfolio companies also benefit from the software.

It gives them access to an out-of-the-box solution for holistic cash management with features such as real-time cash flow monitoring, cash based profit and loss statements and insights into their profitability and runway.

Julian S. Schickel, Partner at Avellinia Capital said, “it’s platform allows us to identify potential constraints at our portfolio companies, which ultimately helps us to be better partners and investors. We have been impressed by the initial product and continuous improvements. The team has been exceptionally responsive and customer-focused”.

About re:cap

Founded in Berlin in 2021, tech company re:cap operates a financing and data insights platform. On the one hand, it uses this platform to provide alternative debt financing and insights to tech and services businesses in Germany and the Netherlands.

On the other hand, it Institutional is a decision-making platform for institutional investors, allowing them to turn data into game-changing insights for better financing decisions. It was founded by fintech experts Paul Becker (CEO) and Jonas Tebbe (CPO), who previously co-founded wealth tech pioneer LIQID.

Follow us

Follow us Follow us

Follow us