[Funding alert] UK-based Globacap Secures $21Million Series B Round Funding

Oct 20, 2023 | By Team SR

UK-based Globacap Secures $21Million Series B Round Funding Investors include capital markets heavyweights Moore Strategic Ventures, LLC, Cboe Global Markets, Inc., and the Johannesburg Stock Exchange (JSE), as well as GABI Ventures and leading Asia-focused investment firm, QBN Capital.

Total private markets assets under management (AUM) reached $11.7 trillion in 2023 and have grown at an annual rate of nearly 20 per cent since 2017. This is expected to nearly double over the next five years. Despite the size and importance of this rapidly growing market, transactions are still laborious, manual and time-consuming, often taking weeks or months.

Read also - Hungary-based Startup Flawless Secures $2.2 Mn in Seed Funding

RECOMMENDED FOR YOU

Swedish Fintech Startup Ankor Secures $1.3Million In Pre-Seed Round

Kailee Rainse

Jun 24, 2025

Glyde Funding News- London-based Glyde Secures £450K Funding To Disrupt The FX Market

Kailee Rainse

Jun 20, 2025

Globacap aims to unleash the potential of private capital markets through digitisation and automation. Its workflow automation software-as-a-service brings public markets-like efficiency to private markets.

Read also - Ukraine-based Product Development Company Trinetix Raises $10 million in Funding

It streamlines time-consuming processes from issuance, and ongoing administration, through to transferability and settlement of securities, reducing costs and improving efficiency for market intermediaries.

Read also - German Climatetech Startup Purpose Green Raises €3.3 million in Funding

Valdene Reddy, Director of Capital Markets, JSE said, “The Globacap ecosystem is a vital enabler to our JSE Private Placements business, and our joint relationship has equipped the JSE to drive our diversification strategy in supporting capital formation in private markets. As the JSE, we support Globacap’s next growth phase and we look forward to continued growth that will produce innovative and implementable solutions to address the ever-evolving need of customers,”

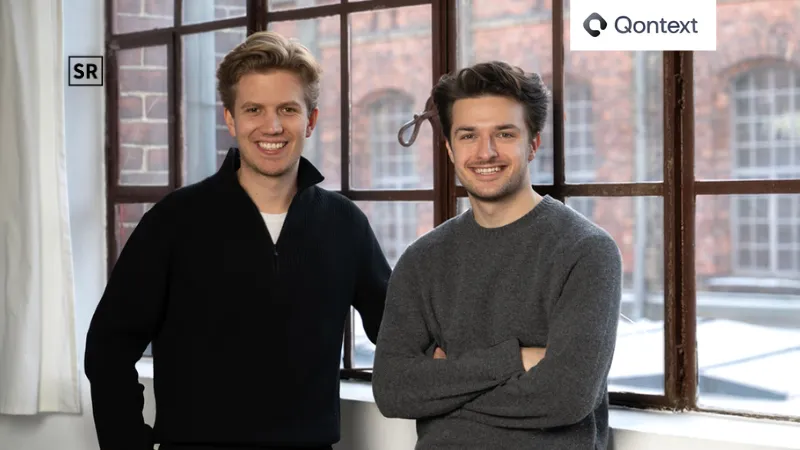

Myles Milston, Globacap Co-Founder and CEO says: “Private capital markets are rapidly growing, but their opaque nature is holding them back from reaching their true potential. We are bringing public markets-like infrastructure to private capital markets to improve access, boost liquidity and remove administrative burdens. Securing considerable backing from world-leading investors during a time of market turbulence, risk aversion and uncertainty is powerful validation of our mission to transform and drive efficiency in private capital markets. We’re in a unique position to grow through the current market turmoil, leading with strength as market conditions eventually improve.”

Alex Green, Globacap Co-founder and CCO adds: “The completion of our Series B enables us to firmly accelerate our global scaling journey. In recent weeks, we have made experienced hires including new COO, Joanna Tibbitt, new CMO, Suzanne McLaughlin, and added three new hires to our sales team. We have a strong team, market validation from key clients across exchange groups, securities firms, private equity, and other asset managers, and now validation from our investors, who are some of the world’s largest and most respected institutions.”

About Globacap

The world's private capital markets have been computerized and digitized by Globacap, the leading supplier of capital markets technology.

Read also - Finnish AI Governance Startup Saidot Raises €1.75M Seed Round Funding

It provides a whitelabel SaaS solution that provides private markets efficiency similar to that of public markets. Financial institutions, such as securities exchanges, securities firms, private banks, and asset managers, can speed up their private market business while also reducing their operational costs thanks to the software's digital workflows.

Read also - UK Fashion Resale peer-to-peer Startup NOLD €1 Million in Seed Funding

Globacap helps to expand the availability of capital by enabling increased investor access, increasing transaction flow and liquidity, and ultimately freeing up restricted economic development.

Follow us

Follow us Follow us

Follow us