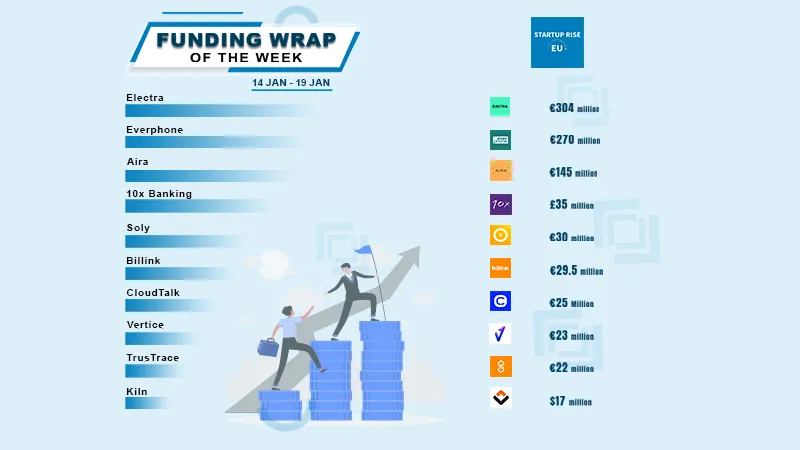

Funding Wrap of the Week | European Startup Funding Roundup | January 14–19

Jan 20, 2024 | By Team SR

There are a lot of funding transactions in European startup ecosystem for growth-stage and early-stage deals this week; we'll discuss the top ten.

Here are the Top10 Funding Deals of this Week

Electra

Electra secures €304 million in funding from PGGM, Bpifrance, Serena, RIVE Private Investment, Eurazeo, and the SNCF group. Ademe Investissement, Eiffel Investment Group, RGreen Invest, Frst, Allianz, Groupe Chopard, and Altarea in France, as well as EIP in Switzerland, RATP Capital Innovation, Caisse des Dépôts et Consignation/ Banque des Territoires, and others, provide financial support to Electra.

With the specific goal of promoting the use of electric vehicles by creating a large, quick, and efficient network of charging stations, the company installs and manages fast charging stations.

Everphone

Everphone raises €270million in series D round funding from Capnor and their partner Calista, as well as from existing investors including Cadence Growth Capital and founder Jan Dzulko himself. Existing investors like Cadence Growth Capital, signal ventures, and Alleycorp.

RECOMMENDED FOR YOU

[Funding alert] Barcelona-based habitacion.com Secures €400k in Pre-Seed Funding

Team SR

Feb 14, 2024

Cyber Guru funding news – Rome-based Cyber Guru Raises €23 Million in Series B Round Funding

Kailee Rainse

Oct 24, 2024

Everphone is the one-stop solution for company smartphones and tablets. As pioneer and leading Device-as-a-Service provider, Everphone handles everything from sourcing, configuration, device administration, security as well as the handling of broken devices and returns for companies and organizations.

Aira

Aira secures €145M in series B round funding from Altor, Kinnevik and Temasek and also includes the Burda family, Collaborative Fund, Creades, Lingotto, Nesta Impact Investments and Statkraft Ventures.

Aira provides clean energy-tech solutions to consumers and is set to become Europe’s number one direct-to-consumer brand within the industry. Aira accelerates the electrification of residential heating with intelligent clean energy-tech to enable the net zero future they all need.

10x Banking

10x Banking secures £35million funding from JPMorgan Chase and BlackRock, two current investors. A fundamental banking platform that is cloud-native and improving banking tenfold for consumers, banks, and society.

The foundation of 10x was established in the summer of 2016, based on concepts that many 10xers are all too familiar with from their time spent in the financial services industry.

Soly

Soly Raises €30million in funding from ArcTern Ventures in collaboration with the American Fifth Wall. Existing investors Shell Ventures and pension fund ABP are also participating in the new financing round.

Brothers Patrick and Milan van der Meulen launched Soly in 2013 with the goal of democratising access to solar energy. The founding team chose to utilise their business "As a force for good" after being moved by Al Gore's documentary "An Inconvenient Truth" when they were young.

Billink

Billink secures €29.5 million in funding from the German Varengold Bank. Billink is a cutting-edge post-payment solution for internet merchants.

With Billink, any online store may offer a simple and risk-free method of payment that lets customers accept their purchases now and pay for them later.

CloudTalk

CloudTalk Secures €26 million in series B round funding from KPN Ventures and Lead Ventures and supported by existing investors Point Nine Capital, henQ, Presto Ventures, and Orbit Capital.

CloudTalk was founded in 2016 to help businesses connect seamlessly with customers over the phone and make customer experience the greatest competitive advantage for driving more revenues.

Vertice

Vertice secures €23 million in series B round funding. Vertice is a tool for spend optimisation that helps businesses save up to 25% on cloud and SaaS expenses.

It uses automation and machine learning to produce guaranteed cost reductions and gives businesses of all sizes and sectors greater insight and control over their software and cloud spending.

TrusTrace

TrusTrace secures €22 million in funding from Industrifonden and Fairpoint Capital, two previous investors, joined this round lead by Circularity Capital.

TrusTrace founding in 2016, the business has been regarded as the go-to partner for international fashion brands looking to manage ESG risks, promote sustainable transformation, and guarantee compliance throughout their intricate supply chains.

Kiln

Kiln secures $17m in funding from 1kx, with contributions from IOSG, Crypto.com, Wintermute Ventures, KXVC, LBank, and their existing investors.

Kiln is the top enterprise-level staking platform that lets institutional clients whitelabel staking features into their products and stake assets. Kiln manages approximately $2 billion in stakes and operates over 3% of the Ethereum network on a multi-cloud, multi-region infrastructure.

Follow us

Follow us Follow us

Follow us