The ClearScore Group, a UK-based financial marketplace has announced the acquisition of Acre Platforms Limited a British technology provider for the mortgage industry.

SUMMARY

- The ClearScore Group, a UK-based financial marketplace has announced the acquisition of Acre Platforms Limited a British technology provider for the mortgage industry.

This move is expected to accelerate ClearScore’s expansion into mortgages complementing its existing position in unsecured credit broking. It follows the company’s earlier acquisition of Aro Finance in early 2025, which enhanced its capabilities in secured loans.

Justin Basini, co-founder and CEO of the ClearScore Group, said: “Acre is a great addition to the ClearScore Group, and we will support the business on its exciting growth trajectory. ClearScore brings the brand, the reach, the user-permissioned data at scale and one of the most advanced, reliable and unique fintech stacks in the industry. Combine that with Acre’s leading CRM platform for intermediaries, and you have an exciting set of technology platforms , data assets and APIs spanning unsecured credit, auto finance and now mortgages.”

Sector trends indicate ongoing activity in mortgage, housing finance, and adjacent FinTech models providing context for ClearScore Group’s acquisition of Acre Platforms.

RECOMMENDED FOR YOU

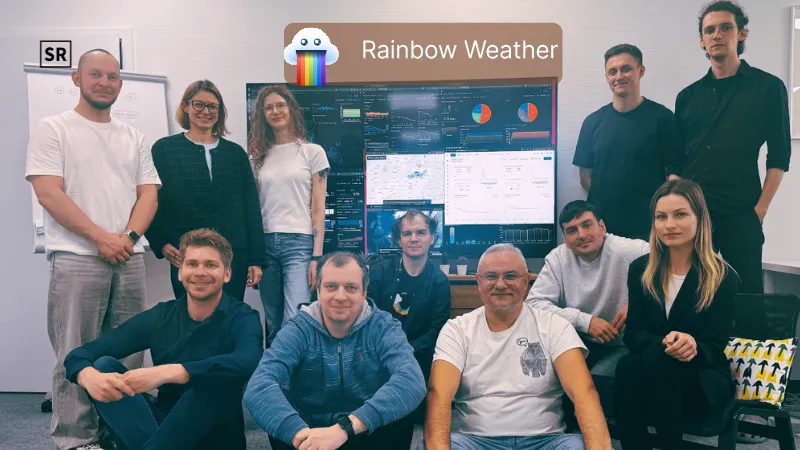

Rainbow Weather Raises $5.5M To Refine Real-Time Weather Forecasting

Kailee Rainse

Jan 27, 2026

In February 2025, Madrid-based Libeen raised €25 million to scale its “Smarthousing” model which combines alternative financing structures with technology to make homeownership more accessible in Spain. The funding is earmarked for expansion, tech development and asset growth.

Read Also - Copenhagen’s Octarine Bio Raises €5M To Grow Sustainable Colour Platform

Meanwhile, Valencia-based Colibid was recently highlighted by EU-Startups as a digital mortgage marketplace connecting borrowers, banks, and brokers via a bidding-style platform. The company has raised approximately €0.5 million to date to support product development and market entry.

Within this landscape, ClearScore’s decision to acquire Acre Platforms, rather than invest, reflects a broader trend of established FinTech groups expanding into mortgages through consolidation complementing the venture funding activity among earlier-stage specialists.

This follows ClearScore’s €36.1 million debt financing from HSBC Innovation Banking UK just one year prior.

“This perfectly complements our successful push into the secured loans market, building on the significant growth we have seen in our home lending business in 2025. The acquisition allows us to accelerate our mortgage strategy with Acre technology powering our home lending business and helping us deliver compelling new experiences for our users,” adds Justin.

ClearScore helps over 25 million people access credit, insurance, and other financial products. Founded over ten years ago, the Group launched its flagship UK credit marketplace in 2015 and has since expanded across four continents, including a new vertical through its DriveScore app.

Through API integrations with over 200 financial institution partners worldwide, ClearScore helps these partners convert more customers, increase revenue, and manage risk. Its marketplaces match users to credit cards, loans, and car finance using a combination of credit and affordability data, powered by credit reports and open banking. ClearScore aims for Acre to become a similarly integral layer of the mortgage ecosystem, just as D•One, its open banking service for lenders, has done for credit.

Acre, founded in 2018, seeks to transform the home-buying process by making property ownership faster, simpler, more transparent, and ultimately more affordable for consumers.

Justus Brown, CEO at Acre, says: Our mission has always been to simplify the mortgage journey, taking the pain out of the process so that consumers can get into their homes quicker. Our data-driven approach has led us to building a platform that’s transformed brokers’ businesses in the UK. Joining the ClearScore Group is an exciting next step in our evolution that allows us to accelerate our drive to become the leading tech platform for the mortgage industry.

“We’re pleased to announce this acquisition as it sets up exciting growth opportunities aligned with ClearScore’s strong brand, tech platform and lender integrations.”

Under new ownership, Acre will continue providing technology solutions for mortgage and protection businesses. Together with ClearScore, it aims to deliver a high-quality home-buying experience for ClearScore’s 16 million UK users.

ClearScore plans to expand its mortgage platform into its operations in South Africa, Australia, New Zealand, and Canada.

The partnership enables ClearScore to route mortgage demand from its users directly to Acre’s broker ecosystem. Acre will also supply additional property, mortgage and affordability data enhancing insights for homeowners and homebuyers across ClearScore’s platform.

Follow us

Follow us Follow us

Follow us