BlackWood Ventures Closes €21.3M Debut Fund To Support Early-Stage European Startups

Jul 28, 2025 | By Kailee Rainse

Copenhagen-based BlackWood Ventures, an early-stage investment fund that supports European founders using a strong network and tech-driven approach, has officially closed its first fund at €21.3 million.

SUMMARY

- Copenhagen-based BlackWood Ventures, an early-stage investment fund that supports European founders using a strong network and tech-driven approach, has officially closed its first fund at €21.3 million.

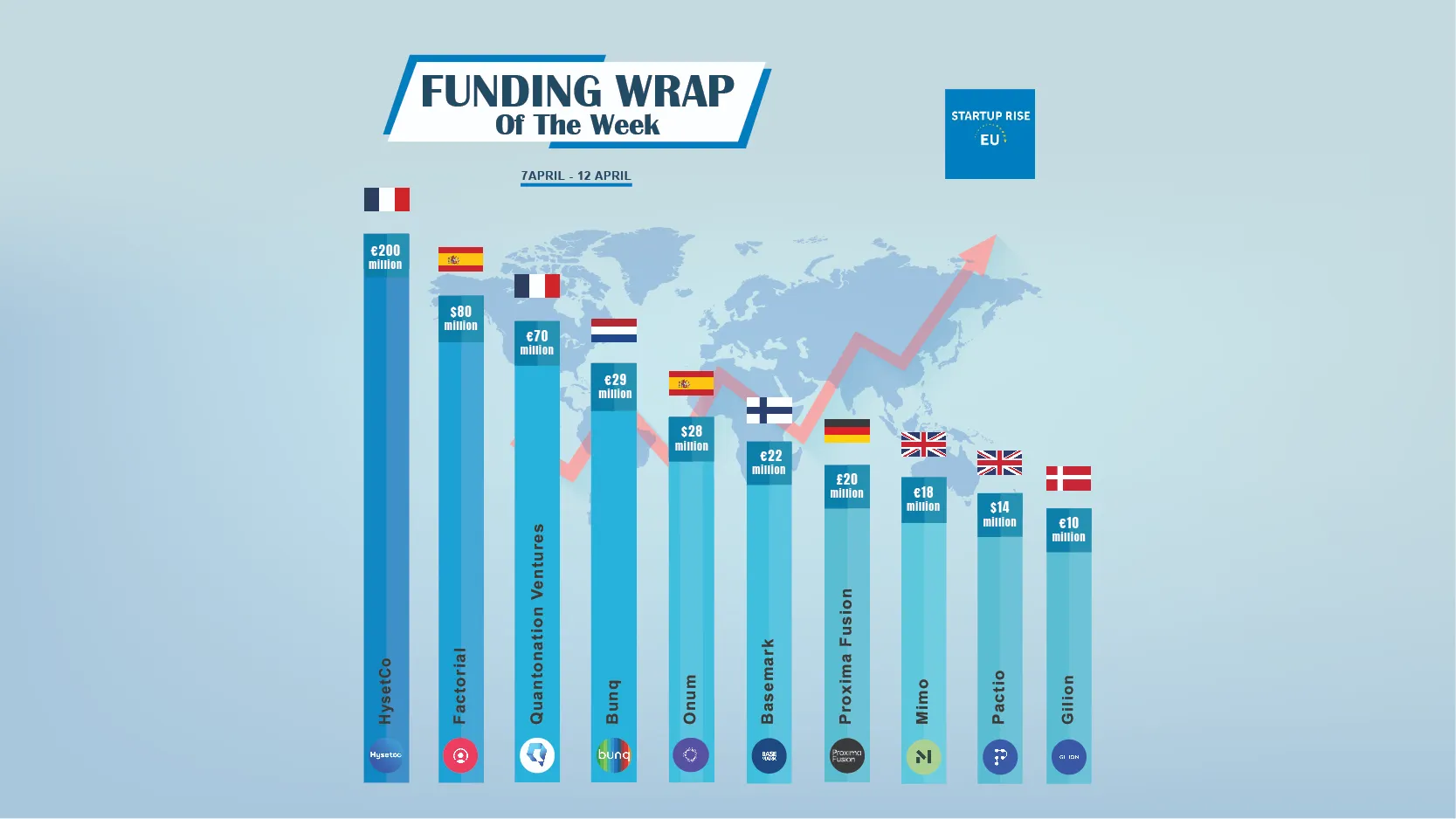

Since starting in April 2023, BlackWood has already invested in 19 startups across nine countries. The fund plans to back around 30 companies in total, focusing on FinTech, CleanTech, and Web 3.0 sectors.

“Europe is not short on talent; it’s short on conviction capital. That’s the gap we’re here to fill,” said Bastian Larsen, Founder and CEO of BlackWood Ventures. “We built BlackWood to be truly European in scope and disciplined in approach, seeing hundreds of opportunities each month and backing Founders whose ambition and focus stand out.”

BlackWood Ventures, founded in 2021, is a Europe-based early-stage VC firm focused on supporting FinTech, CleanTech, and Web 3.0 startups from pre-seed to seed stage.

RECOMMENDED FOR YOU

Electric Twin Raises $14M Funding To Grow Its AI Audience Platform

Kailee Rainse

Feb 12, 2026

The firm takes a tech- and network-driven approach with a strong team spread across Europe. It follows a disciplined, pan-European strategy to back promising founders.

Some of its key investments include the Dutch company beSirius, a B2B SaaS platform for the mining and metals industry used by major players like ArcelorMittal; IVM Markets from London, a FinTech SaaS startup founded by former Deutsche Bank executives.

Sidekick, a UK-based wealth management platform with over €85.3 million in assets under management; Yonder, a UK rewards card company also valued at €85.3 million and selected for the 2025 Tech Nation Future Fifty program; and Particula from Germany, which provides AI-powered risk intelligence for digital assets to support institutional adoption of tokenised finance.

Matthew Ford, Founder and CEO of Sidekick, added: ”BlackWood backed us early last year and has been fantastic to work with. They invest with conviction and it’s refreshing how fast and efficient they were throughout. Their FinTech-experienced team has been hands-on at every turn and supported us throughout. Whether that’s in fundraising processes, helping with sales, or general support and guidance. It’s been a great partnership!”

BlackWood Ventures finds investment opportunities by combining a network of over 1,000 angel investors with tech tools that help them review hundreds of startups each month. They also use technology-driven platforms to improve their deal sourcing.

The firm often co-invests with top names like LocalGlobe, Y Combinator, Seedcamp, Northzone, Octopus Ventures, Firstminute Capital, RTP Global, Giant Ventures, and Norrsken. This, according to BlackWood, shows their strong ability to spot and support high-potential startups alongside leading investors.

“I continue to be impressed by the clarity of the strategy and intensity of execution this team has demonstrated,” said Steffen Saltofte, Limited Partner and Board Member at BlackWood, and CEO of Zentiva, a multinational pharmaceutical company with over 5,000 employees. “BlackWood has built a strong European footprint, moves quickly, and is backing companies many Nordic VCs overlook due to geographic constraints. This ambition and focused execution is exactly what we aimed for with Fund I, and I’m excited to see it continue.”

Follow us

Follow us Follow us

Follow us