ZTLment funding news – Fintech Startup ZTLment Secures €2.4 Million in Total Pre-Seed Funding

May 28, 2024 | By Team SR

Copenhagen-based fintech startup ZTLment secures €2.4 million in total pre-seed funding from investors PreSeed Ventures, Upfin, Giant Ventures, and strong business angels.

SUMMARY

- Copenhagen-based fintech startup ZTLment secures €2.4 million in total pre-seed funding.

- This round was led by PreSeed Ventures, Upfin, Giant Ventures, and strong business angels.

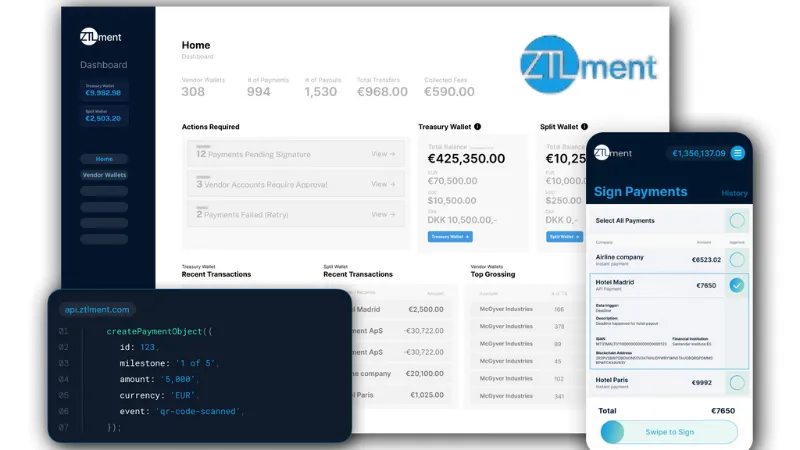

ZTLment hopes to use the additional funding to permanently do away with the need for antiquated banking infrastructures and facilitate peer-to-peer and programmable payment processing.

Being the first in Europe to develop compatible wallet architecture on decentralised rails for ordering and booking platforms, the Danish fintech has created quite a stir.

Read also - Powall funding news – Dutch-based Powall Secures €3Million in Funding

RECOMMENDED FOR YOU

Libattion funding news – Zürich-based Libattion Raises €14 Million in Funding

Team SR

Jun 27, 2024

ThreatMark funding news – Czech Republic-based ThreatMark has Raised $23Million in Funding

Kailee Rainse

Jan 8, 2025

Sitegeist Raises €4M Funding To Bring Automated, AI-enabled, Modular Robots On Construction Sites

Kailee Rainse

Feb 16, 2026

The company is the first in Europe to figure out how to execute fiat money transfers on decentralised rails in end-to-end compliance with Europe's open banking law. It is led by its three co-founders, Mads Stolberg-Mathieu, Harry Kearney, and Jason Spasovski.

Mads Stolberg-Mathieu, CEO, and co-founder of ZTLment said, “We are seeing a transition, where payment operations become so important for the platform user experience that it is carved out of the finance function and handed over to the product team,”

By providing Compliant Wallet Infrastructure, the business achieves this. With an infinite number of wallets at their disposal, platform users may handle payments in an easy and transparent manner without having to deal with complicated technical or legal requirements.

Customers won't have to worry about the underlying rails when the next product launch allows them to assign a multicurrency wallet for each platform vendor, enable split payouts, and release cash into escrow depending on data events.

Global organisations including as Citi, HSBC, JP Morgan, and even the Bank of International Settlements, the central bank for central banks, have acknowledged the promise of programmable payments, like ZTLment is bringing to market.

Richard Breiter, partner and co-founder of the PSVTech01 fund at PreSeed Ventures said, “The ability to lock and unlock money between multiple parties based on data events will help create trust, transparency, and workflow efficiency in cross-border transactions. It also provides a foundation for letting AI agents decide when to release funds while setting limits on the amounts,”.

About ZTLment

ZTLment, a 2020 startup, uses a novel strategy to solve the enduring problems that ordering and booking platforms encounter, such as automating fund flows, improving payment transparency, and upholding regulatory compliance. It also talks about a more general change in the market between the product and finance teams.

Recommended Stories for You

Zeus Sleep Funding News- UK startup Zeus Sleep Raises £150k For Snoring And Sleep Apnoea Solutions

Kailee Rainse May 8, 2025

Follow us

Follow us Follow us

Follow us