ZAKA news – Prague-based ZAKA Unveils its First Fund of €15 Million

Jul 19, 2024 | By Team SR

Operating from the vibrant startup ecosystems of Prague and London, ZAKA VC has announced the establishment of its first fund, sized at €15 million, aimed at supporting early-stage startups across the US and EU markets.

SUMMARY

- Operating from the vibrant startup ecosystems of Prague and London, ZAKA VC has announced the establishment of its first fund, sized at €15 million, aimed at supporting early-stage startups across the US and EU markets.

- Established in 2020 by seasoned businessmen Jan Kasper and Peter Zalesak, ZAKA VC started off as a family office that invested only private capital in pre-seed and seed companies.

ZAKA VC has made notable investments in companies such as Sensible Biotechnologies, ExcepGen, Lime Therapeutics, Miros.ai, Supliful, and Webel. Prioritising the domestic Central and Eastern European (CEE) sector at first, ZAKA VC has now expanded to include the US and the UK.

Read Also - LioniX International funding news – Enschede-based LioniX International Raises €1.5Million in bridge Funding

In contrast to the majority of CEE-based funds, ZAKA VC is committed to investigating and supporting US-based teams, CEE-based teams hoping to expand to the US, and the European diaspora in the US.

RECOMMENDED FOR YOU

TRIVER Secures Up To £114M To Revolutionise How Small Businesses Access Cash Flow Finance

Kailee Rainse

Sep 24, 2025

Trendtracker Secures $7M To Expand AI-Driven Strategic Intelligence Platform

Kailee Rainse

Dec 11, 2025

The company has started its first venture capital fund in response to requests from outside investors to co-invest alongside ZAKA. With a minimum limited partner (LP) ticket of €130,000, the €15 million ZAKA VC Fund I opened with a €10.5 million first closing in June 2024.

An entrepreneurial legacy

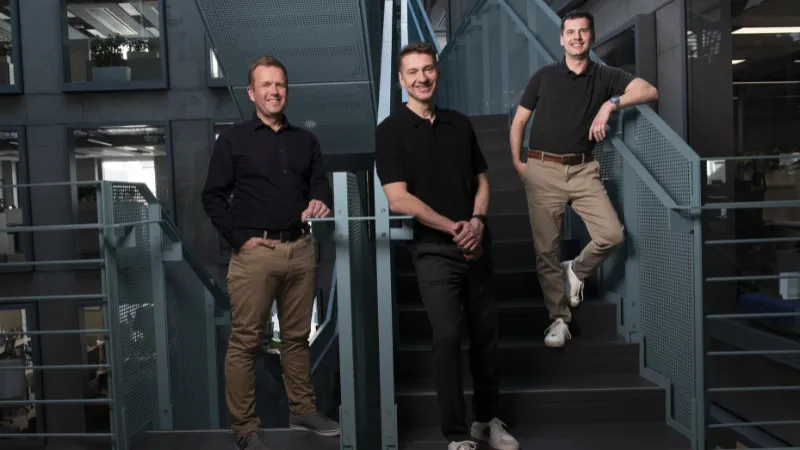

The founding fathers of ZAKA VC, Jan Kasper and Peter Zalesak, have family companies. These seasoned businesspeople have created and co-owned more than 60 businesses in a variety of industries, including media, retail, retail, energy, development, agronomy, leisure, and hospitality, with a total revenue of nearly €1.4 billion. In an effort to be closer to the vanguard of innovation in the quickly changing market, ZAKA VC was established as a synergistic addition, extending its operations into the venture capital asset class.

Jan Kasper shared his motivation for creating ZAKA VC: “The trigger to create ZAKA was my daughter Valentina, who introduced me to the emerging startup ecosystem. I recognized this opportunity as an exciting way to invest the capital we generated in our family businesses. I suggested this idea to my friend and fellow entrepreneur Peter, who has always been a tech and innovation enthusiast.”

Peter Zalesak added: “Even before founding ZAKA, I invested and helped startups, but I realized that it was a full-time business. After conversations with Jan, we decided to do it professionally – to hire the right team and establish rules and processes for selecting, evaluating, approving, and managing the best companies that are emerging around us.”

Investment focus and strategy

Andrej Petrus, Head of the Investment Committee at ZAKA VC, said: “Two interesting factors led us to conclude to double down on early-stage investing in the coming years and to enlarge our capital base. Firstly, there is a strong imbalance between demand and supply of early-stage funding worldwide, compared to the peak in 2021. Capital is scarce, but the number of new first-time or repeating founders is increasing. The second and more exciting factor is a new technology paradigm. Advancements in AI are opening new, previously non-viable business cases across all sectors. Analogous to the mobile and cloud era, we believe that the current years will create new, category-defining future decacorns in the AI space.”

The venture capital fund acts as a co-investor with the capacity to co-lead and seeks to invest in pre-seed and seed-stage firms in Europe (primarily in Central Europe, the Baltics, the UK, and the DACH) and the US. B2B software and cross-sectoral AI applications in B2B, biotech, and health tech are the primary investment emphasis areas.

Jan Kasper, Co-Founder and Managing Partner of ZAKA, stated: “The US ecosystem remains in our interest, and we plan to enhance our presence there. It produces highly competent and motivated founders and offers a huge market to conquer. This is why the investment returns are extremely compelling, despite higher valuations compared to the CEE region.”

About ZAKA

Established in 2020 by seasoned businessmen Jan Kasper and Peter Zalesak, ZAKA VC started off as a family office that invested only private capital in pre-seed and seed companies. With over 55 invested companies in its portfolio and over €11 million invested, the firm has subsequently evolved into a strong team consisting of six key members.

Recommended Stories for You

Tourlane funding news- Berlin-based Tourlane has Raised €25 Million in SeriesD Round Funding

Kailee Rainse Nov 14, 2024

Belgian VC Firm Endgame Capital Closes €8M First Fund To Back Near-Market Climate Tech Innovators

Kailee Rainse Oct 31, 2025

Follow us

Follow us Follow us

Follow us