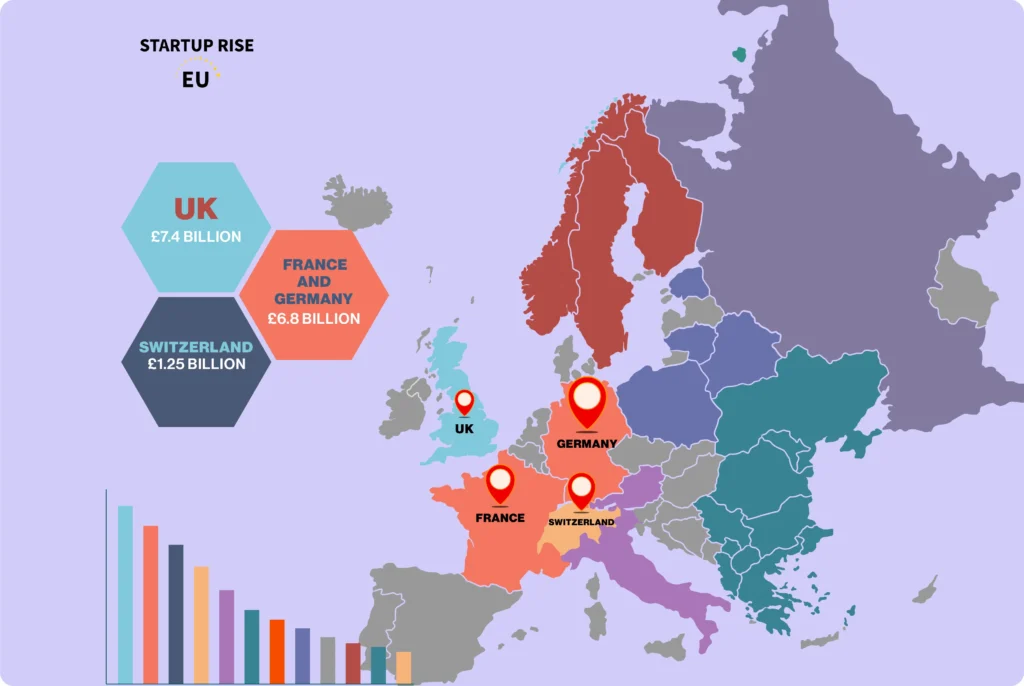

UK Took Nearly One-Third (32%) of All European Funding in H1 2024 to £7.4 Billion

Jul 16, 2024 | By Team SR

VC investment in UK tech is up 16% in 2024 so far, with startups and scaleups raising £7.4 billion ($9.4b) in total AI and fintech dominated the later stage rounds, led by Wayve’s £861M round.

SUMMARY

- VC investment in UK tech is up 16% in 2024 so far, with startups and scaleups raising £7.4 billion ($9.4b) in total AI and fintech dominated the later stage rounds, led by Wayve’s £861M round.

- Across Europe, Generative AI had its strongest quarter on record with £2B raised across multiple companies, whilst Energy continues to be the most funded sector in 2024, with £4.3B billion raised in total.

London investment is up 30% to £5.3 million compared to last year. The UK remains the strongest light in European tech, with startups and scaleups raising £7.4 billion so far in 2024, nearly one-third of all venture capital funding (32%) in Europe this year (£23B), according to new data released by Dealroom.

This is up 16% compared to the same time last year, demonstrating a strong return to growth for the UK tech ecosystem. UK tech companies raised more than France and Germany combined (£6.8B) and more than five times Switzerland (£1.25B).

This was largely driven by later-stage rounds in AI, Fintech and Energy, particularly Wayve’s £861M Series C round to develop embodied AI products for automated driving. Monzo also raised another late-stage round, following its £331M round in Q1 2024.

RECOMMENDED FOR YOU

Hands In funding news – London-based Hands In Secures Over €1.2 Million in Latest Funding

Kailee Rainse

Mar 1, 2025

Dutch Biotech Solynta Lands €20M EIB Boost For Sustainable Potato Breeding

Kailee Rainse

Jul 19, 2025

[Funding alert] Italian Startup Smartpricing Secures €13 Million in Funding

Team SR

Dec 14, 2023

Read also - Adam Funding news – Czech-based Adam Secures €3 Million in late Seed Funding

The top five UK investment rounds in Q2 2024 are:

Wayve - £861M

Abound - £400M

Highview Power - £300M

Monzo Bank - £149M

Char.gy - £100M

London charges ahead

London investment is up 30% already in 2024 to £5.3B, taking 71% of all the investment raised in the UK so far. This was ahead of Paris (£2.4B) and Stockholm (£940M).

Cambridge also made the top 10 European cities for funding, with £517M raised by the city’s tech companies so far, up 83% on 2023’s figures. This included legal AI tech company Luminance raised £31.3M, whilst lithium ion parts supplier Echion Technologies raised £29M.

Across Europe, Generative AI had its strongest quarter on record with £2B raised across multiple companies, whilst Energy continues to be the most funded sector in 2024, with £4.3B billion raised in total. So far this year, 1450 companies across Europe have raised £1.5M in what is promising to be the third-most active year for VC investment in Europe ever, behind only 2021 and 2022.

Catherine Lenson, co-COO, Phoenix Court: “UK tech is on course for one of its best ever years, having raised more than France and Germany combined (£6.8B) in the first half of the year. As late stage funding returns to Europe and in particular to New Palo Alto, the supercluster of innovation ecosystems, we're seeing a surge of thoroughbred companies—boasting strong revenues and incredible potential. Thoroughbreds like these - with revenues in excess of $100m a year - are on track to become regional and global champions and investors are rightly seizing the opportunity to invest in them.”

Sahar Meghani, Partner at Visionaries Club, said: “The UK’s fintech sector continues to be world-leading with Monzo picking up more funding this quarter and credit technology Abound also raising £400 million to boost its lending product. This is a clear example of how open banking and AI is helping to transform financial services and it’s likely we’ll see more fintech success stories using these technologies this year.”

About Dealroom

Dealroom.co is the foremost data provider on startups, growth companies and tech ecosystems in Europe and around the globe. Founded in Amsterdam in 2013, Dealroom.co now works with many of the world's most prominent investors, entrepreneurs and government organizations to provide transparency, analysis and insights on startups and venture capital activity.

Recommended Stories for You

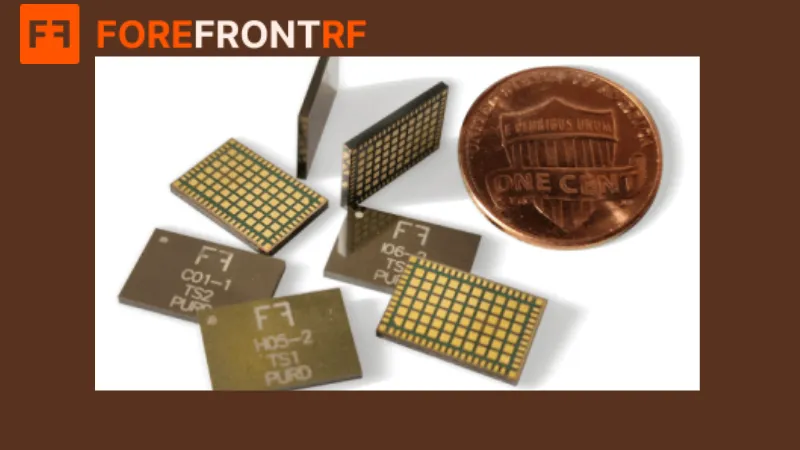

Forefront RF funding news – UK-based ForeFront RF Secures £16Million in Series A Round Funding

Kailee Rainse Nov 8, 2024

Follow us

Follow us Follow us

Follow us