Taktile funding news – London-based Taktile Secures €51.5 Million in Series B Round Funding

Feb 28, 2025 | By Kailee Rainse

Taktile, a decision automation platform with offices in Berlin, London, and New York, has raised €51.5 million in a Series B funding round to improve risk management strategies for customer interactions.

SUMMARY

- Taktile, a decision automation platform with offices in Berlin, London, and New York, has raised €51.5 million in a Series B funding round to improve risk management strategies for customer interactions.

- Taktile is an advanced decision platform that helps teams create, track, and improve automated risk management processes throughout the entire customer journey, from credit checks and onboarding to monitoring transactions and collections.

The round was led by Balderton Capital, with participation from investors like Index Ventures, Tiger Global, Y Combinator, Prosus Ventures, Visionaries Club, and Larry Summers, former U.S. Secretary of the Treasury. This brings Taktile’s total funding to €75.3 million.

Maik Taro Wehmeyer, CEO & Co-founder, Taktile said: “From day one of our journey, we believed that millions of lives could be improved by enabling organisations to make optimal decisions for their customers. By keeping experienced risk experts in control, we make it possible for even the most regulated businesses in financial services to fully adopt AI into high-stakes workflows.”

In 2024, Taktile grew its customer base by four times and increased its annual recurring revenue (ARR) by more than 3.5 times. The company now serves clients in 24 markets, including fintech companies like Mercury, Kueski, and Zilch, as well as major financial institutions such as Allianz and Rakuten Bank.

Rob Moffat, General Partner at Balderton Capital, said: “The best investments for VCs are when your reaction to the company is ‘of course – why doesn’t this happen already?’ It is crazy that businesses use a plethora of separate tools for different decisions across their business when it is the same customer and data. It is also crazy that a lot of decisioning is coded in-house from scratch. Taktile’s integrated decisioning platform allows businesses to take one consistent view of the customer and easily build, iterate and test complex decision logic. This has won them some of the most sophisticated fintechs as happy clients and is now allowing them to expand into banks and insurers.”

While AI is already widely used for things like chatbots in customer support and personalized marketing, Taktile believes that in 2025, AI will start being widely used for important decision-making in areas like credit checks and transaction monitoring. The big challenge in using AI for these decisions is that mistakes can be very expensive.

Errors can lead to problems like loan defaults, fraud, blocking good customers from getting services, or hefty fines from regulators.

Many businesses struggle to scale AI because there aren't enough skilled engineers to build and maintain the systems. Also, AI needs to be more precise, as even the most advanced models can only solve parts of complex problems, not always with perfect accuracy.

Read also - Fund F funding news – Vienna-based Fund F Closes First Fund at €28Million

Taktile aims to solve this by giving risk teams and engineers a shared platform to create, manage, and improve AI-powered workflows that follow rules and integrate with business processes. Over the past year, Taktile helped its customer Zilch cut service and usage costs by 50%.

Chanuka Perera, Head of Credit Risk at Zilch said, “Taktile’s platform has empowered our teams to take control of our automated underwriting processes, allowing us to build, test, and optimise decisions with unprecedented speed and independence, This shift has not only streamlined our operations but has also resulted in significant cost savings, freeing up resources for further innovation.”

Taktile has also helped Zippi improve its decision-making by making policy updates 67% faster, allowing more testing in areas like fraud, credit, and portfolios, and ensuring real-time decisions without delays.

The platform has also cut Breakout Finance's underwriting time by 95%, letting their risk team process 3-5 times more applications and grow quickly.

Pieter Viljoen, CDO at Allianz Partners, said: “It was clear that we needed a partner who fully understood the nuances of decisioning in various use cases and industries, the challenges that come with off-the-shelf AI models, and who could provide the required infrastructure to deploy LLMs in mission-critical workflows. We met Taktile just at the right time.”

About Taktile

Taktile is an advanced decision platform that helps teams create, track, and improve automated risk management processes throughout the entire customer journey, from credit checks and onboarding to monitoring transactions and collections.

Recommended Stories for You

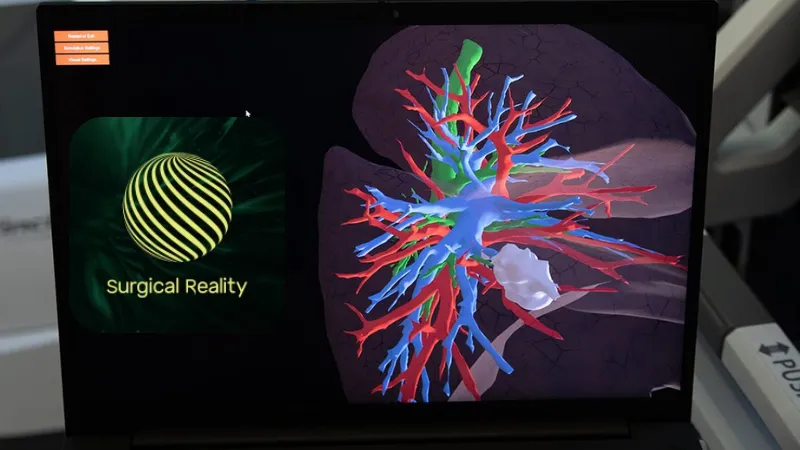

Surgical Reality funding news – Amsterdam-based Surgical Reality Raises Fresh Funding from LUMO Labs

Kailee Rainse Feb 13, 2025

Follow us

Follow us Follow us

Follow us