SeqOne Funding News- France-Based SeqOne Raises €20M Growth Funding

May 27, 2025 | By Kailee Rainse

SeqOne, a company from Montpellier that makes AI software to analyze genetic data for cancer and rare diseases, has raised €20 million in a growth funding round.

SUMMARY

- SeqOne, a company from Montpellier that makes AI software to analyze genetic data for cancer and rare diseases, has raised €20 million in a growth funding round.

The funding round was led by new investor Supernova Invest, with existing investors Elaia, Omnes, and Merieux Equity Partners also joining in.

Rémi Spagnol, Investment Director at Supernova Invest, says, “SuperNova Invest is proud to partner with SeqOne, a company at the forefront of genomic analysis innovation. Their impressive growth, cutting-edge technology, and visionary leadership team give us strong conviction in their ability to become a global category leader.”

“The market needs modern, automated, scalable solutions, and SeqOne is exceptionally well-positioned to meet this demand. We are excited to support their journey in revolutionising how genetic data is used to improve patient outcomes and to help them build a true European champion with global reach.”

RECOMMENDED FOR YOU

MedVasc Funding News -Swedish MedTech Startup MedVasc Raises €917k Funding

Kailee Rainse

May 16, 2025

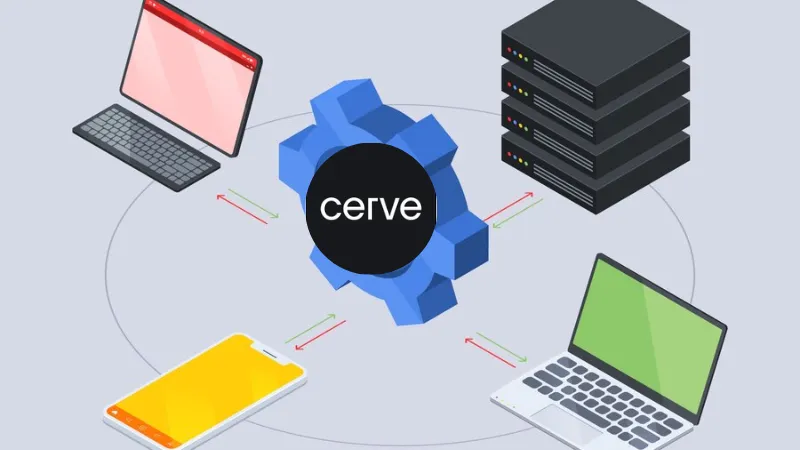

Cerve funding news -London-based Cerve has Secured €4.2 Million in Seed Funding

Kailee Rainse

Dec 6, 2024

SeqOne has received new funding to help it become a top provider of NGS data analysis for clinical diagnostics in Europe and worldwide.

The money will be used to improve its software and meet the growing need for genomic interpretation. It will also strengthen SeqOne’s finances and support long-term partnerships with customers.

Read Also- Memority Funding News- Paris-Based Memority Raises €13M In Series A Round

SeqOne plans to grow in three main ways. First, it will expand internationally, with its customer base tripling to 140 labs in 22 countries and over 110,000 patient analyses expected in 2025.

Second, it will boost its presence in the US by launching a special HIPAA-compliant platform in early 2025.

Third, SeqOne will keep buying companies to widen its technology and reach, like its recent purchase of Life & Soft, which specializes in multi-omics.

Martin Dubuc, CEO of SeqOne, says, “This fundraising is a testament to the incredible work of our team and the transformative potential of our platform in making personalised medicine a reality. We are thrilled to welcome Supernova Invest and are deeply grateful for the continued trust of Elaia, Omnes, and Merieux Equity Partners.”

“This new capital injection not only empowers us to scale our international operations, particularly with our US launch, and to further enhance our technological leadership, but it also fortifies our financial foundations, ensuring our customers can depend on us as a steadfast partner for years to come.”

Dubuc adds, “Our goal is to equip every molecular laboratory with the most advanced, intuitive, and reliable genomic analysis solutions.”

SeqOne is a deeptech company that helps advance personalized medicine. It provides an AI-based platform that assists molecular labs in analyzing genetic data.

The platform is used in areas like cancer, rare diseases, and multi-omics, including detecting pathogens after recent acquisitions. SeqOne works with 140 labs in 22 countries and expects to process over 110,000 patient analyses in 2025.

The company supports healthcare and biopharma organizations worldwide and is growing its presence in the US through partnerships and market expansion.

Recently, SeqOne launched SomaHemato, a new tool for blood disease analysis. It includes a feature to check the IGHV mutational status for Chronic Lymphocytic Leukemia (CLL).

Supernova Invest is a European venture capital firm managing about €800 million. It invests in more than 80 companies in cleantech, digital, industrial technologies, and healthcare. For 20 years, Supernova Invest has provided money, experience, and support to help companies grow. The firm works closely with corporations, research centers, and other investors to support its portfolio.

Elaia is a European investor focused on tech and deep tech startups. It helps entrepreneurs from early stages to becoming leaders. With over 20 years of experience, Elaia combines scientific knowledge with practical business skills. Through a partnership with Lazard called Lazard Elaia Capital, the firm supports founders at different growth stages. Elaia has worked with over 100 startups, including well-known names like Criteo, Mirakl, and Shift Technology.

Omnes is a private equity firm focused on energy transition. It manages more than €6.7 billion. Omnes supports entrepreneurs working in renewable energy, sustainable cities, deep tech, and co-investment projects. It also created the Omnes Foundation, which helps non-profit groups focused on education, health, and social integration for children and young people.

Mérieux Equity Partners (MxEP) is an investment firm that focuses on healthcare. It manages over €1.5 billion using innovation and buyout strategies. MxEP supports companies from startups to established businesses. Based in Lyon and Paris, it invests in European companies with strong growth potential. MxEP provides financial help and business support to improve healthcare products and patient care.

About SeqOne

Founded in 2017, SeqOne is a top European company that provides AI-powered software to analyze genetic data for cancer and rare diseases. Their cloud platform turns complex genetic information into fast, accurate, and useful results. This helps medical labs give important diagnoses and treatments that can save lives.

Follow us

Follow us Follow us

Follow us