Devengo, a Spanish fintech focused on account-to-account (A2A) payment infrastructure, has closed a €2 million pre-Series A funding round, comprising both debt and equity, to expand its multi-sector instant payments infrastructure.

SUMMARY

- Devengo, a Spanish fintech focused on account-to-account (A2A) payment infrastructure, has closed a €2 million pre-Series A funding round, comprising both debt and equity, to expand its multi-sector instant payments infrastructure.

The round was led by Bankinter, Demium, and Banco Sabadell, with continued support from existing partners including TheVentureCity, Wayra (Telefónica’s corporate venture capital arm) and various business angels.

“The entry of banks into Devengo’s capital structure is a clear signal of the strength of our value proposition and reinforces the solidity of our capital structure,” explains Fernando Cabello-Astolfi, CEO and co-founder of Devengo.

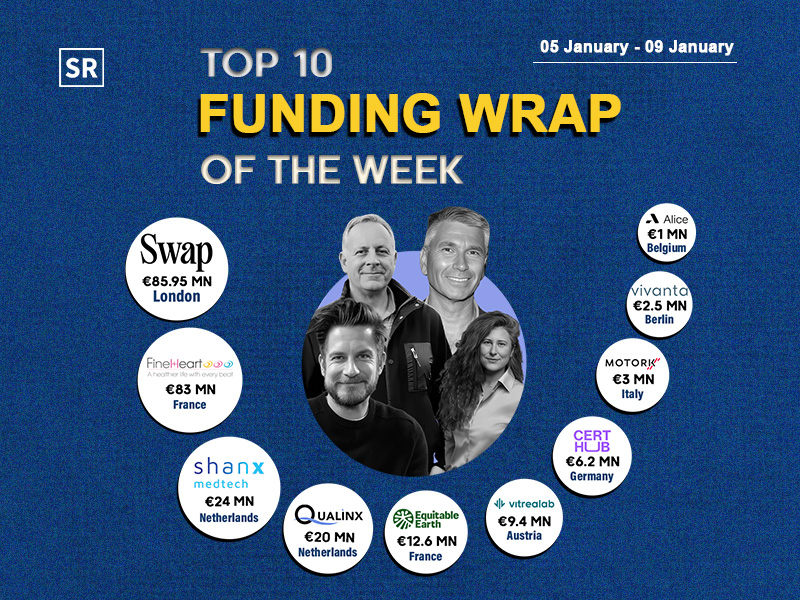

This funding round comes amid a broader surge of activity in European account-to-account (A2A) and payment infrastructure startups.

In early 2025, Open Payments (Sweden) raised €3 million to expand its B2B integration platform, Payrails (Germany) closed €27.7 million to accelerate product innovation and growth across EMEA and Two (Norway) secured €13 million to scale its B2B payments offering. Meanwhile, UK-based Navro and Yaspa raised €36 million and €10.1 million respectively for global and regulated-sector payments solutions.

Read Also - Balnord Launches €70M Fund To Back Frontier And Dual-Use Tech In The Baltics

While Devengo’s round is smaller in scale, it signals the rise of Spain-based players in a market largely led by Northern European fintechs. With the EU Instant Payments Regulation (IPR) driving real-time euro transfers Devengo’s direct Iberpay connectivity and API-first infrastructure align with a Europe-wide trend to modernize payment systems and enable instant, programmable transactions across the SEPA zone.

Andrés Dancausa, General Partner at TheVentureCity, added: “Devengo has everything it takes to lead instant account-to-account paymentsin the SEPA zone and become a key player in the modernisation of European payment infrastructure.”

Founded in 2020, DEVENGO is a fintech focused on account-to-account (A2A) payment infrastructure, delivering instant payment solutions across multiple sectors. Leveraging a direct connection to Iberpay and an API-first architecture, Devengo enables automatic, instant, programmable, and intelligent payments, helping companies optimize processes, reduce operational costs, and enhance their value proposition.

The company differentiates itself through its direct technical integration with the Iberpay clearing house, eliminating reliance on traditional banking intermediaries and providing greater efficiency, control and operational transparency.

With direct access to the national payment system and deep regulatory expertise, Devengo offers a distinctive value proposition, combining speed, security and scalability for businesses seeking modern, reliable payment infrastructure.

“Their API-first approach, their understanding of modern businesses’ needs, and their execution capabilities position them as a natural partner to build the future of instant payments,” added Dancausa.

The funding will enable Devengo to accelerate its expansion across the SEPA zone (Single European Payments Area) and strengthen its position amid rising demand for instant payments in Europe.

The company also plans to adopt next-generation payment protocols early, including Request to Pay and instant international transfers staying ahead of regulatory and technological trends in the European payments ecosystem.

While EU-Startups previously highlighted Devengo as a participant in the We Make Future 2024 startup competition, this marks the first detailed report of the company’s funding activity.

About Devengo

Devengo enables smart payment orchestration through a single API, delivering fast, secure, and automated account-to-account (A2A) payments. Designed for businesses the platform allows companies to embed real-time payments directly into their products, streamlining processes, reducing costs, and creating seamless efficient experiences for customers across multiple sectors.

Recommended Stories for You

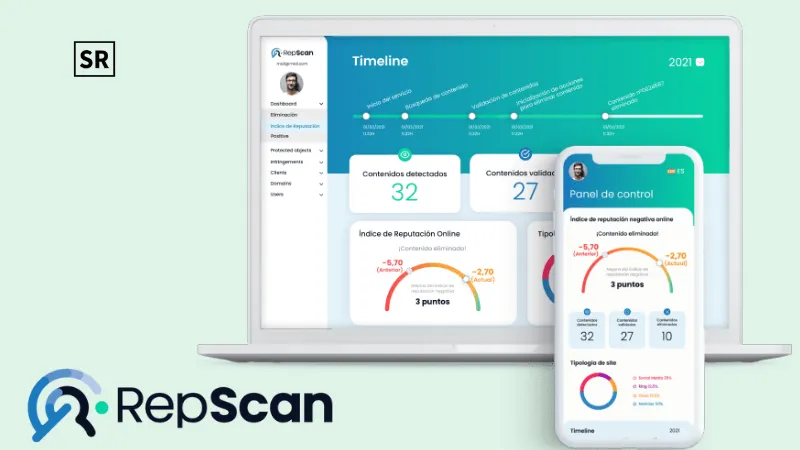

RepScan Funding News – Barcelona-based RepScan Raises €3 Million in Series A Round Funding

Kailee Rainse Feb 21, 2025

Follow us

Follow us Follow us

Follow us