Smart Pension, the UK-based fintech focused on global retirement savings technology, has secured a €69.4 million credit facility to fuel growth and capitalise on opportunities in the rapidly consolidating UK market.

SUMMARY

- Smart Pension, the UK-based fintech focused on global retirement savings technology, has secured a €69.4 million credit facility to fuel growth and capitalise on opportunities in the rapidly consolidating UK market.

The facility was arranged by CIBC Innovation Banking as lead arranger and agent, with participation from investors including Aquiline Capital Partners, Legal & General Investment Management, J.P. Morgan, Link Group, Natixis Investment Managers, Barclays, Chrysalis Investments, DWS Group, and Fidelity International Strategic Ventures.

Eoin Corcoran, Chief Financial Officer, Smart, said: “We are delighted with the growth we’ve achieved in recent years alongside the important milestone of becoming a profitable business.

“CIBC Innovation Banking has been an important part of our journey since 2022 and their ongoing support will enable us to continue developing innovative solutions to help employees around the world save more effectively for retirement. This facility will also help us take advantage of opportunities that will come as the UK market consolidates at a rapid pace.”

RECOMMENDED FOR YOU

LAM’ON funding news – Bulgaria -based LAM’ON has Secured Investment

Kailee Rainse

Dec 16, 2024

MannyAI funding news – Fashiontech Startup MannyAI has Secured €1.5 Million in Funding

Kailee Rainse

Nov 22, 2024

Founded in 2014 by Andrew Evans and Will Wynne, Smart is a global savings and investment technology provider that helps employers effortlessly enrol employees and manage retirement savings.

Read Also - Delphinus Venture Capital Launches With €80 Million To Invest

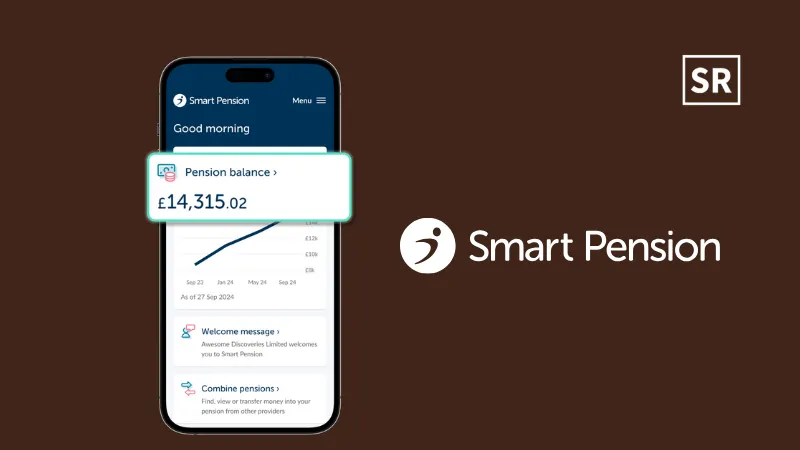

Its flagship platform, Keystone, is a cloud-native workplace retirement solution designed for governments and financial institutions—including insurers, banks, asset managers, and advisers—to deliver digital, bespoke, and cost-efficient retirement savings and income solutions.

Smart also operates one of the UK’s “big four” auto-enrolment master trusts, the Smart Pension Master Trust, serving over 1.5 million savers and 90,000 employers, managing more than £10 billion in assets on Keystone.

Recognised as a leading UK workplace pension provider, Smart is backed by Legal & General Investment Management and J.P. Morgan. Beyond the UK, it operates across the US, Europe, Middle East, and Asia, with over 1.5 million savers and €11.5 billion in assets on its Keystone platform.

Sean Duffy, Managing Director & European Market Lead, CIBC Innovation Banking, added: “Smart’s modern technology, coupled with sector expertise, is the factor for its success to date in the retirement and pension industry. We are thrilled to continue supporting the Smart team on its mission to help transform retirement, savings and financial well-being for employees, employers, financial institutions, and governments globally.”

About Smart Pension

Smart transforms retirement, savings, and financial wellbeing worldwide. Backed by Legal & General and J.P. Morgan, we offer a secure, digital, and award-winning pension experience for employers and employees. With innovative, user-focused solutions, we simplify processes, enhance engagement, and adapt to evolving needs across the UK and international markets.

Recommended Stories for You

Next Sense funding news – Amsterdam-based Next Sense has Raised €11.5 Million in Series A Round Funding

Kailee Rainse Dec 10, 2024

Follow us

Follow us Follow us

Follow us