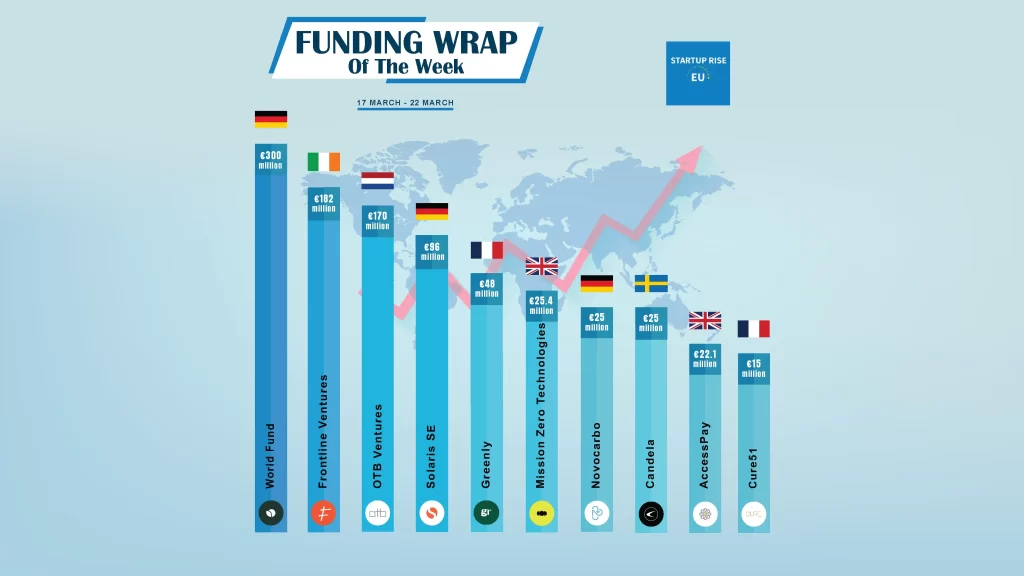

Funding Wrap of the Week | European Startups Funding Roundup | March 17 – March 22

Mar 23, 2024 | By Team SR

European Startups raised capital in order to expand and move into more successful. Here is this week's Top 10 European Startups Funding Roundup.

The Top 10 European Startups Funding Roundup of This Week

World Fund

World Fund, one of European venture capital firm, has secures €300 million first fund. Prominent supporters include NRWbank, Ignitis Group, BPI France, PwC Germany, EIF, KfW Capital, Wachstumsfonds, and PwC Germany.

World Fund, European Climate Tech venture capital fiem, support the world economy’s decarbonisation. They are motivated to address the climate catastrophe as climate tech venture capitalists, and they only fund scalable enterprises and technologies with large potential for reducing emissions.

Frontline Ventures

Frontline Ventures, a leading venture capital firm to support b2b software startups, secures €182 million in funding across two funds: Frontline Growth and Frontline Seed.

RECOMMENDED FOR YOU

Remberg Funding News- German Startup Remberg Rasies €15 Mn To Expand AI-powered Platform

Kailee Rainse

May 19, 2025

[Funding alert] London-based Baanx Secures $20Million in Series A Round Funding

Team SR

Mar 11, 2024

Frontline Ventures, European venture firm which was established in 2012, is committed to building long-term connections throughout the technology industry by providing access to a wealth of resources, knowledge, and tactical alliances in addition to financial support.

OTB Ventures

OTB Ventures, a European Venture Capital firm secures a €170 million in oversubscribed funding. The European Innovation Fund (EIF), Isomer Capital, NATO Innovation Fund (NIF), Foundation for Polish Science, TDJ Venture, Marcin Zukowski, co-founder of Snowflake, and OnDean, the family office of the Relativity founders, will support Fund 2.

OTB Ventures, a European venture capital firm specializes in European deep tech and has an unfair advantage when it comes to gaining access to deal flow in Central and Eastern Europe (CEE).

Solaris SE

Solaris SE, Europe’s leading embedded finance platform secures €96 million in series F round funding. The funding round was led by SBI Group, one of Solaris’ early strategic investors, and will enable the delivery of the ADAC migration.

Solaris is Europe’s leading embedded finance platform. Founded in 2015, Solaris’ proprietary modular B2B tech stack and scalable licensing system empowers its partners – from large global non-financial companies to innovative fintechs – to offer unique, customer-centric financial services.

Greenly

Greenly, a leading carbon accounting startup secures €48 million in series B round funding paris startup ecosystem. Two years after a successful €21 million Series A, Fidelity International Strategic Ventures led this round.

Greenly, a paris based french startup, has helped businesses accelerate their transition to a net-zero carbon economy by providing accurate and user-friendly carbon management.

Mission Zero Technologies

Mission Zero Technologies, a developer of versatile modular direct air capture (DAC) technology secures €25.4 million in series A round funding. 2150 led this round, with participation from Breakthrough Energy Ventures, Siemens Financial Services, World Fund, and Fortescue.

Mission Zero, Carbon is being reinvented for a healthy earth. They have quickly developed adaptable Direct Air Capture (DAC) technology since 2020 to remove historical CO2 emissions from the atmosphere at any location and on any scale.

Novocarbo

Novocarbo secures €25 million in growth funding to establish a pan-European infrastructure network of its net-zero solution. The investment made by SWEN Capital Partners (SWEN CP) marks one of the largest CDR-investments in Europe within the last year.

Novocarbo is driving decarbonization with a unique concept: The German company operates Carbon Removal Parks that will enable it to remove up to 1 million tonnes of CO₂ from the atmosphere by 2030.

Candela

Stockholm-based electric vessel maker Candela secures €25 million in funding to expand production of its game-changing electric ferries.

Candela has altered the concept of a boat. The only electrical boat in the world with the same speed and range as a fossil boat. And an unmatched temperament in choppy waters. Just the boats of the future.

AccessPay

AccessPay, the leading bank integration provider secures strategic funding round at $24 million with a combination of equity and debt. The round was led by True Ventures, the Silicon Valley-based venture capital firm, with participation from Manchester-based investment firm Praetura Ventures, NatWest, Mastercard, Route 66 Ventures, and Beringea.

AccessPay is driving digital transformation within finance and treasury teams, by modernising processes across banking operations, minimising the risk of fraud and error, enhancing efficiency and optimising cash visibility.

Cure51

Cure51, a paris based techbio startup that aims to uncover the biological underpinnings behind extraordinary survivorship among cancer patients secures €15 million in seed funding.

Nicolas Wolikow and Simon Istolainen established Cure51 in March 2022. It is the great contribution in paris startup ecosystem. with the help of seasoned businesspeople and four internationally recognized cancer centers: the Gustave Roussy Institute (IGR, Paris, France); the Leon Bérard Center (CLB, Lyon, France); Charité Universitätsmedizin (Berlin, Germany); Milan, Italy; and Vall d’Hebron (VHIO, Barcelona, Spain).

In various European Startups Funding Roundup, these startups raised funding from venture capitalists and angel investors, and secured place in the Top 10 European Startups Funding Deals of this Week.

Follow us

Follow us Follow us

Follow us