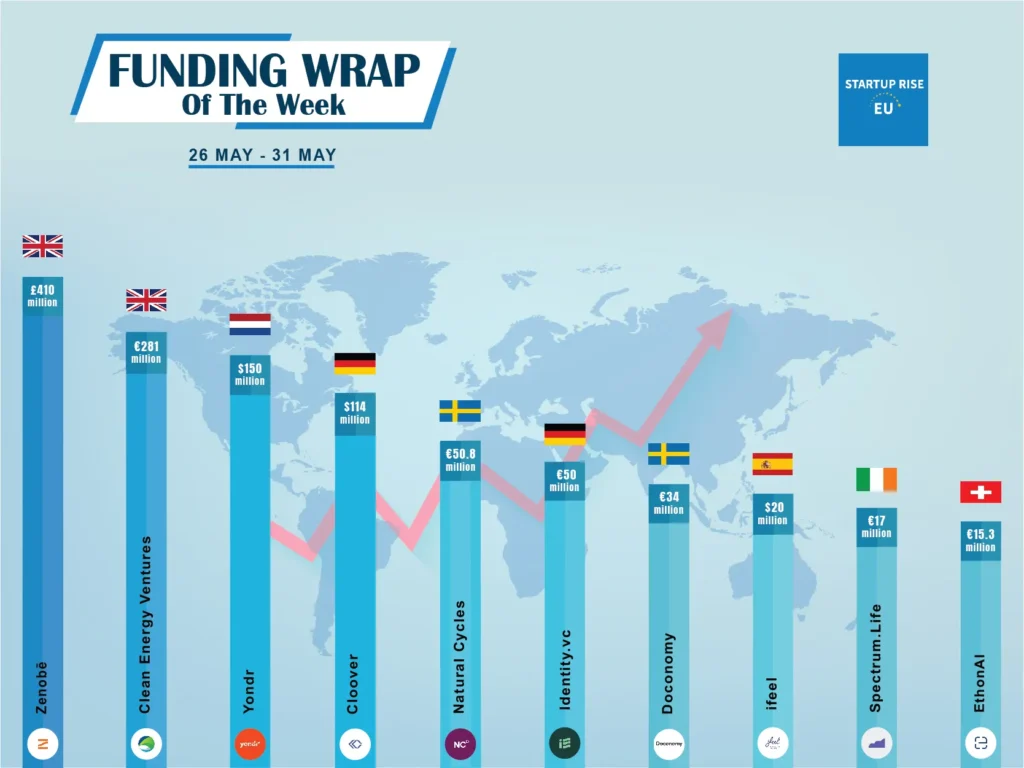

Funding Wrap of the Week | European Startups Funding Roundup | May 26 – May 31

Jun 1, 2024 | By Team SR

European Startups raised capital in order to expand and move into more successful. Here is this week's Top 10 European Startups Funding Roundup.

SUMMARY

- Funding Wrap of the Week | European Startups Funding Roundup | May 26 – May 31.

- Zenobē, Clean Energy Ventures, Yondr Group, Cloover, Natural Cycles, Identity.vc, Doconomy, ifeel, Spectrum.Life, EthonAI, are the Top 10 European Startups Funding Roundup in This Week.

The Top 10 European Startups Funding Roundup of This Week

Zenobē

Zenobē, the leading EV fleet and battery storage specialist, raises an additional £410 million in funding– securing the largest electric bus platform financing in Europe.

This influx of capital, in addition to its existing £241m EV financing platform established in 2022, will enable the business to support the deployment of over 2,000 electric bus vehicles throughout the UK and Ireland by 2026.

Clean Energy Ventures

Clean Energy Ventures (CEV), a leading global venture capital firm funding early-stage climate innovations, secures €281 million in oversubscribed second fund with total capital commitments of $305 million.

The most recent fund not only greatly increases the firm's North American investment opportunities but also enables CEV to provide its approach and experience to European climate technology innovators.

Yondr Group

Yondr Group, a leading global developer, owner and operator of hyperscale data centers, raises $150 million in funding from the International Finance Corporation (IFC), the largest global development institution focused on the private sector in emerging markets and a member of the World Bank Group, to fund the construction of the first phase of its hyperscale campus in Johor, Malaysia.

As global economies rapidly adopt artificial intelligence and emerging technologies, the demand for digital infrastructure in Asia continues to intensify.

Cloover

Berlin-based startup Cloover, wraises $114 Million in Seed Funding to fuel the growth of its operating system for the renewable energy industry. The company connects all relevant stakeholders of the energy transition - installers, prosumers, manufacturers, energy providers, and investors - through its software, finance, and energy solutions.

The round is led by Lowercarbon Capital, founded by renowned venture capitalist Chris Sacca, and with participation from existing investors 9900 Capital and QED. This oversubscribed round underscores the team’s momentum and investor confidence in the business model, even amidst economic challenges.

Natural Cycles

Natural Cycles, a leading women’s health company that developed the world’s first birth control app, secures €50.8 million in series C round funding led by Lauxera Capital Partners.

Investments in new product development, commercial acceleration, and healthcare reimbursement automation will be made with the help of a €50.8 million financing that includes participation from Point72 Private Investments and a revolving lending facility from J.P. Morgan.

Identity.vc

Identity.vc has launched Europe's first LGBTQ+ venture capital fund, with €50Million LGBTQ+ Founders in the form of €250K to €1.5M initial tickets.

Four investments have been made by the Art. 9 SFDR social impact fund thus far. These include London-based Omni, which sells nutritious vegan dog food, and Berlin-based Frontnow, which provides an AI solution for online shops.

Doconomy

Doconomy, a leading impact fintech company providing banks with innovative tools to drive climate action and financial wellbeing, secures €34 million in series B round funding.

The round was co-led by UBS Next, the venture and innovation arm of UBS, and existing investor CommerzVentures, a pioneering venture capital firm specializing in climate fintech.

ifeel

ifeel , a provider of a mental health solution secures $20million in series B round funding. FinTLV Ventures and Korelya Capital led the $40 million round, in which current investors SCOR Ventures, Nauta, and UNIQA Ventures also participated.

The company plans to improve its product and innovation skills in the mental health arena and expand its commercial engine across current and new markets with the cash.

Spectrum.Life

Spectrum.Life, a startup delivering clinically backed digital health, mental health and wellbeing solutions to organisations and their people, secures €17 million in funding . Act Venture Capital led the round, with participation from current investors.

With this investment, it will be able to carry out its mission to transform and save as many lives as it can, as well as to establish itself as insurers, academic institutions, and corporate partners of choice for health tech and digital health.

EthonAI

EthonAI, a pioneer of AI-powered manufacturing analytics, secures €15.3 million in series A round funding – led by Index Ventures, with existing investors General Catalyst, Earlybird, and Founderful participating.

While other industries pounced on data analytics early and never looked back, manufacturing has lagged behind. Now, across products as diverse as chocolate, watches, automotive parts and consumer electronics, EthonAI is powering data-driven factories and changing the whole paradigm of manufacturing.

Follow us

Follow us Follow us

Follow us