Funding Wrap of the Week | European Startups Funding Roundup | April 28 – May 3

May 4, 2024 | By Team SR

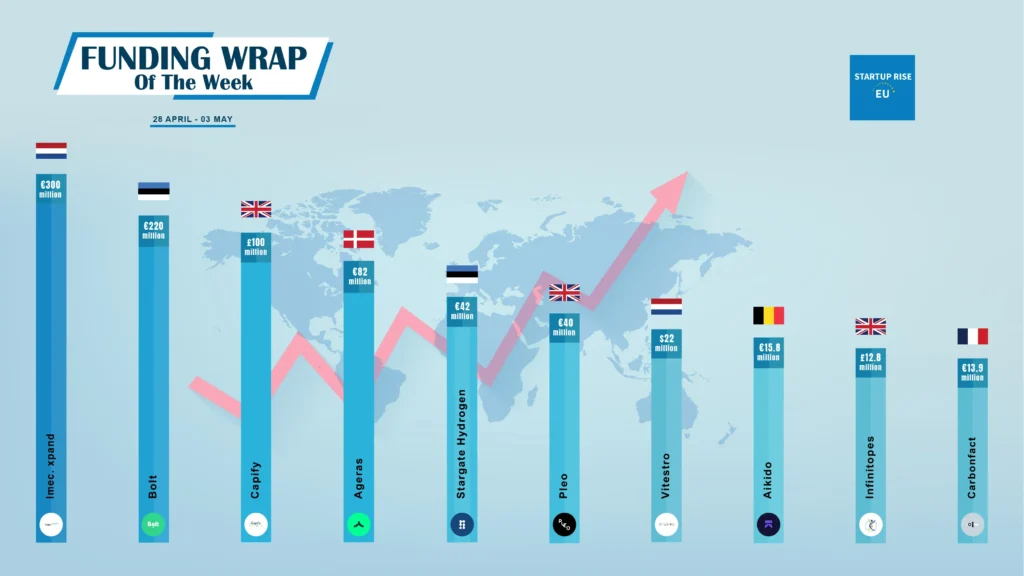

European Startups raised capital in order to expand and move into more successful. Here is this week's Top 10 European Startups Funding Roundup.

The Top 10 European Startups Funding Roundup of This Week

Imec. xpand

An independent worldwide venture capital firm called imec.xpand, with headquarters in Leuven, has raised a new fund valued at €300 million with the goal of spurring the development of breakthroughs in nanotechnology and semiconductors.

Investing in early stage innovation at the intersection of corporate venturing, traditional venture capital, and technology transfer is made possible by the innovative approach of Imec.xpand.

Bolt

Bolt, a multinational shared mobility platform with its headquarters located in Tallinn and formed in 2013, has obtained finance for a syndicated revolving credit facility (RCF) of €220 million.

RECOMMENDED FOR YOU

SolidIO funding news – Medtech Company Solid IO Secures €800k in Funding

Kailee Rainse

Feb 25, 2025

At Bolt, they were constructing a world in which people can travel about conveniently and safely without requiring their own automobiles. a time when individuals are free to utilise transportation whenever they choose, selecting an e-bike, automobile, or scooter depending on the situation.

Capify

Leading online SME lender Capify secures £100million from Pollen Street Capital (“Pollen Street”), an alternative asset manager dedicated to investing within financial and business services.

The new facility will support the lender’s ambitious future growth plans and provide working capital to thousands of SMEs over the coming years. UK-based Capify has been offering financing to small and medium-sized businesses in the UK Over the nearly 15 years, they have assisted a great number of happy clients in raising the money they require.

Ageras

Denmark-based Ageras secures €82 Million in funding, The round brings the company’s funding to almost €200 million. Ageras provides accounting software to over 300,000 small businesses. By using its solutions—which combine accounting, payroll, banking, and finance tasks into a single cockpit—business owners can focus on managing their operations.

At Ageras, they provide the finest ecosystem possible to support small and microbusinesses' financial needs, enabling their success. They are an ambitious network of fintech firms that operate across 12 countries in Europe and the US, with over 350 workers, and they have managed to keep their start-up mentality.

Stargate Hydrogen

Estonia – Stargate Hydrogen, a pioneering force in green hydrogen solutions, secures €42 million in seed funding . This substantial investment, comprising both equity and grant instruments, is designated for the scaling of its patented electrolyser technology.

In order to help their clients expedite their hydrogen projects, Stargate Hydrogen provides cutting-edge stacks and electrolyser systems for the generation of green hydrogen. Their goal is to develop sustainable and economical green hydrogen solutions in order to expedite the world's shift to a zero-carbon economy.

Pleo

London-based spend management platforms Pleo secures €40 million in debt funding from HSBC Innovation Banking UK, the specialist financial partner for the innovation economy.

Pleo is a smart business spending solution for forward-thinking teams. Their intelligent company card gives thousands of companies autonomy across Europe. With features including subscription management, spend categorisation, invoice payments, email synching and direct reimbursement.

Vitestro

Utrecht-based, Vitestro, the pioneering autonomous blood drawing company, secures $22 million in funding to accelerate commercialization of its innovative robotic blood drawing device. This brings its total funding raised to $50 million (€46 million) from both equity investments and grant funding.

Founded in 2017, Vitestro is committed to improving the blood draw experience for patients and clinicians. With its revolutionary autonomous blood draw technology and a team of more than 70 highly skilled specialists in medical robotics, artificial intelligence, imaging software, and healthcare commercialization, it is transforming the blood draw industry globally

Aikido

Ghent-based Aikido, the get-it-done security platform for developers and SMEs, secures over €15.8 million in fresh series A round funding from Singular.vc, joined by Notion Capital and Connect Ventures.

Developers may use Aikido as a get-it-done security platform. All required code and cloud security scanners are centralised in one location by Aikido. As a team of pragmatic engineers, they prioritise open-source solutions and the developer experience in both their design and development process.

Infinitopes

UK-based Infinitopes Precision Immunomics, an integrated cancer biotech combining world leading platforms in precision antigen discovery with vaccine vectors capable of durably stimulating protective immune responses, secures £12.8million in seed funding led by Octopus Ventures.

Infinitopes Ltd is a soon to be clinical stage, integrated cancer biotechnology company supported by Cancer Research UK (CRUK) and the University of Oxford. The Company combines two world leading platforms, in precision antigen discovery and in high efficiency, vector delivery systems, to develop immunologically durable vaccines for use against multiple solid tumour indications.

Carbonfact

Paris-based Carbonfact, a Carbon Management Software built for the fashion industry, secures €13.9 million in series A round funding. This round was led by existing investor Alven. Headline is joining as a new investor and also joins the board. Existing investor Y Combinator also participated.

The fashion industry-specific carbon management software. Carbonfact helps luxury, footwear, and clothing businesses monitor, report, and cut emissions without requiring physical labour.

In various European Startups Funding Roundup, these startups raised funding from venture capitalists and angel investors, and secured place in the Top 10 European Startups Funding Deals of this Week.

Frequently asked questions (FAQs)

Name the Top 10 European Startups Funding Roundup in This Week?

Recommended Stories for You

Kodesage funding news – Modernisation Startup Kodesage Secures €2.3 Million in Pre-Seed Funding

Kailee Rainse Jan 30, 2025

Follow us

Follow us Follow us

Follow us