Czech Startup Flowpay Expands To Netherlands With €30M To Help SMEs

Nov 12, 2025 | By Kailee Rainse

Flowpay, a Prague-based FinTech and Data & AI company, provides embedded finance infrastructure to help SMEs grow. The company has officially launched in the Netherlands and secured a €30 million facility from investment manager Fasanara Capital.

SUMMARY

- Flowpay, a Prague-based FinTech and Data & AI company, provides embedded finance infrastructure to help SMEs grow. The company has officially launched in the Netherlands and secured a €30 million facility from investment manager Fasanara Capital.

The launch comes after Flowpay’s participation in the ABN AMRO + Techstars Future of Finance Accelerator in Amsterdam. The new €30 million credit facility will help Flowpay advance its mission to close Europe’s €400 billion SME financing gap by offering fast, accessible, and flexible growth capital to small and medium-sized businesses.

“This new credit line from Fasanara Capital enables us to strengthen our position as a leading embedded lending solution in Europe,” said William Jalloul, CEO and Founder of Flowpay. “Our ambition is to become the next European FinTech unicorn empowering SMEs across the continent with fast, data-driven, and flexible financing that fuels real economic growth.”

Flowpay’s €30 million facility positions it within a growing European trend of FinTechs addressing the SME financing gap through data-driven, embedded finance solutions.

RECOMMENDED FOR YOU

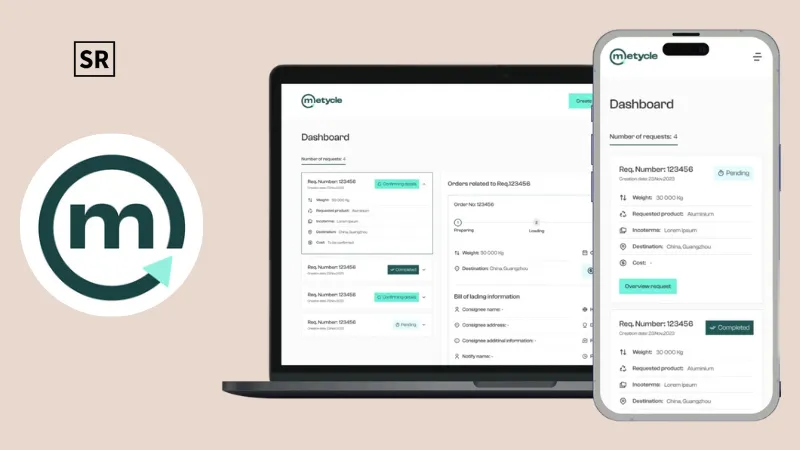

METYCLE funding news – METYCLE Secures €14.1Million in Series A Round Funding

Kailee Rainse

Feb 20, 2025

Read Also - myTomorrows Raises €25 Million To Expand Global Patient Access To Treatments

Across Europe, investors are backing similar initiatives: Wealthon (Poland) €126.2M, FINOM (Netherlands) €92.3M, Juice (UK) €29.4M, and Sibill (Italy) €12M. In the Netherlands, Factris raised €100M to expand SME lending continent-wide, reflecting strong investor interest in the segment.

Flowpay’s expansion from Central and Eastern Europe into the Netherlands aligns with this broader trend of FinTechs scaling pan-European embedded finance infrastructure. Its partnership with Fasanara Capital follows the investor’s prior SME-finance collaborations, such as the 2023 facility with SME Finance, highlighting continuity in funding for SME-lending innovation.

“Flowpay has developed a technology that makes SME financing faster, simpler, and scalable. We believe the future of financial markets depends on innovative models like this. Our partnership with Flowpay aligns with our mission to bridge the funding gap faced by European SMEs,” said Matt Kus, Partner and Head of Origination at Fasanara Capital.

Founded in 2021 by serial entrepreneur William Jalloul, Flowpay aims to simplify access to capital for the businesses that form the backbone of the economy. The company operates in the Czech Republic, Slovakia, and the Netherlands.

Flowpay leverages AI to evaluate business potential rather than focusing solely on risk, providing operational financing that supports growth. Its AI-driven platform automates the entire funding process, from applications to risk assessment, and delivers tailored, flexible loans of up to €100,000 without traditional paperwork.

Using an embedded lending infrastructure, Flowpay integrates directly into platforms businesses already use like POS systems and e-commerce platforms removing inefficiencies and enabling seamless access to finance.

The recent €30 million debt facility from Fasanara Capital will accelerate European expansion, marking the Netherlands as Flowpay’s first Western European market and the launch of its Dutch entity.

Flowpay was previously featured by EU-Startups in March 2025 for its innovative approach to embedded finance and SME lending.

About Flowpay

Flowpay leverages predictive AI to assess risk accurately and understand SME potential. The company acts as a direct lender, provides embedded finance infrastructure for SME platforms and offers Risk-as-a-Service (RaaS) to lending institutions, enabling smarter, faster, and more flexible financial solutions for small and medium-sized businesses.

Follow us

Follow us Follow us

Follow us