Berlin-based fintech Credibur has raised $2.2 million in pre-seed funding to launch its credit infrastructure platform.

SUMMARY

- Berlin-based fintech Credibur has raised $2.2 million in pre-seed funding to launch its credit infrastructure platform.

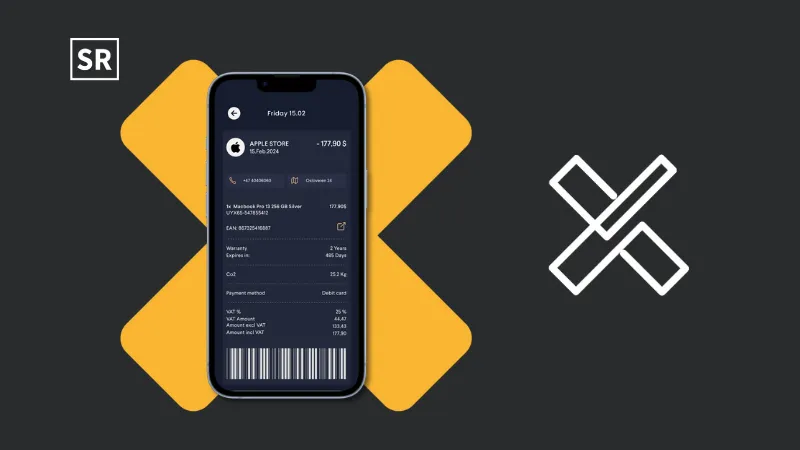

Many institutional capital providers still use outdated systems or manual processes. Credibur solves this with a modular, API- and AI-powered SaaS platform that automates debt facilities between non-bank lenders (like BNPL, factoring, and leasing companies) and institutional investors (such as asset managers, debt funds, and family offices).

By replacing manual Excel workflows with automated, integrated data flows, Credibur improves risk assessment and supports smarter credit decisions. Its platform covers the full credit lifecycle helping both lenders and investors scale with speed and confidence.

Read Also - Kondor Secures Pre-Seed Funding To Combat Industrial Energy Waste with AI

RECOMMENDED FOR YOU

Axe Funding News- Irish Startup Axe Raises €1.5Mn In Pre-Seed Round

Kailee Rainse

May 10, 2025

Big Audience Machine funding news – Stockholm-based Big Audience Machine has Secured €350k in Funding

Kailee Rainse

Dec 5, 2024

Founded in late 2024 by credit expert Nicolas Kipp, Credibur aims to modernise credit infrastructure and bring more scalability and transparency to the market.

With global private credit volumes hitting €2.1 trillion, including €430 billion in Europe, Credibur is well-positioned to become the infrastructure layer between alternative lenders and institutional investors, helping streamline and scale debt facility management.

Nicolas Kipp, Founder and CEO of Credibur explains: Debt facility management is the underestimated Achilles' heel in non-bank lending – operationally complex and technologically neglected. With Credibur, we're digitalising this final frontier in the value chain and efficiently connecting institutional capital with new credit models.

Credibur’s platform goes beyond traditional reporting tools by managing the entire lifecycle of institutional funding—from structuring and contract management to capital calls and SPV administration. It’s built for alternative lenders like BNPL, factoring, and leasing firms, as well as institutional investors such as asset managers, debt funds, and family offices.

The $2.2M pre-seed round is led by Redstone (Europe), with participation from MS&AD Ventures (Silicon Valley) and Inovia (Canada). Notable fintech angels also joined, including Malte Rau (Pliant), Topi Co-Founders Estelle Merle and Charlotte Pallua, and super angel Bjarke Klinge Staun.

Timo Fleig, Managing Partner at FinTech VC Redstone, says: Nicolas has already proven with Banxware and Ratepay that he can master the complexity of the credit business. With Credibur, he's now solving the next fundamental problem: manual debt facility management is slowing growth across the entire private credit sector. His infrastructure can finally digitalise this €430 billion industry in Europe.

Jon Soberg, CEO and Managing Partner at MS&AD Ventures, added: While everyone's talking about private credit as an asset class, many overlook the operational hurdles behind it. Credibur creates the technical infrastructure that institutional investors need to efficiently invest in this growing market. This is a classic infrastructure play with enormous scaling potential.

With this funding, Credibur is stepping out of stealth and launching with its first pilot customers. The fresh capital will help enhance its API- and AI-driven platform, expand its customer base, and grow the team.

About Credibur

Founded in 2024, Credibur is building the infrastructure layer for private credit. Its platform helps lenders manage debt capital efficiently—from structuring to reporting—by automating manual tasks and ensuring transparency. Backed by top fintech founders and early investors, Credibur aims to make credit faster, safer, and more scalable.

Follow us

Follow us Follow us

Follow us