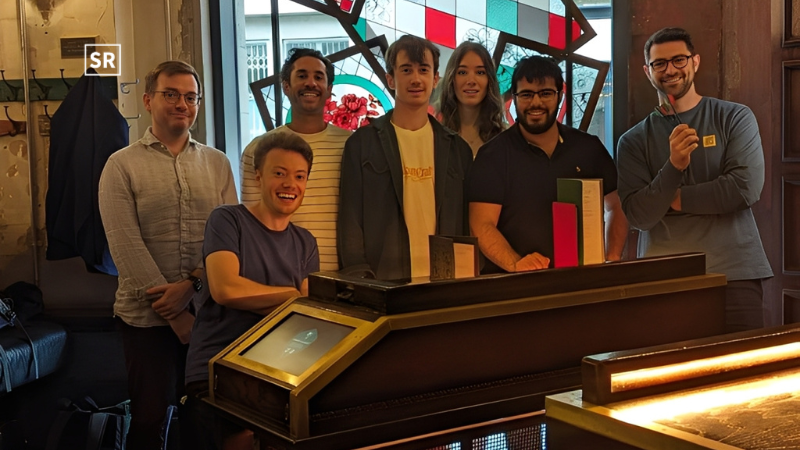

Bynd funding news – Lisbon-based Bynd Secures €40 Million in Funding

Nov 11, 2024 | By Kailee Rainse

Bynd Venture Capital has launched its third fund, worth €40 million, with backing from notable investors like the Spanish fund Fond-ICO, Portuguese industrial group Nors, Caixa Capital, and private investors from Spain and Portugal.

SUMMARY

- Bynd Venture Capital has launched its third fund, worth €40 million, with backing from notable investors like the Spanish fund Fond-ICO, Portuguese industrial group Nors, Caixa Capital, and private investors from Spain and Portugal.

- Bynd is a top venture capital firm in Iberia, focused on investing in seed and early-stage tech companies since 2010.

Plan to invest launched fund

It plans to invest in around 40 early-stage tech startups in Spain and Portugal, focusing on areas like artificial intelligence (AI), software, consumer goods, and sustainability.

The fund will run for ten years, with the first four years focused on making investments and the remaining six years on growing the portfolio and helping startups exit successfully.

RECOMMENDED FOR YOU

Apheros Funding News – Zurich-based Apheros Raises €1.65 Million Pre Seed Funding

Team SR

Aug 20, 2024

London-based Messium raises €3.8M to revolutionize global food production

Kailee Rainse

Sep 11, 2025

Read also - Oriole Networks funding news – London-based Oriole Networks Secures an Additional €20.2 Million Funding

The launch of Fund III marks a key moment in Bynd's 15-year history in venture capital. The firm aims to help Iberian startups grow and expand globally. Santiago Salazar, Chairman of Bynd Venture Capital, said, "This new fund underscores our long-term commitment to innovation in the Iberian Peninsula, which began in 2010 with our Business Angels initiative and strengthened in 2015 with the founding of Bynd VC."

The goal of Fund III is to continue supporting entrepreneurs in Spain and Portugal who want to build global companies. With the experience and network Bynd has built over the years, the firm has access to valuable investment opportunities and the tools to help founders scale their businesses.

It also plans to create a positive impact globally by tracking environmental, social, and governance (ESG) metrics across its portfolio. The fund will prioritize startups led by diverse teams, furthering Bynd's commitment to diversity and sustainability in the tech sector.

Francisco Ferreira Pinto, partner at Bynd VC, said: “After our first closing in May, we have been actively investing and plan to make around 40 investments over the next four years. This includes approximately 20 investments in pre-seed startups and another 20 seed-stage companies, with additional capital earmarked for follow-on rounds. We have managed to attract new, highly qualified investors with diversified and experienced profiles, who have contributed to the fund’s development and led to our team’s expansion, demonstrating their confidence in Bynd’s work.”

Founded in 2015, Bynd has become a key player in the regional venture capital scene, with previous funds supporting over 60 tech startups.

The new fund has already made three investments in startups: Equall, a Legal Tech company using AI to develop software for the legal industry; CircuitLeap, which specializes in integrated circuit design and simulation; and Spot, an AI company automating processes in large organizations.

With Fund III, it strengthens its position as a leading venture capital firm in Iberia. The firm’s large network gives its portfolio companies access to over 400 partners and 70 active founders. This support helps startups overcome early-stage challenges and positions them for long-term success.

About Bynd

Bynd is a top venture capital firm in Iberia, focused on investing in seed and early-stage tech companies since 2010. It currently has over 35 active portfolio companies.

Recommended Stories for You

Hummink Secures €15M To Bring Precision Printing Technology To Chip And Display Manufacturing

Kailee Rainse Nov 17, 2025

Follow us

Follow us Follow us

Follow us