BrightCap launches €60Mn Successor Fund to Invest in Founders From Rising SEE

Jul 10, 2024 | By Team SR

BrightCap Ventures, a Sofia-based VC, has completed the first close of its new fund targeting €60m. The new capital will be invested in founders from Rising Southeastern Europe – a region home to outstanding tech talent and an increasing number of global success stories in recent years.

SUMMARY

- BrightCap Ventures, a Sofia-based VC, has completed the first close of its new fund targeting €60m.

- Founded in 2018, BrightCap Ventures is an early-stage venture capital firm investing in companies with defensible technology and significant global growth potential.

Founded by a diverse team, combining entrepreneurial, big tech and investment experience, BrightCap’s goal is to help founders from Rising SEE scale into Western European and US markets.

Read also - SciRhom Funding News – SciRhom Secures €63M Series A Funding

RECOMMENDED FOR YOU

Zaiffer Raises €2M From Zama And PyratzLabs To Introduce Privacy In DeFi

Kailee Rainse

Nov 13, 2025

Finnish Nordic Foodtech VC Secures €40M To Back Food And AgriTech Startups

Kailee Rainse

Jun 5, 2025

[Funding alert] Paris-based Planity Secures $50 Million in Series C Round Funding

Team SR

Feb 20, 2024

With its first fund, BrightCap has validated this thesis. Notable investments include storage collaboration platform LucidLink, which recently raised a $75m Series C round, enterprise orchestration platform Pliant, which was recently acquired by IBM, as well as pioneer in scalable AI for 3D spatial data Enview, acquired by Matterport. Overall, BrightCap’s Fund I portfolio has so far seen 5 exits to strategic acquirers out of 22 investments and more than $150m of follow-on capital raised.

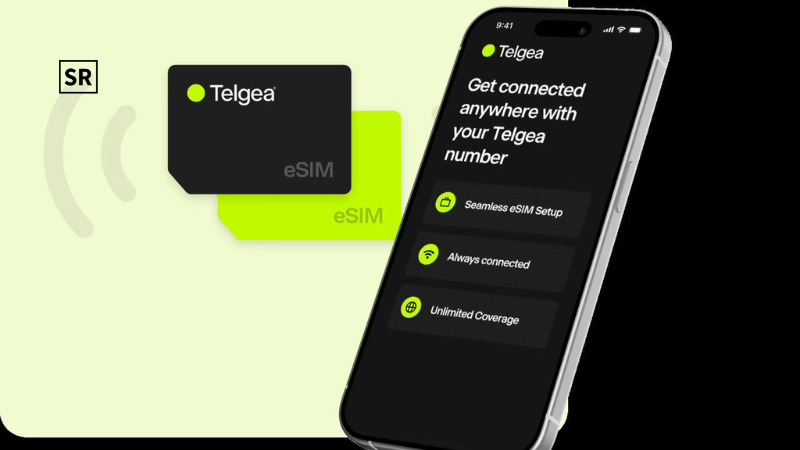

With Fund II, BrightCap aims to build upon this experience and invest in unique, globally scalable and impactful tech companies born out of Rising Southeastern Europe. There will be three priority verticals – Future of Work, Digital Health and Fintech. The majority of initial investment tickets will be aimed at the pre-seed and seed stages and in the €0.4m to €3m range.

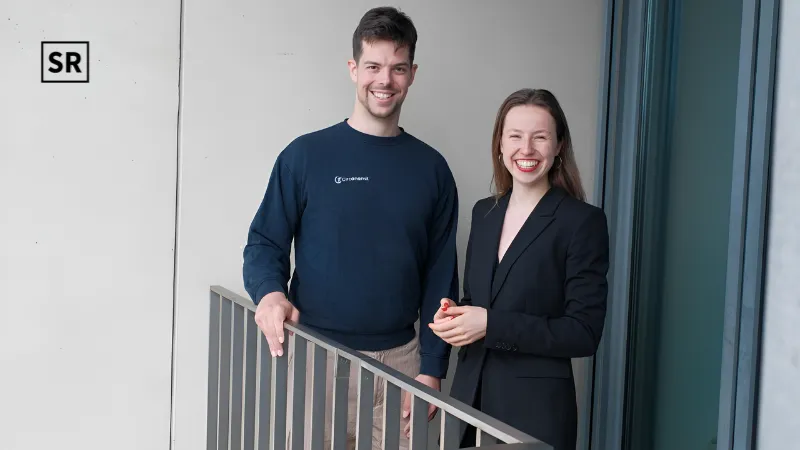

BrightCap II is one of the very few VCs with a female majority among its General Partners. Diversity of experience, ideas and perspectives is at the core of BrightCap’s decision-making process and this is clearly reflected in the team. The fund combines public capital, managed by the EIF, as well as more than 30% private capital from new and existing individual and corporate investors. BrightCap Fund II is the first VC fund to have attracted RRF funds from two countries, Bulgaria and Romania.

Georgi Mitov comments: “BrightCap II is an exciting new step for us – larger scale fund with a wider scope and even greater ambitions than our first. At the same time, our philosophy of working with deeply technical founders with domain expertise and global reach from day one hasn’t changed. It keeps us grounded in the AI era where opportunities seem everywhere, but lasting technology winners can be built by few.”

Diana Stefanova, who joins the team as a full time partner after 16 years at VMware, concludes: “The tech industry is facing a pivotal moment. With BrightCap II, we have the opportunity to capture the next generation of category-defining companies from our region and nurture them to success. I look forward to bringing my tech enterprise experience in support of SEE startups to scale their businesses and reach global markets.”

BrightCap II is funded by the European Union – NextGenerationEU with the financial backing of the Government of Bulgaria under the Bulgaria Recovery and Resilience Plan, and with the financial backing of the Government of Romania under the Romania Recovery Equity Fund.

About BrightCap

Founded in 2018, BrightCap Ventures is an early-stage venture capital firm investing in companies with defensible technology and significant global growth potential. Headquartered in Sofia, BrightCap deploys an extended network in Silicon Valley and Europe to assist its portfolio.

Recommended Stories for You

Avisomo funding news – Oslo-based AgriTech startup Avisomo Secures €5 Million in New Funding

Kailee Rainse Jan 29, 2025

Follow us

Follow us Follow us

Follow us