Arāya Ventures funding news – London-based Arāya Ventures Announce Arāya Super Angel Fund at €22 Million

Mar 3, 2025 | By Kailee Rainse

London-based Arāya Ventures has announced that it has raised €22 million for its Arāya Super Angel Fund and received €6 million from British Business Investments. This fund will co-invest with Arāya and focus on supporting up to 60 early-stage startups in the UK over the next four years, mainly in Health, FinTech, Commerce, and the Future of Work.

SUMMARY

- London-based Arāya Ventures has announced that it has raised €22 million for its Arāya Super Angel Fund and received €6 million from British Business Investments.

- Arāya was founded in 2022 and invests in early-stage startups worldwide. Their first fund mainly focuses on the UK but also invests 20% globally.

Founder & Managing Partner Rupa Popat said: “This is Arāya Ventures’ debut fund and I’m incredibly proud of what we are able to offer both our investors and founders. As a former founder turned investor, I’ve been on both sides of the table and I know that for most early-stage founders, whilst capital is important, it’s also about the additional value and support that investors can provide. And my goal is for us to be operationally impactful to founders with access to our deep and extensive networks. I am thrilled to have secured the support of British Business Investments in Arāya, their first ever commitment to a Solo GP, underscoring our shared commitment to fostering innovation and driving growth in the technology sector whilst addressing imbalances that exist in the early-stage funding environment.”

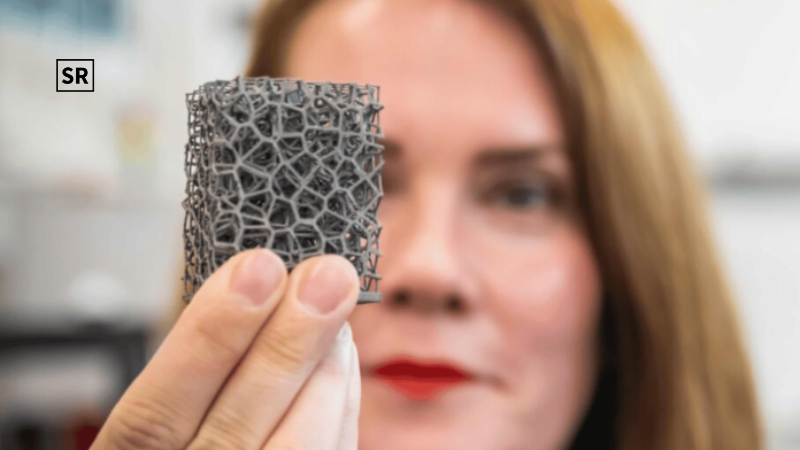

Recent investments by Arāya Ventures include Capably, Research Grid, and Cold AI. Rupa Popat, the Founder and Managing Partner, has over 20 years of experience as a successful entrepreneur and investment banker. She also has five years of experience as an angel investor, with exit offers from Google Ventures and Unilever Ventures in her portfolio last year.

RECOMMENDED FOR YOU

[Funding alert] Amsterdam-based TheyDo Secures €31.1 Million in Seed Funding

Team SR

Mar 15, 2024

akeno Funding News-German AI Startup akeno Secures €4.5M To Automate Production Planning

Kailee Rainse

May 15, 2025

Read also - Fund F funding news – Vienna-based Fund F Closes First Fund at €28Million

One of Arāya’s portfolio founders said, “since investing in October, Arāya has already made valuable introductions to prospective investors and customers and has been advising us on our growth levers and strategy, following our explosive ARR growth last year.”

This investment will be used alongside the Arāya Super Angel Fund. The fund's investors include Saarthi Capital, former CEOs like Phil Cutts (Credit Suisse) and Holli Rogers (Browns), successful entrepreneurs such as Rachel Pendered and Dr. Raoul-Gabriel Urma, VC investors like Niraj Pabari (Giano Capital) and Daljit Sandhu (former COO of Precede Capital Partners), as well as family offices from the UK and the Middle East.

Adam Kelly, Managing Director British Business Investments said: “We are excited to partner with Rupa and Arāya Ventures. The Super Angel Fund is a great example of leveraging angel expertise in a formal committed structure which works well for investee companies. The Regional Angels Programme plays an important role in reducing imbalances in access to early-stage equity finance for UK smaller businesses. By co-investing alongside Arāya’s Super Angel Fund, we are bringing together finance, business experience and skills to support the development of high-growth smaller businesses across the UK.”

About Arāya Ventures

Arāya was founded in 2022 and invests in early-stage startups worldwide. Their first fund mainly focuses on the UK but also invests 20% globally. Arāya’s investors include successful entrepreneurs, family offices, and a strong network that helps with funding, customers, and talent. They also run Arāya Ventures Academy for Angels (AVA Angels), a program to train new angel investors.

Recommended Stories for You

PyxiScience Funding News- Paris EdTech Startup PyxiScience Nets €2M To Innovate Math Learning With AI

Kailee Rainse May 20, 2025

Follow us

Follow us Follow us

Follow us