9fin funding news – London-based 9fin has Secured €47.5 Million in Series B Round Funding

Dec 3, 2024 | By Kailee Rainse

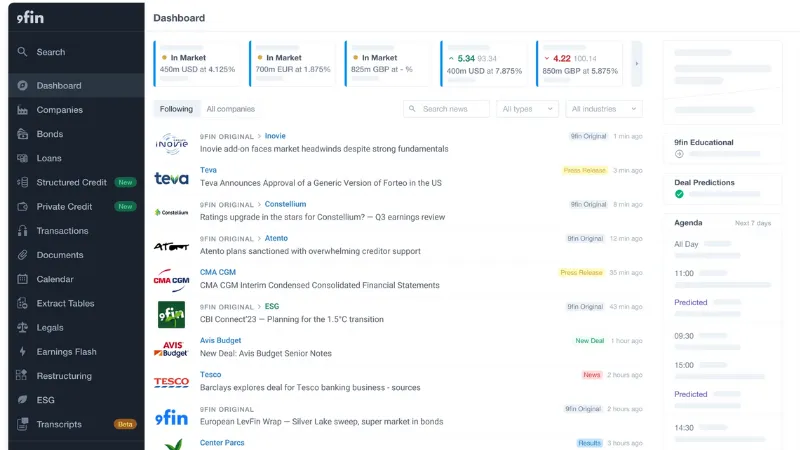

UK startup 9fin, which uses AI for analytics in debt capital markets, has raised €47.5 million in a Series B funding round led by Highland Europe.

SUMMARY

- UK startup 9fin, which uses AI for analytics in debt capital markets, has raised €47.5 million in a Series B funding round led by Highland Europe.

- 9fin offers a faster and smarter way to access debt market intelligence.

Existing investors, including Spark Capital, Redalpine, Seedcamp, 500 Startups, and Ilavska Vuillermoz Capital, also took part in the round. The funds will help it continue developing its AI technology, expand into the US, and grow its analytics team.

Read also - Taito.ai funding news - Helsinki-based Taito.ai has Secured €2.5 Million in Seed Funding

It uses AI to provide quick and easy access to information on high-yield bonds, loans, distressed debt, CLOs, private credit, and asset-backed finance.

RECOMMENDED FOR YOU

FibreCoat funding news – Germany-based FibreCoat has Secured over €20Million in Funding

Kailee Rainse

Dec 5, 2024

The platform is used by nearly 200 firms managing €16 trillion in assets, and it includes AI-powered tools like smart Q&A, real-time updates, and improved search features.

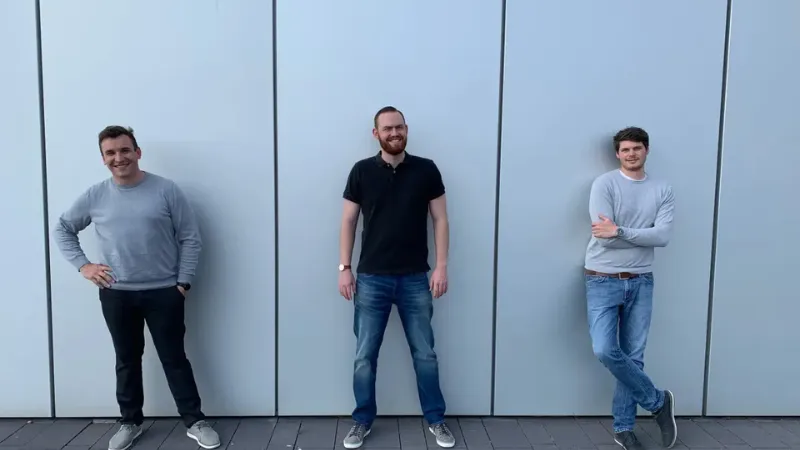

Steven Hunter, Co-founder and CEO of 9fin, commented: “Debt markets are the biggest overlooked asset class in the world and yet they still rely on technology and information sources straight out of the 1980s – opaque, slow and messy. We started 9fin to give professionals in the market a data edge, with smarter, faster intelligence. I’m really proud of the product, team and company culture we’ve built so far at 9fin, and we’re just getting started. There’s a huge opportunity to build the #1 global provider of debt market analytics, and bring debt markets into the AI age. We’re delighted to welcome Highland as a partner to help us achieve that vision.”

Since its Series A+ in 2022, the company has grown quickly, with a 400% increase in Annual Recurring Revenue (ARR) and major expansion in the US. 9fin now has 240 employees and has doubled its tech team to support product development.

Highland Europe’s Co-founder and partner, Fergal Mullen, who joins 9fin’s board, said: “Debt markets are booming but data and technology offerings simply haven’t kept pace. 9fin’s vision, its relentless focus on technology, innovation and company culture, positions it as the go-to platform for those working in debt markets. We’re thrilled to support their ambition to become the global market leader.”

Co-founder and CTO Huss El-Sheikh added: “From the moment we started building at our kitchen table, 9fin has pioneered the use of AI in debt capital markets, setting a new industry standard. By investing in the best product and engineering talent, we’ve dramatically increased product velocity, delivering capabilities to give our customers the best workflows, tools and insights, and helping them navigate easily through complex financial markets.”

About 9fin

9fin offers a faster and smarter way to access debt market intelligence. Its AI-powered platform brings all the tools needed to analyze credit or secure a mandate in one place, helping users win business, stay ahead of competitors, and save time.

Recommended Stories for You

Final Frontier Funding News- Danish VC Final Frontier Secures Funding From Former NATO Secretary

Kailee Rainse May 8, 2025

Follow us

Follow us Follow us

Follow us